Balance of Payments and its Importance in Global Transactions

The article covers balance of payments and its importance in observing the economic behavior of a country in relation to others.

Banks send account statements every month that help us to obtain control over the management of our money. These statements tell us what transactions have been made in a given period, deposits, investments, and other details. In the same way, the balance of payments tells us, at the national level, the entry and exit of currencies (foreign currency) in terms of exports, imports, income from work abroad, transactions, and capital. In other words, it records a country’s economic transactions in relation to others.

Must Read –What is Finance?

Content

- What is Balance of Payments?

- Structure of the Balance of Payments

- Deficit and Surplus in the BoP

- Stepwise Calculation of the Balance Accounts

- Importance of the Balance of Payments

Explore Online Finance Courses

What is Balance of Payments?

Balance of payments (BoP) is a tool that allows us to observe the economic behavior in relation to other countries. It helps investors understand whether it is appropriate to invest in the country, and, on the other hand, it offers us an overview of how our national resources are managed.

The balance of payments is a macroeconomic indicator that provides information on the economic situation of the country in a general way.

It helps to determine the income a country receives from the rest of the world and the payments it makes to the rest due to imports and exports of goods, services, capital, or transfers in a period.

Also read: Difference between Export and Import

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

Structure of the Balance of Payments

Within the balance of payments, there are three main accounts:

Current Account Balance: This balance is the most important since it is the most used to know the state of a country’s economy. This includes imports and exports of goods and services and income and transfers. It is subdivided into four sub-accounts: trade balance, services balance, income balance, and transfer balance.

Capital Account Balance: This represents the movement of capital. For example, the aid from abroad or the purchase and sale of non-financial goods.

Financial Account Balance: The financial account balance keeps records of the transactions between parties that include a change of ownership of the assets or liabilities of a country.

Therefore, the formula for the balance of payments would be the following:

Balance of Payments = Current Account Balance + Financial Account Balance + Capital Account Balance.

Check out the top finance interview questions

Deficit and Surplus in the BoP

Each of these scales gives an independent balance that can be positive or negative:

Surplus: If the balance of a type of scale is positive, we will be talking about the scale being in surplus.

Deficit: If the balance is negative.

However, we cannot determine the equilibrium of these balances. What we achieve is the global equilibrium of the balance of payments. Therefore, the balance of payments will always be in equilibrium.

For example, a deficit in the current account balance will be offset by a surplus in the capital account balance. This, since because if a country has more purchases than sales, it must obtain money from somewhere, either through investments or foreign loans.

Check out the common finance terms for every newbie

Stepwise Calculation of the Balance Accounts

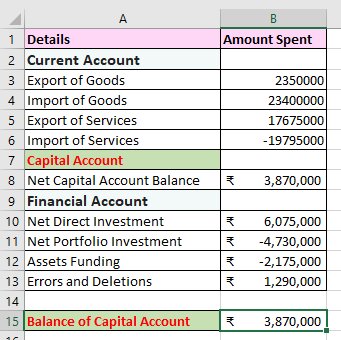

We have the below data for a particular that we will calculate for different balance accounts as discussed above and figure out if the country is in Surplus or Deficit –

We will calculate the balance of payments for –

Current Account

Balance of Current Account = Exports of Goods + Imports of Goods + Exports of Services + Imports of Services

As per the above formula, the balance of current accounts is ₹ 23,630,000. Hence the current account is in SURPLUS.

Capital Account

Balance of Capital Account = Net Capital Account Balance

The Balance of the Capital Account is in SURPLUS since the Net Capital Account Balance is ₹ 3,870,000.

Balance of Financial Account

To calculate the Balance of the Financial Account, we will add up the components of the financial account –

Balance of Financial Account = Net Direct Investment + Net Portfolio Investment + Assets Funding + Errors and Deletions

The Balance of the Financial Account is negative (₹ -2,120,000); hence there is a DEFICIT.

Related Read – Digital Economy- A Journey From Double Taxation To Fair Taxation

Importance of the Balance of Payments

The importance of the balance of payments is as follows –

- The balance of payments helps any country determine if its currency’s value is appreciating or depreciating.

- It provides almost accurate information on the commercial and/or financial performance of the external sector of an economy.

- Balance of payments helps to monitor the import-export transactions in a given period.

- It analyses the export growth potential of a country. It helps the government make sustainable fiscal and trade policies and strategies.

- BoP helps to analyze macroeconomic policies to preserve the external balance of the national economy. It also contributes to correcting temporary and structural imbalances that may arise in the external accounts of a given economy.

- It allows us to analyze the relations of a country with other countries in a certain period. This way, you can see how some accounts relate to others.

To understand this, the example of the BoP crisis in the Indian economy is suitable. In 1991, the increased foreign borrowing rates, high oil prices, and unnecessary domestic spending led to the BoP crisis. India almost defaulted on its international commitments and was denied any access to external credit. The only way out was to borrow the credits against the security of its gold reserves. The crisis helped the Indian economy overcome the issues and paved the way for the much-needed and long-overdue industry and trade policy reforms.

Top Trending Finance Articles:

Financial Analyst Interview Questions | Accounting Interview Questions | IFRS Certification | CPA Exams | What is Inflation | What is NFT | Common Finance Terms | 50-30-20 Budget Rule | Concept of Compounding | Credit Cards Rewards System | Smart Budgeting Approaches

FAQs

What does the Balance of Payments consist of?

The Balance of Payments consists of three main components - the current account, the capital account, and the financial account.

What does the current account of the Balance of Payments include?

The current account includes the trade balance (exports and imports of goods and services), net income from abroad (such as wages and investments), and net transfers (remittances, foreign aid, etc.).

What does the financial account of the Balance of Payments include?

The financial account tracks transactions involving financial assets, including direct investment, portfolio investment, reserve assets, and other investment flows.

Why is the Balance of Payments important?

The Balance of Payments is crucial for understanding a country's economic relationships with the rest of the world and its overall external financial position.

What does a surplus in the Balance of Payments mean?

A surplus in the Balance of Payments occurs when a country's receipts from exports, income, and transfers exceed its payments for imports, income, and transfers.

What does a deficit in the Balance of Payments mean?

A deficit in the Balance of Payments happens when a country's payments for imports, income, and transfers exceed its receipts from exports, income, and transfers.

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio