Applications of Data Analytics In Banking

Data analytics has a range of applications in banking. It uses advanced data processing techniques to extract valuable insights from vast financial data, enabling banks to make data-driven decisions, assess credit risk, and detect fraudulent activities. It enhances customer experiences by tailoring financial products and services to individual needs and preferences through predictive analytics and targeted marketing campaigns. Data analytics in banking allows them to contextualize and personalize their products and services to cater to their consumers better and have a straightforward, customer-centric approach to growing the business.

How can banks benefit from a data-driven strategy? Let’s explore.

Must Explore – Data Analysis Courses

Why Is It Important To Analyze The Data?

The use of data analytics in banking isn’t new. These banks have been implementing data analytics for the past few decades to differentiate themselves and gain a competitive edge while ensuring their customers’ best and most customized services. Data analytics is crucial for banking and other financial services because it contributes to –

- Understand your audience and customers better

- Risk assessment and mitigation

- Determine interest rates and forecast NII

- Manage overall funds situation and FTP

- Maximize sales while minimizing cost by optimizing revenue

- Improve customer satisfaction and loyalty

- Improved marketing and remarketing campaign planning

Best-suited Data Analytics courses for you

Learn Data Analytics with these high-rated online courses

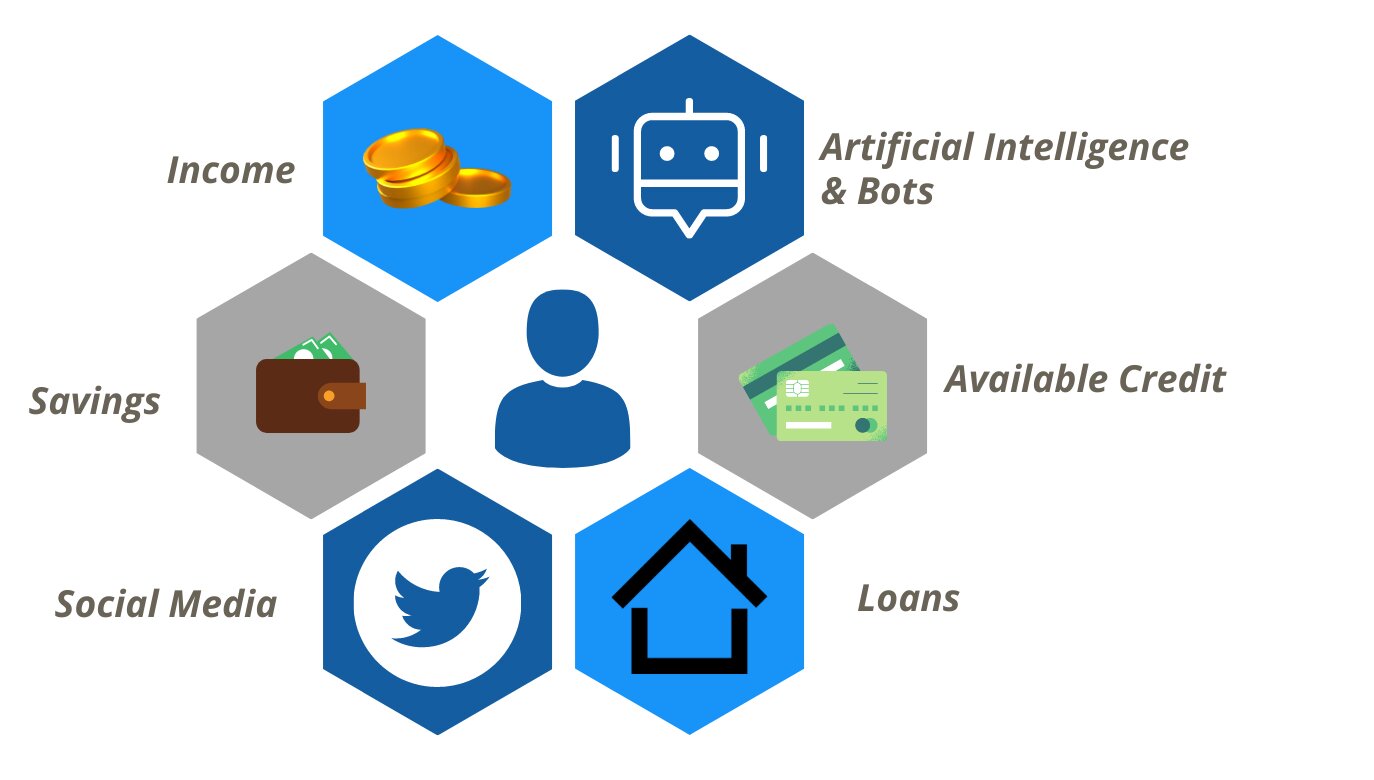

Technology for Data Analytics in Banking

Today, the growing volume of data and advanced data analysis technologies lead to deeper and faster information. Some of the technologies used in data analytics in banking are:

Predictive Analytics

Predictive analytics allows the prediction of future data and the probability of occurrence. They usually use statistical algorithms and machine learning. Banking data analytics extensively uses tree-based learning algorithms like Random Forest, CART, and CHAID.

Machine Learning

Machine learning is a subset of artificial intelligence vital for data analytics. ML involves self-learning algorithms. It uses existing data and analyzes it for the prediction of results. As information emerges, the system will continue to learn to gather more data and become more accurate.

Data Mining

Data mining classifies large amounts of data to identify patterns and discover relationships between data. All this contributes to making relevant decisions. Current technologies allow these tasks to be completed quickly.

Optimization

Linear and non-linear techniques of optimization are used in banking data analytics. These optimization techniques help in controlling risk and maximizing revenue.

Data Visualization

Data visualization and dashboarding tools like MS Excel, Tableau, QlikView, and SAS visual analytics have been very insightful for banking professionals and help them derive the most intricate details from the available data.

How Does Data Analytics Help Banking?

As a huge amount of data is generated, extracting useful information is imperative. Data analytics is, therefore, key in improving the business. Data analytics initiatives can help financial institutions offer clients a totally personalized service since by processing the information that users generate, their preferences, habits, and needs can be known to offer individual services. The market has put the customer and their data as the epicentre, as it must offer them personalized and unique services.

In addition, companies can use all this information in processes where data analysis is needed to make decisions: from strategies to increase revenue, improve operational efficiency, respond more quickly to market trends or gain a competitive advantage over rivals.

Below are some of the applications of data analytics in banking –

Smart Account

With the help of data science functionalities and logistic regression analysis methods, financial institutes can offer the client a new value-added account concept of Smart Account. This allows banks to –

- Receive predictions of future expenses and other possible short or medium-term discoveries.

- Analyze the consumer behavior based on the expenses

- Automatic categorization of movements to consult by groups

- Compare expenses with anonymous clients of the same profile

- Product recommendations that meet the specific needs of the client

Risk Management and Fraud Prevention

Risk management and fraud prevention are the two pioneering use cases in banking entities based on data science, data analytics, machine learning, and big data. Banking and financial institutions are now relying on utilizing data science to predict vulnerabilities, basis current market trends targeting the industry. Other popular data science and analytics methodologies adopted by banks and financial organizations include –

- Predictive detection, encompassing user authentication

- Enhanced internal process efficiency

- Automated fraud triage

- Robotic process automation (RPA)

Efficient Consumer Analytics

Real-time data analytics aids in a better understanding of customers and effective personalization. Sophisticated machine learning algorithms and customer sentiment analysis techniques can generate information about their behavior, social media interaction, comments, and opinions and optimize personalization, thus getting more information about the user. Since the amount of data is huge, only experienced data scientists can make an accurate breakdown.

More Efficient Marketing and Sales

Insights derived from data analytics of banking data allow targeting the right set of customers and segmenting their audience accurately. It allows banks to –

- Generate the right marketing and sales strategy

- Identify the best channels to market their products and services

- Spot influential clients and make them the brand’s voice

- Boost cross-selling effort

- Correctly apply dynamic pricing

AI-Driven Chatbots & Virtual Assistants

Banks and other financial institutions are already implementing artificial intelligence-enabled chatbots. Such technologies have helped in reducing the time spent on day-to-day tasks –

- Better consumer assistance

- Removal of manual processes like emailing or calling rooms

- Improved customer engagement

The intelligent and strategic use of data and smart business intelligence tools will greatly influence the future of banking. The emerging technology trends would enable the automation of reports and visualization, optimize commercial efforts, and help create the most customized products and services.

FAQs

What are some specific use cases of data analytics in banking?

Data analytics is used in banking for credit scoring, fraud detection, customer segmentation, personalized marketing, forecasting financial trends, and optimizing branch locations, among many other applications.

How does data analytics enhance customer experience in banking?

By analyzing customer data, banks can tailor their services, offer personalized recommendations, and provide a more convenient and efficient experience. This can include customized product offerings and improved customer support.

Can data analytics help banks prevent fraud?

Data analytics plays a crucial role in fraud prevention by identifying unusual patterns, monitoring real-time transactions, and flagging potentially fraudulent activities. It can help banks stop fraud before it causes significant financial losses.

What role does data analytics play in credit risk assessment?

Data analytics assesses borrowers' creditworthiness by analyzing their credit history, income, and other relevant factors. It helps banks make more accurate lending decisions, reducing the risk of loan defaults.

Can data analytics be used to predict market trends for investment purposes?

Data analytics can analyze historical market data, news sentiment, and other relevant information to predict market trends, helping banks make informed investment decisions.

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio