All About Profitability Ratios and Their Types

Different types of financial ratios that determine the financial performance of a business are known as profitability ratios. While these are segregated in two types, the two types are further subdivided.

You can consistently calculate profitability ratios to track a company’s profitability over time. Different types of profitability ratios are calculated as shown below:

What are profitability ratios?

Profitability ratios are different types of accounting ratios. These determine the financial performance of any business at the end of an accounting period. Such ratios represent how companies can make profits from their operations.

These ratios are a class of financial metrics. They determine the ability of any business to generate earnings relative to revenue, balance sheet assets, shareholder’s equity and operating cost. These are some of the most popular metrics that is used in financial analysis.

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

Types of Probability Ratios

Profitability ratios are mainly of two types of categories:

- Margin Ratios

- Return Ratios

Margin Ratios

Margin ratios are the financial metrics that assess the company’s profitability relative to its sales. These ratios provide insight into how efficiently the company operates and manages its costs.

1. Gross Profit Margin

The ratio is used for measuring the sales revenue percentage that exceeds the cost of goods sold (COGS). Through this ratio, one can assess the production efficiency of a company.

- A higher gross profit margin indicates a company that retains more money on every dollar of sales to cover its other costs.

- When this gross profit margin drops, it suggests higher production costs or declining sales prices.

Interpretation:

For a basic understanding, let us understand this profitability ratio with the analogy of a lemonade stall.

- Think of this as the money you keep after paying for the lemons and sugar but before paying for other things like the stall’s rent.

- If you sell a cup for $1 and the lemons and sugar cost you 50 cents, you have kept 50 cents. That is half of what you sold it for, or 50%.

- Operating Profit Margin

It measures the sales revenue percentage after deducting operating expenses from gross profit.

- When the operating profit margin is higher, the company can efficiently manage its operating costs relative to its sales.

- If the operating profit margin declines, the company may suffer from operational inefficiencies and operating costs.

Interpretation:

Let us continue further with the lemon stall analogy:

- Now, after paying for the lemons and sugar, you also pay your little brother 20 cents to help and 10 cents for the stall’s rent. What you have left now is 20 cents.

- This means out of your $1 sale, after paying for everything related to making and selling the lemonade, you keep 20%.

3. Net Profit Ratio

Also known as the Net profit ratio indicates an important ratio representing the relationship between net sales and net profit after tax. It measures the percentage of sales revenue once each expense has been deducted. Deductions include taxes, interest, operating costs and other non-operating costs.

- A higher net profit margin indicates that the company effectively manages all its expenses relative to its sales. This provides a comprehensive view of the company’s overall profitability.

- A lower net profit margin indicates that the company can retain a smaller percentage of its sales as profit after expense reduction.

Interpretation:

Let us continue with the lemonade stall analogy

- Finally, imagine at the end of the day; you also give 5 cents from each sale to a friend because they lent you some money to start.

- After giving them their share, you’re left with 15 cents for every $1 cup you sell. This is your final profit, or 15%.

Related Read – Solvency Ratio: Formula, Interpretation, Examples, Tips to Improve it

Return Ratios

Let us discuss the types of profitability ratios that come under return ratios:

1. Return on Equity (ROE)

The Return on Equity (ROE) measures a company’s profitability by revealing the amount of profit generated with the shareholders’ invested money. It is an indicator of how well the company’s management is using shareholders’ equity to generate earnings.

ROE assesses the efficiency with which a company is generating profit from its equity.

It helps investors understand the return they are getting on their investment.

Here is how you calculate Return on Equity:

Interpretation:

Let us again understand this profitability ratio with the help of lemonade stand analogy:

- Imagine you decided to start a lemonade stand business. To set it up, you used $100 from your savings, which you spent on buying a stand, lemons, sugar, and other essentials. This $100 represents your equity or the money you’ve personally invested.

- At the end of the summer, after selling lemonade for several months, you count your earnings and find out you made a profit of $20 after deducting all your expenses.

- In this scenario, your ROE would be 20%. This means that for every dollar you invested from your savings (equity), you earned a return of 20 cents. It’s a way to see how well you’ve used your own money to generate profits in your lemonade business.

2. Return on Assets (ROA)

The Return on Assets (ROA) indicates how efficiently the company uses its assets for making profit. It provides a ratio that compares the net income of a company to its total assets.

ROA shows the effectiveness of a company in generating profit from its assets.

It is useful for comparing the performance of companies within the same industry.

Here is the formula to calculate Return on Assets:

Interpretation:

Let us continue with the same analogy:

- Continuing with your lemonade stand business, let’s consider everything you own for the business as assets. This includes the physical stand, pitchers, cups, leftover lemons, and sugar. Let’s say the total value of all these items (assets) is $150.

- Now, if you made a profit of $20 over the summer, you’d want to know how efficiently you’ve used all these assets to generate that profit.

- Your ROA, in this case, would be 13.33%.

- This means that for every dollar’s worth of assets (everything you used in your business), you managed to earn a profit of roughly 13 cents. It gives you an idea of how effectively you’ve used all your resources, not just the money you invested, to run your lemonade stand.

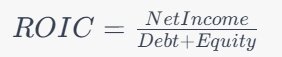

3. Return on Invested Capital (ROIC)

The Return on Invested Capital (ROIC) assesses a company’s efficiency in allocating its capital to profitable investments. It provides a measure that compares the net profit of a company to the total capital it has invested.

- ROIC measures the returns a company is generating from all its capital sources, including both debt and equity.

- It offers investors a comprehensive view of how effectively a company is using its capital to generate returns.

Interpretation:

Understanding the profitability ratio with the help of lemonade stand analogy:

- Let’s say you wanted to expand your lemonade business. To do this, you took a loan of $50 from a friend and added it to your initial $100 savings, making the total capital you’ve invested in the business $150.

- At the end of the season, after paying back any interest on the loan and other expenses, you still made a net profit of $20.

- Your ROIC, in this context, would be 13.33%. This means that for every dollar of total capital (both the money you borrowed and your own savings) you invested in the business, you earned a return of 13.33 cents. It helps you understand how well you’ve used both your own money and borrowed funds to generate profits.

What Do Profitability Ratios Indicate?

The following points represent what does exactly profitability ratios indicate:

- Profitability ratios indicate how a company’s management operates a business.

- Investors use them to determine whether investing in a company is good.

- A company’s profitability ratios are useful when comparing to similar companies, average ratios, and performance history.

- These qualitative tools help in assisting with management planning and decision-making.

- They analyze and evaluate the financial performance of a business.

- Such ratios allow businesses to compare their performance with competitors, industry averages and historical data.

- This helps businesses understand their position in the market and the areas that require improvement.

- It also indicates how well an organization has minimized costs while generating profit.

- They help determine whether a company is optimizing its assets for profit generation and the amount of returns for shareholders.

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio