What is Credit Default Swap (CDS)?

A Credit Default Swap or CDS is a financial contract or derivative that allows one party (the protection buyer) to transfer the credit risk of an underlying asset, typically a bond or a loan, to another party (the protection seller) in exchange for regular premium payments.

What is CDS?

Credit default swaps (CDS) are financial derivatives associated with the credit risk of bonds issued by a company or a government and are similar to an insurance contract. The main purpose of CDS is to help manage the credit exposure of fixed-income investments between two or more investors. A CDS allows investors to hedge against unexpected market volatility and other risk factors.

Two parties enter the CDS contracts where the seller sets a periodic premium that the buyer pays. In return, in case of non-payment, the seller will compensate the buyer for his losses.

Explore finance courses

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

CDS Analogy – Bank Loan Portfolios

Suppose a bank has provided loans to various businesses. These loans are assets on the bank’s balance sheet, and the bank earns interest income from them. However, the bank is concerned about the possibility of some of these borrowers defaulting on their loans, which could lead to significant financial losses.

The bank enters into CDS agreements with other financial institutions to reduce its exposure to potential loan defaults. The bank effectively transfers some of the credit risk associated with its loans to other financial institutions. If one of the borrowers defaults on its loan, the bank receives a payout from the CDS contracts to offset its losses.

Background of CDS

Credit Default Swap was invented to provide banks with the means to transfer credit exposure, but later, it became an active portfolio management tool. The performance of CDS, like corporate bonds, is closely related to changes in credit spreads. This makes them an effective tool for hedging risk and efficiently taking credit exposure.

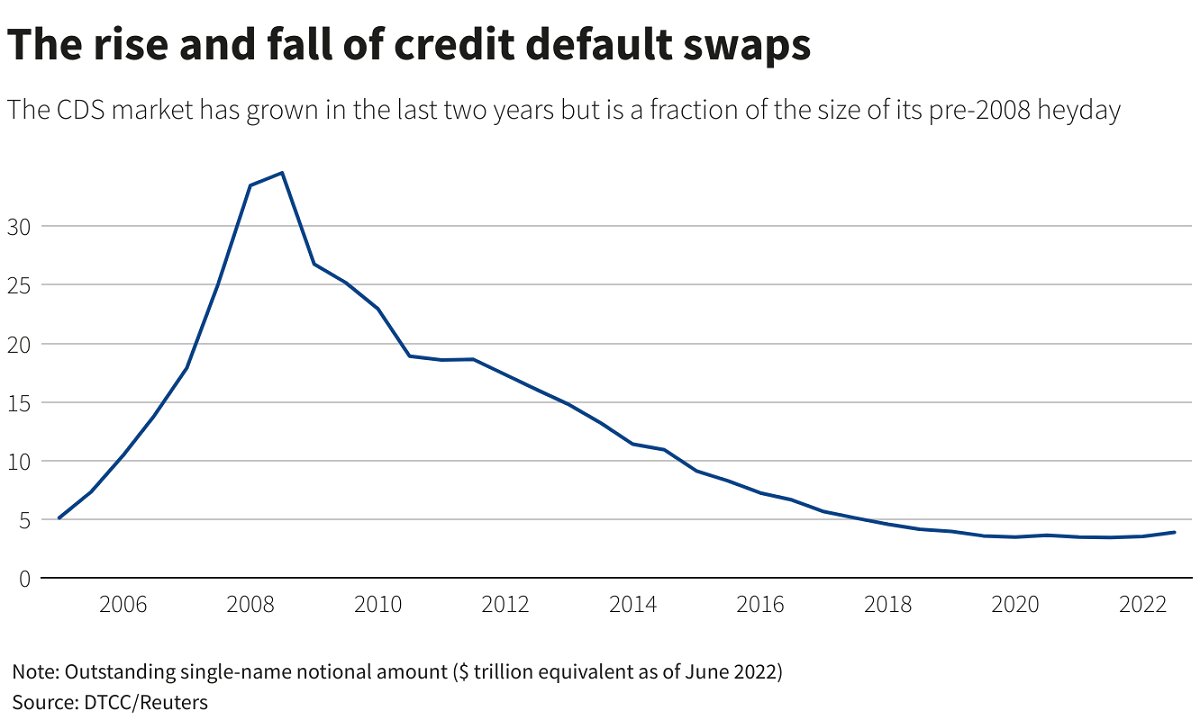

The CDS market, with a current valuation of approximately $3.8 trillion, according to the International Swaps and Derivatives Association (ISDA), has significantly contracted from its peak of $33 trillion in 2008. The CDS market remains relatively small compared to other financial markets, such as equities, foreign exchange, and the global bond markets.

The global bond market’s outstanding value exceeds $120 trillion, and foreign exchange sees a substantial daily trading volume nearing $8 trillion, highlighting the relatively modest scale of the CDS market.

How CDS Works?

Here is a simplified process of how CDS works –

The fundamental steps involved in Credit Default Swap are as follows –

- The credit risk transfers from a protection buyer to a protection seller.

- The protection buyer pays a premium to the protection seller. This premium is similar to an insurance premium and is paid periodically.

- In exchange for the premium, the protection seller assumes the risk of default on an underlying asset, such as a bond or loan.

- If a default event occurs on the underlying asset, the protection buyer has the right to receive compensation from the protection seller. This compensation is determined based on the face value of the underlying asset.

Advantages of CDS

- CDS provides liquidity and allows portfolio diversification.

- It allows investors to buy or sell protection on various credit risks quickly.

- CDS makes managing and trading credit exposure easier.

- Investors can use CDS to diversify their portfolios by gaining exposure to different credit risks without directly owning the underlying assets.

- CDS can be valuable tools for banks and financial institutions to hedge against credit risk in their loan portfolios, reducing potential losses from defaults.

- CDS spreads can provide useful information about market perceptions of credit risk, helping assess and price credit risk.

Disadvantages of CDS

- Credit Default Swap contracts are bilateral agreements, which means each party relies on the other to fulfil their obligations. If one party defaults, it can lead to significant losses for the other.

- CDS contracts can be highly complex, with terms and conditions tough to understand, leading to misunderstandings and disputes.

- CDS can be used for speculative purposes. Speculative trading can increase market volatility.

- CDS markets are often over-the-counter (OTC), which means they are less transparent than exchange-traded markets, making it difficult to accurately assess market conditions and pricing.

- The use of CDS has raised regulatory concerns, as excessive risk-taking and lack of oversight contributed to past financial crises.

Common CDS Terminologies & Events

| Term | Description |

| CDS Index | A financial instrument tracking multiple CDS contracts on various entities. |

| Counterparty | The other party in a CDS trade (buyer or seller) with whom the contract is made. |

| Credit Event | A predefined event (e.g., default, bankruptcy) triggering the CDS contract. |

| Mark-to-Market | Valuing a CDS contract based on current market conditions. |

| Notional Amount | The face value of the reference obligation representing the amount covered by the CDS. |

| Premium | Payments made by the CDS buyer to the seller, similar to an insurance premium. |

| Protection Buyer | The party purchasing CDS as insurance against credit risk. |

| Protection Seller | The party selling CDS and assuming credit risk in exchange for premiums. |

| Reference Entity | The entity or issuer of debt whose credit risk forms the basis of the CDS contract. |

| Reference Obligation | The specific debt security or obligation is the basis for the CDS contract. |

| Senior Tranche | A CDS contract covering higher-ranking debt, typically with lower risk and payouts. |

| Settlement | The process of determining and executing payments after a credit event. |

| Spread | The cost of CDS protection typically quoted in basis points (e.g., 100 basis points = 1%). |

| Spread Tightening | When CDS protection costs decrease, indicating improved creditworthiness. |

| Spread Widening | When CDS protection costs increase, suggesting deteriorating credit quality. |

| Subordinated Tranche | A CDS contract covering lower-ranking debt, usually with higher risk and payouts. |

| Termination Date | The contract’s expiration date. |

Related Read – Difference Between Central Bank and Commercial Bank

Key Takeaways

CDS Basics

- CDS is a contract between two parties to protect against losses from a borrower’s default.

- It is based on the debt of a third party known as the reference entity, typically a senior unsecured bond.

Parties Involved:

- The credit protection buyer is short the reference entity’s credit.

- The credit protection seller is long the reference entity’s credit.

Credit Events: CDS pays off upon credit events like bankruptcy, failure to pay, and involuntary restructuring.

Settlement Methods: Settlement can be through cash payment based on the cheapest-to-deliver obligation or physical delivery of the reference obligation. Cash settlement uses auction results to determine the payout.

CDS Varieties: CDS can be on a single entity or as indexes with multiple entities.

Fixed Payments: Fixed payments from the CDS buyer to the seller are typically set at an annual rate (e.g., 1% for investment-grade debt and 5% for high-yield debt).

Monetization: Parties can monetize gains or losses by entering offsetting positions matching the original CDS terms.

In a Nutshell

If you want to buy credit default swaps, be aware they are traded over the counter. The swap value can fluctuate depending on the probability of a credit event. If required, investors can sell their interest to another individual or entity and make an exit. Remember that credit default swap accounting requires in-depth market knowledge.

FAQs

What triggers a payout in a CDS contract?

Payouts occur when specific credit events, such as default, bankruptcy, or debt restructuring, happen with the reference entity (the entity whose credit is insured).

How do CDS contracts benefit investors?

CDS can be used for risk management, allowing investors to protect themselves from potential losses due to credit events without selling the underlying assets.

Can CDS be used for speculative purposes?

Yes, CDS can be used speculatively by investors who do not hold the underlying asset but believe the credit risk will change.

How is the value of a CDS determined?

The value of a CDS depends on the credit spread, which represents the cost of protection and the likelihood of a credit event occurring.

What is the difference between cash settlement and physical settlement in CDS?

Cash settlement involves a payment based on the value of the reference obligation, while physical settlement requires the actual delivery of the reference obligation.

How are CDS markets regulated?

CDS markets have undergone increased regulatory oversight to address transparency and market stability concerns, particularly after the 2008 financial crisis.

What are the risks associated with CDS?

Risks associated with CDS include counterparty risk (the risk of the protection seller defaulting), basis risk (mismatch between CDS and underlying asset), and the potential for speculative trading to impact market stability.

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio