Public Vs. Private Education Loan Providers for Study Abroad

The high cost of studying abroad presents a financial challenge for many Indian students to finance their studies. For many of them, student loans become their first experience with borrowing money. Here, the question arises which type of loan provider is best - public vs private banks?

Education is widely regarded as one of the most integral parts of our lives. It can open many doors for a person and it shapes the path they take in their future. Education has been seen as a source of wealth and those who have the capability to attain quality education are often very successful in their lives. The biggest wealth one generates through education is knowledge, however, it is not just education but quality education that matters.

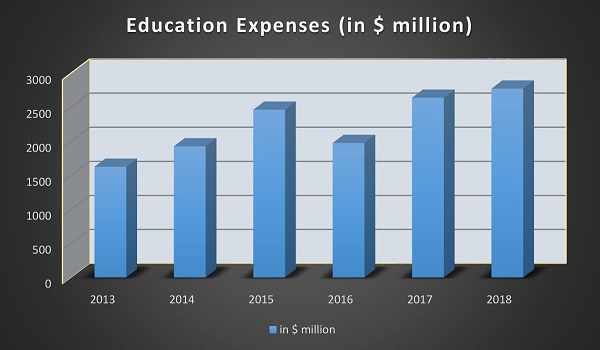

In order to get a quality education, more and more students are going abroad. According to recently released data from RBI, spending on tuition and hostel by Indian students going abroad has increased 44% from $1.9 billion in 2013-14 to $2.8 billion in 2017-18 and is expected to increase by 1.8 million approximately by 2024 academic session. The exorbitant increase proves that people are preferring to pursue skill education abroad.

Predict your IELTS, TOEFL, and PTE in just 4 steps!

Check:

Acquiring quality education is becoming expensive day by day. Arranging for funds to finance an education abroad is one of the biggest challenges one faces. People overcome this hurdle with the help of student loans. Also, there are numerous institutions one can think of while taking an education loan. The biggest chunk of the market is with public sector banks, however, private banks and NBFCs (non-banking financial companies) are also catching up rapidly. Public sector banks offer low-interest rates, no pre-payment charges, and low processing fees. Whereas, private sector banks provide enhanced customer service, high-interest rates (as compared to public sector banks) and faster processing. Contact India’s leading education loan providers through Shiksha Study Abroad.

(Source: Reserve Bank of India)

Download this guide to read it offline

Government Banks vs. Private Banks for Education Loans to Study Abroad

There is a huge difference when taking a student loan from a public sector bank or a private sector bank. The interest rates are the very first thing we consider when discussing student loans. The interest rates supplied by public banks are consistently lower than those offered by private lenders, as individuals who have done their homework on school loans may already be aware. Additionally, we may bargain with private lenders about processing costs and loan insurance percentages in addition to interest rates. Students without good negotiating abilities can pass on a better offer. Private lenders almost always demand greater processing costs than public institutions. Public banks may levy a processing fee for an international student loan that might be anything between zero and ten thousand rupees. In this article, we’ll compare the difference between taking a student loan from a government bank (SBI, PNB, Canara, Syndicate Bank) or a private bank (ICICI, Yes Bank, Kotak Mahindra Bank, HDFC).

| Factors |

Government Banks |

Private Banks |

|---|---|---|

| Interest Rates |

Any change in repo rate by the central bank gets a transfer to the customers with immediate effect. |

The change in the Repo rate does not result in a decrease of interest rates even for the existing customers. |

| Prepayment Charges |

There is a huge advantage as it comes to prepayment charges, as public sector banks do not charge levy any prepayment charges. |

If the borrower wants to prepay the loan then private banks generally charge 2% of the remaining loan amount as they do not want to lose out on the interest they are earning. |

| Prepayment Period |

Generally, there is no such condition. The borrower can repay the complete loan amount whenever he/she arranged it. |

Usually, the borrower cannot repay the loan before completing 6 months of his/her loan. |

| Processing Fees |

The processing fees charged by banks range between 0.5% to up to 1% of the total loan amount or any fixed amount. The processing fee charged by the government banks is generally low compares to the private sector banks as they do not promote selling through agents. |

Private banks can charge up to 2% of the loan amount. Many times, private banks have to give commissions to their agents in order to bring customers, so, the processing fee is higher in private banks. |

| Trust Factor |

Although this factor doesn’t affect your loan in any way, it is one of the most important factors one considers before taking a student loan. It is said that public sector banks have more transparent policies in comparison to private sector banks. |

It is a general thought among customers that private banks have various kinds of hidden charges that they don’t disclose at the time of disbursing the loan. Their policies are driven by profit-making, so, it is always better to read the complete terms and conditions in advance before taking any decision. |

Also Read: How to choose your bank for Education Loan to Study Abroad

Top Banks for Study Abroad Education Funding

In order to be eligible to apply for an education loan from an Indian government bank, the applicants applying should take the following information into consideration

Eligibility:

- The applicant must be an Indian citizen who lives in India or abroad or is an NRI, OCI, or PIO.

- While an employed candidate must be at least 45 years old, a non-employed applicant may be as young as 35.

- They are eligible to apply for any level of study - undergraduate, graduate, doctoral, etc. in any nation.

- The institution must be either public, private, professional, or international for the student to be enrolled.

Documents Required:

- Admission letter from the institution

- Previous Education Marksheets

- Completed application form with signature

- Indian ID Proof - Aadhar Card / Pan Card

- Bank Statement

- Address Proof

- Salary Slips

- ITR Proof

- Passport sized photograph

- Visa proof

- Valid Passport

Top Banks with Interest Rates Offering Indian Students an Education Loan

As per the revaluation in interest rates in 2022, the interest rates have risen since 2020 quarter. Check: Indian Banks offering Education Loans for Studying Abroad

The following table elaborates a brief estimate upon how much Indian students would be charged while studying abroad:

| Indian Public / Private Banks | Interest Rates | Minimum Loan Amount | Loan Tenure |

|---|---|---|---|

| Indian Public Banks | |||

| PNB Educational Loan | 8.80% to 9.50% | Based on the requirement or need based | 15 years |

| SBI Education Loan | 10.90% | Above 7.50 lakhs | 15 years |

| Axis Bank Education Loan | 13.70% to 15.20% | INR 50,000 | 15 years |

| Bank of Baroda Education Loan | 10.10% to 10.45% | INR 12,50,000 | - |

| Private Banks | |||

| Kotak Mahindra Bank Loan | Upto 16% | INR 7,50,000 | 5-7 years |

| Federal Bank Education Loan | 11.95% | INR 10,00,000 | 15 years |

| HDFC Bank Education Loan | 9.55% to 13.25% | INR 30,00,000 | 15 years |

| Union Bank of India Education Loan | 8.8% to 10.05% | INR 4,00,000 | 15 years |

Note: The interest rates are subject to change as per the regulations of the bank.

A lot of banks (both public and private) have a clause for collateral that is, property or other immovable assets to be submitted with the bank against the loan taken till repayment. In case you're finding it difficult to apply for an education loan, you may also apply for loan through Shiksha website.

Also Check:

- Indian Banks offering Education Loans for Studying Abroad

- Top Education Loans Providers in India for Study Abroad

- How to choose your bank for Education Loan to Study Abroad

Apart from the public and private sector banks, NBFCs (non-banking financial companies) are also active in the education loan segment. The average loan amount of the NBFCs is more than what the banks disburse as it is their main source of income generation. 90% of the NBFC's education loan portfolio is over INR 10 lakh i.e. they are preferred for big-ticket loans.

While deciding on a student loan, always consider the above-stated facts and then take your decision wisely. Calculate the overall amount you have to return after adding both the principal and the interest then go for the one which is not heavy on your pocket. And in case you need faster and better service then go for the private sector banks.

Note: Always consult an expert before taking the final decision.

Calculator for Educational Loan EMIs

Before you apply for a loan, figure out how much you can borrow by using the education loan EMI calculator to calculate your monthly payments and the loan's overall cost. Enter some loan-related details, including the loan amount, length, interest rate, and processing costs to get an estimate of your equivalent monthly payment (EMI). The total interest due and a thorough amortisation chart that breaks down your EMIs into principle and interest payments on a monthly and annual basis are important data.

Quick links:

FAQs

Q. Should I choose a private bank or a public bank for an education loan to study abroad?

Q. What will happen if I forgot to pay back my education loan on time?

Q. What are the points which I should be careful about while applying for an education loan to study abroad?

Q. Why should a student apply for an education loan?

Q. What are collateral loans?

Raj Vimal has experience of 7+ years in SEO Content Writing, which includes 5+ years in the Ed-Tech industry. He has written articles about studying abroad, especially in the USA, UK, and other English-speaking coun... Read Full Bio

Comments

(1)

K

2 years ago

Report

Reply to KAVITA AMIN

P

2 years ago

Report