Education Loan to Study in Spain

The cost of studying in Spain may not be that high as compared to other top study abroad destinations. But it is significantly higher than that in India. For this reason, Indian students willing to study abroad in Spain look for financial aid options to proceed with their abroad education dream without any stress. This article talks about the education loans in Spain for international students.

A lot of times students and their parents are unable to gather the funds required to cover the costs of studying abroad. During such times, education loans from banks or financial institutions play a crucial role in funding education abroad. There are multiple Indian banks offering loans to study in Spain. In this article, we will be talking about the features of a student loan, eligibility of a student loan, fees & charges and documentation required for processing an education loan to study in Spain.

While there are multiple private and public Indian banks offering loans to study in Spain. Most Indian banks have identical eligibility, features and documentation required from borrowers/ co-applicant. So for the benefit of our readers, we are providing generic education loan requirements for students looking to apply for an education loan. Students should note that they need to get in touch with their nearest bank(s) to understand the requirements. Rad this articel ahead to get the complete information on the education loans in Spain.

Predict your IELTS, TOEFL, and PTE in just 4 steps!

Also Read: Cost of Studying in Spain for International Students

Education Loan for Spain

Applicants should note that education loans for studying abroad would cover the entire cost of education with no upper limit, however, this would come with collateral. If education loan applicants are looking to apply for an unsecured loan without collateral, there is an upper limit - the amount is determined by individual banks.

Student Loan in Spain - Eligibility Criteria

Applicants looking to apply for an education loan need to fulfil the eligibility criteria laid down by various banking and non-banking financial institutions. These include (not limited to) the following:

- The borrower must be an Indian citizen.

- Co-applicants must be an Indian citizen.

- Ability to offer collateral for certain cases.

- Co-borrower(s) must have a bank account in any bank in India with cheque writing facilities.

- Confirmed admission to the colleges before disbursement.

- Borrower and Co‐applicant(s) to meet the bank's credit and underwriting norms as applicable from time to time.

Related Reads:

- Apply to India's top education loan providers through Shiksha Study Abroad

- SBI Education Loan for Study Abroad: Ultimate Guide

Student Loan in Spain - Fees and Charges

These include charges that are levied by any bank for a number of services that are availed by borrowers. Candidates should note that the charges mentioned below are the charges for the HDFC Education Loan for Foreign Education. We have included the charges to give you an idea of the costs involved in applying for an education loan to study in Spain or any other country. These charges are bound to vary from bank to bank.

| Description of Services |

Charges in Rupees |

|---|---|

| Pre-payment charges |

Nil |

| Nil |

|

| Delayed Payment Charges * |

@ 2 % per month of instalment ( MI/PMII) applicable taxes thereon |

| Statutory CERSAI charges |

As per charges levied by CERSAI. |

| Cheque or ACH mandate or Direct Debit swapping charges* |

Up to Rs.500/- per swap instance plus applicable taxes thereon |

| Cheque/ACH/Direct Debit Bouncing Charges* |

Rs. 400/- per dishonour of cheque or ACH or Direct Debit return per presentation plus applicable any taxes thereon |

| Legal/ incidental charges |

At actual |

| Stamp Duty and other statutory charges |

As per applicable laws of the state |

| Manual Collection Charges* |

Rs. 200/- per visit plus applicable any taxes thereon |

| Charges for Updating & Handling Loan Account As Per Customer Request* |

Rs. 1,500/- plus applicable any taxes thereon |

| Origination Fees |

1.5% Taxes of the Sanction Amount & is Non-Refundable |

*Terms & conditions apply and may change conditionally. Credit at the sole discretion of HDFC Credila Financial Services Limited (formerly known as HDFC Credila Financial Services Private Limited)

*Charges which are in nature of fees are EXCLUSIVE of GST. GST and other government levies, as applicable, would be charged additionally.

Also, Read

Interest on Education Loan by HDFC Credila Financial Services Limited

Source: HDFC Bank

Education Loan to Spain – Documents required

In this section, we are going to be talking about the documents required as part of the process to apply for an education loan in Spain. Candidates should note that these are the requirements for a particular private bank, the document requirements could vary on a case-by-case basis. Hence, it is always advisable to check with your bank for the documents required as part of the application process.

Education Loan application form: Education loan applicants are required to submit their education loan application form duly completed and signed

Two Passport Size Photos: Applicant and Co-Applicant are required to provide one set to be pasted on the application form and a second set to be affixed (stapled) to the application form

Photo ID: Applicant and Co-Applicant are required to provide any one of the following as photo identification proof:

- Permanent Account Number (PAN) Card

- Passport

- Driving License

- Aadhaar Card

- Voter's ID Card

Residence Proof: Applicant and Co-Applicant are required to provide any of the following as residence proof:

- Passport

- Driving License

- Aadhaar Card

- Voter's ID Card

Academic Documents of Student: The student is required to provide the following academic transcripts:

- Marksheet/Certificate of 12th Exam

- Marksheet/Certificate of Subsequent Years of Education e.g. BE, BCom, BSc, etc.

- Marksheet of Any Entrance Exam Taken e.g. CAT, CET, etc. (If applicable)

- GRE/GMAT/TOEFL/IELTS, etc. Marksheets (If applicable)

- Scholarship Documents (if applicable)

Proof of Admission (If available): The student is required to provide a printed admission letter from the Institute on its letterhead with the institute's address.

Bank Statement: Co-Applicants are required to include the last eight months of bank statements of the Bank Account where Salary or Business/ Professional receipts are credited every month. If more than one bank account, provide copies of all.

Income Proof of Co-Applicant: Co-Applicants (salaried/self-employed) are required to include income proof as part of the loan application.

- In the case of Salaried Employees (All the following)

- Latest 3 Salary Slips or Salary Certificate on Employer's Letterhead

- Last 2 year's Form 16 from Employer or Last 2 Year's Income Tax Returns

- Any Other Income Proof That is Not Reflected in the Above Documents

- In case of Self Employed or Professional (All the following)

- Last 2 Year's Income Tax Returns

- Last 2 Year's Certified Financial Statements or Provisional Financial Statements Duly Certified by CA

- Proof of Office (any one of the following, Lease Deed, Utility Bill, Title Deed, etc.)

- Any Other Income Proof That is Not Reflected in the Above Documents

Collateral - Immovable Property: A higher education loan amount would require the borrower/co-borrower to submit collateral against the loan amount. In this section, we are going to be talking about document submissions for immovable collaterals. These include Flat, House, and Non-Agriculture Land. All the Relevant Documents from the following list are required:

- Property Title Deed

- 7 / 12 extracts in case of land

- Registered Sale Agreement Along With Society Share Certificate

- Original Registration receipt for the above agreement

- Allotment Letter By Municipal Corporation / Authorized Govt. Authority Like MHADA, CIDCO, etc. Please add HUDA, DDA, JDA, GIDC etc

- Previous Chain of Sale Deed establishing title

- Latest Maintenance bill along with Receipts issued by the builder/ society,

- Latest Property tax bill along with receipts,

- NOC for the mortgage from society/builder,

- Approved building plan

- Encumbrance certificates as on date etc

Note: Other than the original completed application form, Please DO NOT provide any original supporting documents at the time of applying for a loan. All copies of the above-provided documents should be self-attested.

Candidates should note that other Indian banks offering loans to study in Spain include:

| Nationalized Banks |

Private Banks |

|---|---|

| SBI |

HDFC Credilla |

| PNB Udaan |

ICICI Bank |

| Bank of Baroda |

Axis Bank |

What are the expenses covered in an Education Loan:

All of the tuition fees as determined by the college/University. Up to 100% of other expenses including living and hostel expenses, travelling expenses, examination fees, library/laboratory fees; purchase of books/equipment's/instruments/uniforms; passage money for studies into India; purchase of computers/laptops considered necessary for the completion of the course as decided by the bank. Travel fare is restricted to one economy class return ticket between India and the country of study.

In case you're finding it difficult to apply for an education loan, you may also apply for loan through Shiksha website.

What are the Steps to applying for an Education Loan to study abroad

While applying for an education loan is technical. However, candidates are required to do their homework well to be able to land the best deals. Education Loan enthusiasts are required to follow the below-mentioned steps while applying for an education loan:

- Candidates should check whether their university/ course is recognized by the bank for the loan application

- The candidate should have a loan amount that he/ she plans to borrow from the bank. Applicants should note that tuition fees and other expenses would have to be accounted for by the student to the bank in the form of documents as received by the university.

- Candidates should check out the bank that is giving the best rate of interest and apply accordingly

- Once the formalities are complete the education loan would be credited for study purpose

Why is an Education Loan not as Bad as it Sounds?

Well, we all know that an education loan could have some ugly connotations. However, here are a couple of reasons why you should opt for an education loan:

- Seamless remittance to international institutes

- Hassle-free process for timely disbursement of loan

- Students who want to take their own financial responsibilities, without depending on their parent’s savings

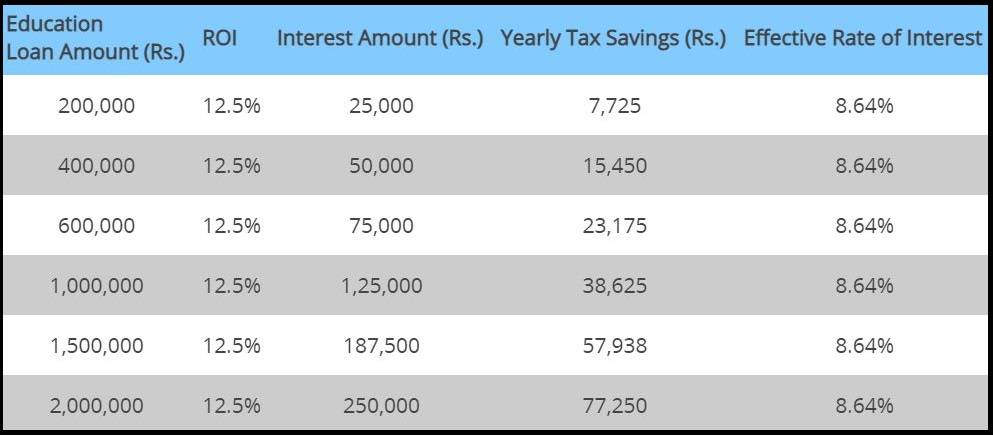

- Interest deduction applicable on the Education Loan under Section 80E of the Income Tax Act of 1961

- Get a collateral-free loan of up to Rs 40 lakh, for select institutes (the amount can vary depending on the bank)

- Pre-Visa disbursal, for students applying for education in a foreign country

- Other student expenses, such as laptop or exchange travel are also covered

- Attractive interest rate starting at 10.50% per annum.

If you need assistance with university admissions, our Shiksha Study Abroad counsellors would be happy to assist you. If you want to get in touch with us, you can write to us in the comments below.

Also, Read

Education Loan to Study in Spain FAQs

Q: Can I get student loan to study in Spain?

Q: How much fund is required to study in Spain?

Having sufficient amount of needs is crucial to apply for a student visa in Spain and get it approved. The application for study visa in Spain requires applicants to have a minimum definite amount of funds and as of 2022, this required amount is equivalent to 100% of Spain's Public Multiple Effects Income Indicator (IPREM). However, this amount may reduce if a documentation is provided that demonstrates that the accommodation charges for the entire length of student's stay have been paid for.

Q: Can I get 100% loan to study in Spain?

Yes, one can absolutely get a 100% education loan to study in Spain from private banks and Non-Banking Finance Companies (NBFCs). However, other banks may require students to pay some amount of the costs included in studying abroad by self-financing.

Q: What is the cost of studying in Spain?

Due to its low and affordable tuition fees, Spain has come to be recognised as one of the popular study destinations for international students, who are budget-minded. How much it will cost will also depend upon a few other factors such as the university, place, type of programme, and the institute’s reputation. If a student is looking forward to studying at a public university, he or she may have to spend between 2,000-3,500 Euros annually.

Q: How to apply for a Spain visa?

Step 1: If the applicant is a minor, one of their parents must submit the application for a study visa to Spain on their behalf.

Step 2: The Consular Office is the competent authority to accept visa applications from individuals residing in cities that have a consulate. Applicants may also speak with visa brokers who have received advance approval from the Consular Office.

Step 3: The Consular Office will give the applicant a certificate of receipt of the application along with a number that will allow them to monitor the progress of their dossier via a link on the official website after they submit their Student Visa application.

Step 4: The Consular Office could ask the applicant to provide any missing paperwork or to offer further information if it's needed to make a determination on their application for a student visa to Spain. A personal interview with the candidate may also be scheduled.

Step 5: After a decision has been reached, the Spain Study Visa must be picked up in person within two months by the applicant or their agent (if the applicant is a minor).

Q: What is the cost of living in Spain?

How much would you pay for living will depend on lot many factors such as the room type, facilities available, location, etc. A one-bedroom apartment in the student-famous city, Madrid, may cost students around 1,000 Euros, whereas one may have to pay 850 Euros for an apartment in Barcelona.

The table below displays the rent of a 1-bedroom flat in different Spanish cities that are cheap for overseas students:

City | 1-bedroom flat (centre) | 1-bedroom flat (periphery) |

|---|---|---|

Salamanca | 450 € | 305 € |

Córdoba | 416 € | 350 € |

Seville | 620 € | 446 € |

Granada | 550 € | 420 € |

Q: Is it worth getting an MBA in Spain?

If students are considering Europe a study destination, then Spain is a wonderful place to study. If students want to diversify their CV and work in Spain in a MNC then an MBA in Spain can be their gateway. The tuition fees in Spain is lower than Canada, UK, Ireland Universities have a well-deserved international reputation

- Low tuition fees

- Variety of scholarship options

- Students can participate in internship opportunities

- Various MBA specializations

Q: Should I get an MBA in Germany or Spain?

Both Germany and Spain offer unique experiences and advantages when it comes to studies. But, the decision to study abroad in Spain or Germany depends on various factors such as academic goals, personal preferences, and priorities. Refer to the table given below to make an informed decision of studying MBA from any of these countries:

Factors | Germany |

|---|---|

Academic Excellence | Known for world-class education, with various universities ranked best in the world. Germany is an excellent place to study if students want to explore fields like Science and Engineering |

Tuition free education | Various public German universities offer tuition-free education, thereby, reducing financial burden of students |

Strong economy | Germany has a robust economy with various job prospects and internships, especially in industries like Technology, Finance and Automotive Engineering |

Culturally Diverse | Germany is culturally diverse. Students can explore different cuisines and cultures |

Efficient Public Transportation | Efficiency and well-connect transportation system |

Spain

Factors | Spain |

|---|---|

Cultural Experience | Spain is known for its beautiful landscapes, rich culture, and warm climate. This country offers a unique blend of history, art, music, and cuisine |

Language Learning | While studying here, students will have an opportunity to learn or improve Spanish language skills |

Affordability | Affordable as compared other countries like the US and UK |

Know more about:

Priya Garg is a seasoned content writer and editor. With her rich experience in content writing, teaching and research & analysis, Priya believes in providing only the correct information which is also up-to-date. H... Read Full Bio

Priyakant Sharma brings over 14 years of diverse experience in operations management, team leadership, and devising sales/merchandising strategies for multi-unit retail chains across Europe and India. Transitioning ... Read Full Bio

Yes, you can easily get an education loan to study in Spain. To be eligible to aply for an education loan in Spain, the applicant must be a citizen of India and enrolled with a Spanish higher education institute.