Digital Economy- A journey From Double Taxation To Fair Taxation

Under the present taxation regime, Indian domestic tax triggers taxation on a particular income based on its business connection rule. These are based on brick and mortar systems i.e. taxing particular goods and or services on the basis of their physical movement from place A to place B including services consumption. In this article, we will be learning about the following.

Table Of Contents

- Key Considerations in framing taxation rules

- Introduction of Equitization Levy

- The two-pillar approach to tax digital economy

- Recent developments

Today, we cannot imagine the absence of the internet in and around our life, its necessities, especially in the era of globalisation which paved the way for the digital economy. Before speaking about correct taxation of the digital economy, it is important to first quickly touch upon the existing system of taxation and rules.

The Fast pace of the digital economy and e-commerce has become the order of the day. This has greatly impacted new Indian digital business models. It has led to digital business disruption which mandated thinking aloud and afresh for aptly taxing the digital economy. Old taxation models relying on physical presence and business connection fall short to capture this huge digital business.

The digital economy allows businesses to operate completely through online platforms. Starting a new digital business, selling products or services digitally without any need for a physical place. For example, we have doorstep services from the world top multinational brands with just a click of a button like food delivery, car services and so on and so forth.

Key Considerations in Framing Taxation Rules

Key considerations in framing taxation rules to tax the digital economy are as under:

- Difficulty in the characterization of income i.e. Business income vs Passive Income;

- Difficulty in determining Business Nexus for taxing right i.e. source vs Residence;

- Global consensus on Income Allocation Principles and Effective Dispute Resolution Minimum Taxation and Double Taxation Relief

The Organisation for economic cooperation and development (“OECD”) along with G20 nations at the international level first realised the importance and necessity of taxing the digital economy. It initiated work on taxation solutions of the digital economy to work out an amicable solution to taxation of the digital economy. A special project titled Base Erosion and Profit Shifting (BEPS) Project way back in 2015 helps in doing these. Under this, Action-1 is Report –Addressing the Tax Challenges of the Digital Economy.

Introduction of Equitization Levy

India, including many European countries, introduced unilateral measures to tax the digital economy to tap revenue leakages. India introduced Equalisation Levy (“EL”) in the budget, 2016 vide Finance Act, 2016. To begin with, EL was introduced as a levy to tax online advertisements. This includes the provision of digital advertising space by non-resident digital companies. New EL@2% was also introduced to tax sale of goods or services by Non-resident e-commerce operators effective from 1 April 2020.

Significant Economic Presence (SEP) i.e. virtual permanent establishment (PE) rules got enshrined in domestic income tax law w.e.f 1st April 2018. It expands the scope of income of a non-resident that accrues or arises in India. This results in a ‘digital business connection’ in India.

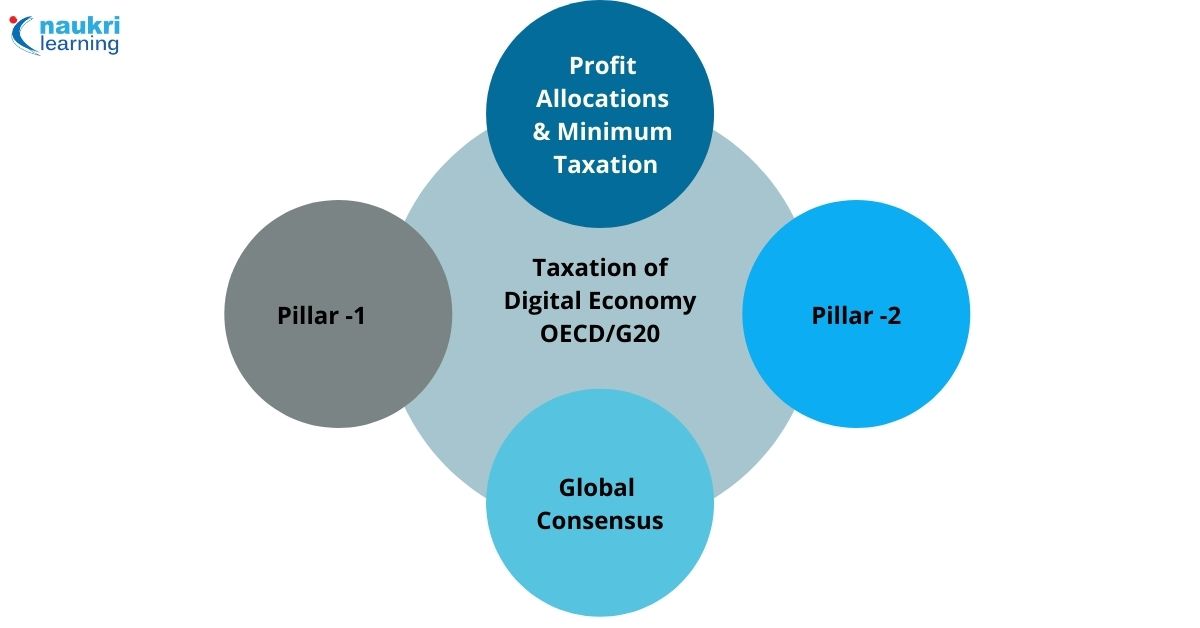

OECD with the support of 130 plus countries, Inclusive Framework (“IF”) introduced the draft scheme to tax the digital economy. It released a report on the Pillar One and Pillar Two Blueprints on 12 October 2020 for public consultation.

It will help in reaching global consensus, avoid double taxation and do away with the unilateral taxation attempts by many countries.

The Two Pillar Approach to Tax Digital Economy

Blueprint of Pillar One

Pillar One provides taxing rights to market jurisdictions on part of the residual profits earned by Multinationals Enterprise (MNE) groups with an annual global turnover exceeding €20 billion and 10 per cent profitability. The nexus is set at 250 000 euros for smaller jurisdictions with a GDP lower than 40 billion euros.

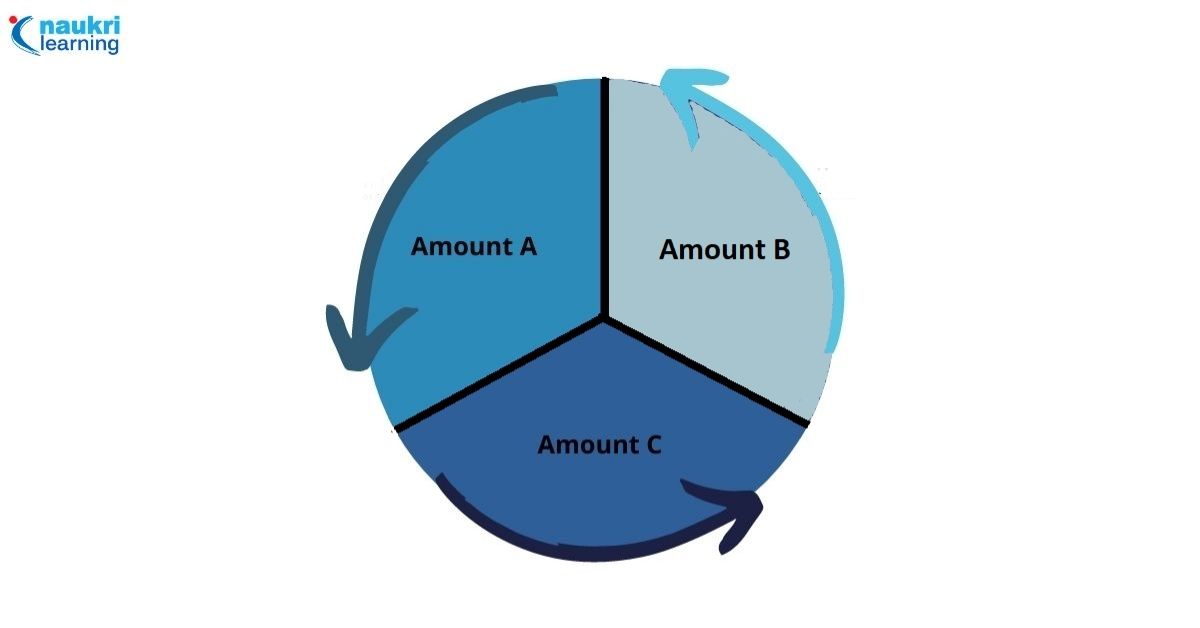

The sum total of Amount-A & Amount-B adjustments represents Pillar 1. To calculate Amount-A, you will consider 25% of the residual profit. Revenue will be sourced to the end market jurisdictions where goods or services are used or consumed. Whereas, the baseline minimum return towards marketing and distribution functions represents Amount-B.

Exemption or credit method helps in avoiding double taxation. Entities that will bear the tax liability will draw it from those that earn residual profit. Dispute prevention and resolution mechanisms ensure tax certainty and help in avoiding double taxation for Amount A.

It is important to note that unilateral measures introduced by various countries will be gradually withdrawn as the OECD model of digital taxation kicks in.

Explore Popular Online Courses

Blueprint of Pillar Two

Pillar Two requires MNE groups with an annual global turnover exceeding €750 million to pay at least 15 per cent tax. It consists of Global anti-Base Erosion Rules (GloBE) rules.

The two interlocking domestic GloBe rules are:

- Income Inclusion Rule (IIR)- It imposes an additional (top-up) tax on a parent entity in respect of the lower-taxed income; and

- Undertaxed Payment Rule (UTPR)- It denies deductions or makes adjustments to undertaxed companies under the group. Further, the treaty-based Subject to Tax Rule (STTR) allows source countries to impose taxes. The minimum rate for the STTR will be 9%.

Explore Free Online Courses with Certificates

Recent Developments

The OECD and G20 with the support of 137 member countries, issued a statement dated 8 October 2021, on taxation of the digital economy with the help of its Two-Pillar approach. Participating countries will sign Multilateral Conventions (“MLC”) during 2022 for effective implementation.

Recently, the Indian Government issued a press release on 24th Nov 2021. As per the agreement, the USA will phase out a 2% Equalization levy on digital economy supply or services.

The applicable interim period will be from 1 April 2022 till the implementation of Pillar One or 31 March 2024, whichever is earlier.

Top Trending Finance Articles:

Financial Analyst Interview Questions | Accounting Interview Questions | IFRS Certification | CPA Exams | What is Inflation | What is NFT | Common Finance Terms | 50-30-20 Budget Rule | Concept of Compounding | Credit Cards Rewards System | Smart Budgeting Approaches

_______________

Recently completed any professional course/certification from the market? Tell us what you liked or disliked in the course for more curated content.

Click here to submit its review with Shiksha Online.

This is a collection of insightful articles from domain experts in the fields of Cloud Computing, DevOps, AWS, Data Science, Machine Learning, AI, and Natural Language Processing. The range of topics caters to upski... Read Full Bio