Amortization Meaning: Definition, Calculation and Examples

Amortization is a crucial concept in accounting that helps businesses and individuals better understand and manage their finances. By amortizing assets, companies can spread out the expense and tie it to the revenues generated, providing a clearer picture of their true earnings. It is a vital tool in financial reporting and management. It is used to quantify the loss of value of assets over time and enables us to manage our finances accurately and understand the true cost of owning assets. Let us explore amortization in detail.

Table of Contents

- What is Amortization?

- Amortization Formula

- How to Calculate Liability Amortization?

- Example - Amortization Schedule

- Importance of Amortization

- Examples of Amortization

What is Amortization?

Amortization Definition: Amortization is a financial concept that involves spreading the cost of the value of a loan or intangible asset over a period. It's a way of recognizing and accounting for the gradual reduction of a financial obligation or the allocation of the cost of an asset over its useful life.

Amortization applies to two situations: Paying off a loan and valuation of intangible assets -

Loan Amortization: When individuals or companies borrow money, they usually agree to repay the loan in periodic instalments, including principal and interest. The process of spreading loan payments over time is known as loan amortization.

Amortization of intangible assets: In the context of intangible assets, such as brands, copyrights or goodwill, the cost of acquiring or developing these assets is allocated over their estimated useful life. This cost distribution over time is known as amortization of intangible assets.

In accounting, amortization is included in the profit and loss category on the income statement and is deducted from profits. When applied to an asset, amortization is similar to depreciation in terms of calculations.

Amortization is generally recorded as an expense using a straight-line method so that the same amount is spent periodically over the asset's useful life. Generally, expensed assets based on the amortization method have no resale or salvage value when discarded.

Amortization meaning in Hindi - ऋणमुक्ति

Best-suited Financial Planning & Analysis courses for you

Learn Financial Planning & Analysis with these high-rated online courses

Amortization Formula

There are several formulas used for amortization, depending on the specific context. Here are some common formulas:

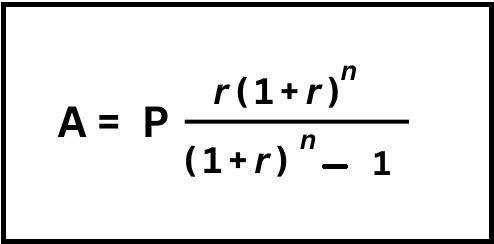

1. Loan Amortization Formula

This formula calculates the amount of each periodic payment for a loan, including both principal and interest.

Where,

A = Payment amount

P = Initial loan amount or Principal

r = Rate of interest

n = Total number of payments

2. Amortization of Intangible Assets:

This formula calculates the periodic expense recognized for an intangible asset.

Formula:

Expense = Cost of asset / Estimated useful life

3. Amortization of Prepaid Expenses:

This formula calculates the periodic expense recognized for a prepaid expense.

Formula:

Expense = Prepaid amount / Number of periods covered by the prepayment

4. Amortization of Debt Discount or Premium:

This formula calculates the periodic adjustment to the carrying value of a bond.

Formula:

Adjustment = (Discount or premium) / Number of periods to maturity

5. Amortization of Lease Costs:

This formula calculates the periodic lease expense recognized under a lease agreement.

Formula:

Expense = (Lease payments + Amortization of lease liability) / Number of periods in the lease term

6. Amortization of Warranties:

This formula calculates the periodic expense recognized for warranty obligations.

Formula:

Expense = Estimated warranty cost / Estimated Number of warranty claims

How to Calculate Liability Amortization?

Let's look at the most used systems for the amortization of liabilities.

French System

- Fixed monthly payments include both principal and interest.

- Initially, more amount goes toward interest, with decreasing interest and increasing principal payments over time.

- Commonly used for mortgage loans in many countries.

German System

- Fixed monthly payments, with the same amount allocated to the principal in each instalment.

- As time passes, the interest portion decreases, decreasing total monthly payments.

- Used in Germany and referred to as "annuity loan."

American System

- Monthly payments cover only interest.

- The principal amount is due as a lump sum when the loan matures.

- Less common for traditional mortgages but used in certain loan types, like balloon mortgages.

Example - Creating an Amortization Schedule

Let's take an example of a machine purchased for Rs 5,60,000. It had an estimated useful life of 5 years and a residual value of Rs 12,000 at the end of 5 years. To calculate amortization schedule of this machine, we can use the straight-line depreciation method.

| Year |

Beginning Book Value |

Annual Depreciation |

Ending Book Value |

| 1 |

Rs 5,60,000 |

Rs 1,09,600 |

Rs 4,50,400 |

| 2 |

Rs 4,50,400 |

Rs 1,09,600 |

Rs 3,40,800 |

| 3 |

Rs 3,40,800 |

Rs 1,09,600 |

Rs 2,31,200 |

| 4 |

Rs 2,31,200 |

Rs 1,09,600 |

Rs 1,21,600 |

| 5 |

Rs 1,21,600 |

Rs 1,09,600 |

Rs 12,000 |

Here's how the table works:

- Year 1: The beginning book value is the initial cost of the machine, which is Rs 5,60,000. The annual depreciation is calculated as (Cost of Asset - Residual Value) / Useful Life, which is (Rs 5,60,000 - Rs 12,000) / 5 = Rs 1,09,600. The ending book value is the beginning book value minus the annual depreciation.

- Year 2: The beginning book value is the ending book value from Year 1, which is Rs 4,50,400. The annual depreciation remains the same at Rs 1,09,600. The ending book value is calculated as the beginning value minus the annual depreciation.

- Year 3: Similar calculations are done for Years 3, 4, and 5, where the beginning book value is the previous year's ending book value, the annual depreciation remains constant at Rs 1,09,600, and the ending book value is calculated accordingly.

- Year 5: At the end of Year 5, the ending book value equals the residual value of Rs 12,000.

This table represents the depreciation schedule for the machine over 5 years, showing the beginning and ending book values for each year and the annual depreciation expense.

7. Amortization of Software Licenses:

This formula calculates the periodic expense recognized for a software license.

Formula:

Expense = Cost of license / License term

Importance of Amortization

Amortization plays a crucial role in both personal and business finance. It provides a structured and logical way to manage costs over time, offering several key benefits:

1. Predictability and Budgeting

- Amortization schedules provide a clear breakdown of future payments, including both principal and interest. This predictability helps individuals and businesses budget effectively and plan for upcoming financial obligations.

- By knowing the exact amount of each payment, individuals can allocate resources accordingly and avoid unexpected financial burdens. Businesses can use this information to forecast cash flow and make informed decisions about investments and expenditures.

2. Financial Transparency and Accurate Reporting

- Amortizing assets allows a more accurate representation of a company's financial health and performance. By spreading out the cost of long-term assets over their useful life, the company's income statement reflects the actual cost of its operations in each period.

- This transparency benefits investors, creditors, and other stakeholders by clarifying the company's financial position.

3. Reduced Risk and Improved Debt Management

- Amortization helps individuals and businesses manage debt effectively by splitting the payment into manageable instalments, thus reducing the risk of default and making debt repayment more sustainable in the long run.

- By spreading out the cost of borrowing, individuals can free up cash flow for other purposes, such as investments or emergency savings.

4. Matching Expenses to Revenue

- Amortization ensures that an asset's cost correctly matches the revenue it generates over its useful life. This provides a more accurate picture of a company's profitability and helps investors make informed investment decisions. For example, the cost of a software program should be spread out over the years. It generates revenue rather than expending in the year it is purchased.

5. Tax Benefits

- In many jurisdictions, businesses can deduct the amortized cost of intangible assets from their taxable income, reducing their overall tax liability and improving their financial performance.

- The tax benefits of amortization vary depending on the jurisdiction and the type of asset being amortized.

Examples of Amortization

Here are some real-life examples of amortization:

- Home Loans: This is the most common example of amortization. When you take out a home loan, you borrow money from a lender to buy a house. The loan amount, interest rate, and loan term determine your monthly payment. Each monthly payment includes a portion of the principal (the loan amount) and interest. Over time, the principal portion of your payments increases, and the interest portion decreases. This is because you are gradually paying off the loan.

- Car Loans: Similar to mortgages, car loans are also amortized. Your monthly payment includes both principal and interest. Over time, the principal portion of your payments increases, and the interest portion decreases.

- Student Loans: Most student loans are also amortized. Your monthly payment includes both principal and interest. However, some student loans have income-driven repayment plans, meaning your monthly payment is based on your income. This can make it easier to afford your payments if you have a low income.

- Intangible Assets: Businesses often amortize intangible assets, such as patents, trademarks, and goodwill. The cost of these assets is spread out over their estimated useful life. This is because the value of these assets is expected to decline over time.

- Leases: Lease payments are often amortized. This is because the lease is essentially a loan for using an asset. The cost of the lease is spread out over the lease term.

- Prepaid Expenses: Businesses often prepay expenses like insurance premiums and rent. The cost of these expenses is amortized over the period they cover.

- Bonds: Bonds are essentially loans issued by businesses or governments. The cost of a bond is amortized over the bond's term.

- Warranties: Businesses often offer warranties on their products. The cost of these warranties is amortized over the warranty period.

Key Takeaways

- Amortization gradually allocates the cost of an asset over its useful life, making it more manageable.

- Amortization matches expenses to revenues and accurately reflects a company's profitability to provide better financial transparency.

- It reduces risk by spreading out loan payments, improving debt sustainability.

- Businesses can often deduct amortized costs, lowering their tax liability.

- Amortization applies to various assets - from loans to intangible assets, and helps manage costs for various financial obligations.

Conclusion

By understanding amortization, individuals and businesses can better manage their finances, knowing how payments are split between interest and principal or how an asset’s cost is spread across its useful life. Calculating amortization allows for more transparent budgeting, providing a predictable repayment or expense schedule. Through examples and calculations, it’s easier to see how amortization impacts personal and business financial planning, making it an essential tool for effective financial management.

FAQs - Amortization

Why is amortization important?

Amortization offers various benefits:

- Predictability and budgeting: Individuals and businesses can plan for future payments and allocate resources effectively.

- Financial transparency: Provides a more accurate picture of a company's financial health and performance.

- Reduced risk and improved debt management: Mitigates the risk of default by making loan repayment more manageable.

- Matching expenses to revenue: Ensures that an asset's cost is correctly matched to its revenue.

- Tax benefits: Businesses may deduct amortized costs from their taxable income, reducing their tax burden.

What are the limitations of amortization?

- Estimating useful life: Accurately estimating the useful life of an asset can take time and effort, leading to misrepresented financial statements.

- Linearity assumption: Amortization typically assumes a linear decrease in value, which may not be accurate for all assets.

- Subjectivity and flexibility: Determining the useful life of an asset can be subjective, leading to discrepancies in how companies amortize similar assets.

- Ignoring obsolescence: Amortization focuses on wear and tear but may not fully account for obsolescence.

- Potential for manipulation: Aggressive, useful life estimates can be used to manipulate financial statements.

What are some real-life examples of amortization?

- Home loans

- Car loans

- Student loans

- Intangible assets (patents, trademarks, goodwill)

- Leases

- Prepaid expenses

- Bonds

- Warranties

How is amortization different from depreciation?

Amortization and depreciation are similar concepts, but they have some key differences. Depreciation is used for tangible assets, while amortization is used for intangible assets. Additionally, depreciation typically assumes a physical decline in value, while amortization can account for other factors like obsolescence.

What are the accounting standards for amortization?

Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) guide the accounting treatment of amortization. Specific rules and regulations may vary depending on the jurisdiction and the type of asset being amortized.

What are the ethical considerations of amortization?

Companies should ensure that they use amortization appropriately and not manipulate it for financial gain. Aggressive estimates of useful life can mislead investors and creditors.

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio