What is GST Number in India and How to Get It?

Goods and Services Tax Identification Number which is abbreviated as GSTIN; is a 15-digit alphanumeric code crucial for businesses for complying with the GST regime. This identification number is a unique number essential for filing GST returns, claiming input tax credits, and conducting GSTIN verification.

Table of Contents

- What is GST Number in India?

- What is GST Number format?

- What is GST Number for Business?

- Why is GSTIN Required?

- When is the GSTIN Required?

- How to Apply for GSTIN?

- GSTIN Verification Process

- How to Check the Validity of a GSTIN?

- GST Number Check

- What is GST Number used for?

- Can GST Number be Transferred?

What is GST Number in India?

GSTIN is a 15-digit alphanumeric code, essential for businesses to comply with the GST regime. This 15 digit GSTIN is a unique identifier for each taxpayer registered under GST. The format of GSTIN in India is state-wise PAN-based, with the first two digits representing the state code, the next ten digits being the PAN of the taxpayer, one digit signifying the entity number, one character for future use, and the last character being a check code.

Best-suited Indirect Taxation courses for you

Learn Indirect Taxation with these high-rated online courses

What is the GST Number Format?

The GST Number format, specifically in India, is a unique 15-digit alphanumeric code known as the Goods and Services Tax Identification Number (GSTIN). This format is carefully structured to provide specific information about the taxpayer. Here's a breakdown of the GSTIN format:

- First Two Digits: These represent the state code as per the Indian Census 2011. Each state and union territory in India is assigned a unique two-digit code. For example, '09' stands for Uttar Pradesh, and '27' stands for Maharashtra.

- Next Ten Digits: These are the taxpayer's PAN (Permanent Account Number). This part of the GSTIN is crucial as it links the tax details of a business with the central database of the Income Tax Department.

- Thirteenth Digit: This digit is assigned based on the number of registrations a business entity has within a state under the same PAN. It is usually a number from 1 to 9, depending on the number of registrations. For instance, if a business has one or two registrations in the same state, this digit will be '1' or '2', respectively.

- Fourteenth Digit: This is currently defaulted to 'Z' in all GSTINs and is held for future use.

- Fifteenth Digit: This is a check code, used for detection of errors. It can be a number or an alphabet.

To illustrate, a GSTIN might look like this: 09AAACI1234M1Z5, where '09' is the state code for Uttar Pradesh, 'AAACI1234M' is the business's PAN, '1' indicates the number of registrations, 'Z' is the default character, and '5' is the check code.

Explore free GST courses

What is GST Number for Business?

A GST Number for a business is a unique 15-digit alphanumeric identifier assigned to each business registered under the GST regime in India. It is crucial for businesses for several reasons:

- Legal Identity for GST: The GSTIN serves as the legal identity for a business under the GST framework, enabling it to engage in activities that are subject to GST.

- Compliance and Taxation: It is essential for compliance with GST laws. Businesses use their GSTIN to file GST returns, pay GST, and comply with other GST-related statutory requirements.

- Input Tax Credit: Businesses use their GSTIN to claim Input Tax Credit (ITC) on their purchases. This reduces the overall tax burden on the company.

- Inter-State and Intra-State Transactions: The GSTIN is required for both inter-state and intra-state sales and purchases. It helps in determining the IGST, CGST, and SGST components of the tax.

- Invoicing and Documentation: For all GST-compliant invoices, a business must mention its GSTIN. This is also necessary for various other business documents and transactions.

- Business Credibility: Having a GSTIN enhances the credibility of a business, as it reflects the business’s commitment to adhering to the legal tax framework.

Learn what is GST and Taxation

Why is GSTIN Required?

GSTIN is required for a multitude of reasons. It facilitates the tracking of transactions for tax purposes, ensuring transparency and compliance. It's also essential for availing of the benefits under the GST regime, such as input tax credit, which is crucial for reducing the overall tax burden on the supply chain.

When is the GSTIN Required?

A GSTIN is required as soon as a business crosses the minimum threshold turnover that makes GST registration mandatory. In India, this threshold is ₹20 lakhs for service providers and ₹40 lakhs for goods suppliers, with some variations in special category states. Once this threshold is crossed, obtaining a GSTIN becomes mandatory for the business.

How to Apply for GSTIN?

The staff at GST Seva Kendras help businesses and individuals understand the process of obtaining a GSTIN, which is crucial for GST compliance. They assist in filling out the GST registration forms and guide on the necessary documentation required to obtain a GSTIN.

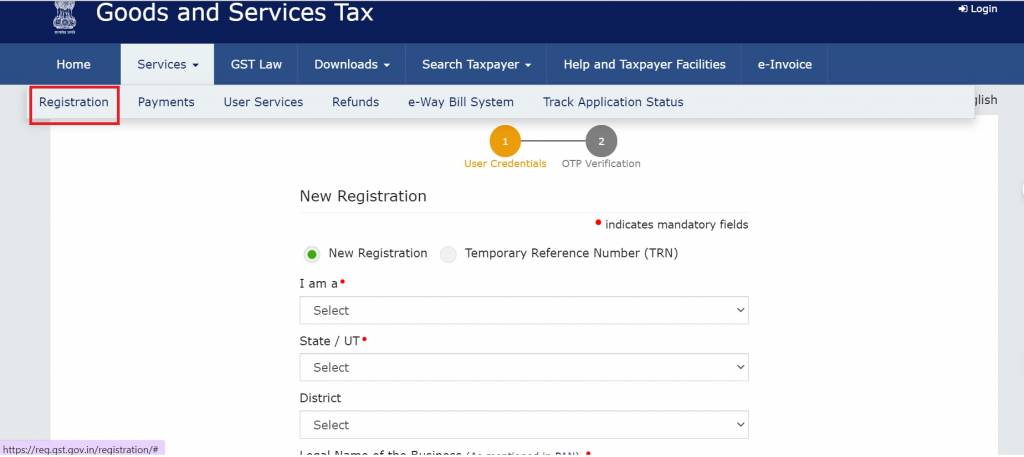

- GST Registration: The portal is the starting point for obtaining a GSTIN. Businesses and taxpayers can register themselves on the GST portal, a process that involves submitting various documents and details , including PAN, business details, and bank account information. GST Officers are responsible for overseeing the registration process of taxpayers under GST, ensuring that all eligible businesses are registered and have a valid GSTIN.

- Filing Returns and Payments: Once registered and assigned a GSTIN, businesses can file their GST returns through the portal. This includes declaring their tax liabilities, claiming input tax credits, and making tax payments. GST officers monitor the filing of GST returns by businesses and conduct audits to verify if the information provided in the returns is accurate and authentic.

- Access to Various Forms and Documents: The portal provides access to various forms required for GST compliance, including registration forms, return forms, and refund claims.

- Information and Updates: The GST portal is also a valuable resource for the latest updates, guidelines, and notifications related to GST, ensuring that taxpayers stay informed about any changes in the tax system.

GSTIN Verification Process

GSTIN verification is a critical process that ensures the authenticity of the GST number provided by businesses. This verification process is crucial for several reasons:

- Preventing Fraud: Verification helps in identifying and preventing fraudulent activities. It ensures that the GSTIN provided by a business is valid and registered in the GST database.

- Facilitating Accurate Transactions: For B2B transactions, it's essential to verify the GSTIN of the entities involved to ensure accurate invoicing and eligibility for input tax credits.

- Ease of Verification: The GST portal offers an easy-to-use facility for GSTIN verification. Anyone can verify the GSTIN of a business by entering the number on the portal. This process provides details like the name of the business, the state of registration, and the date of registration, ensuring transparency in transactions.

- Building Trust in Business Transactions: GSTIN verification builds trust among businesses and clients. It assures the parties involved that they are dealing with a compliant and legitimate entity.

How to Check the Validity of a GSTIN?

- Visit the portal: Visit the official GST portal of the Government of India, which is www.gst.gov.in.

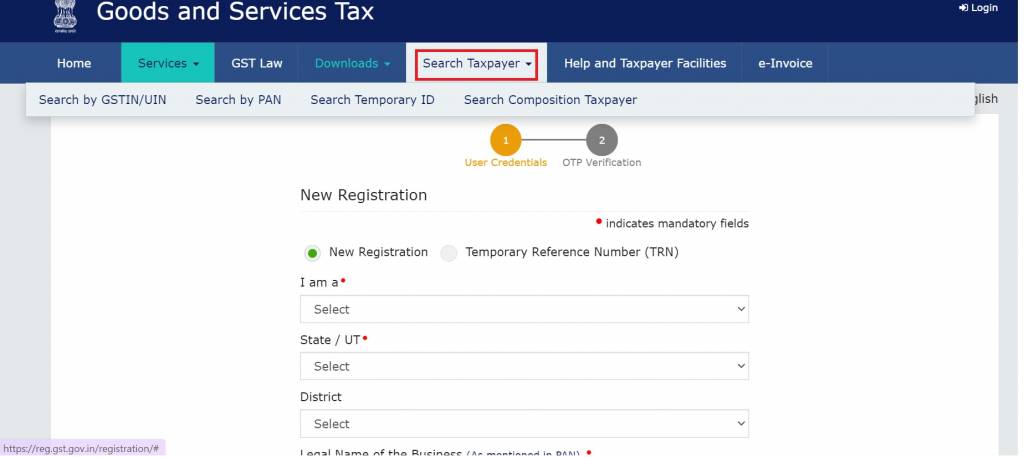

- Find the ‘Search Taxpayer’ Option: On the homepage of the GST portal, look for an option that says ‘Search Taxpayer’. This is typically found under the ‘Services’ tab.

- Input the GSTIN Number: In the ‘Search Taxpayer’ section, you will find a field to enter the GSTIN that you wish to verify. Type in the 15-digit GSTIN carefully.

- Submit for Verification: After entering the GSTIN, click on the ‘Search’ or ‘Verify’ button.

- View the Results: The portal will display the details associated with the GSTIN if it is valid. This typically includes the legal name of the business, the state in which it is registered, the date of registration, and the type of taxpayer (regular, composition, etc.).

- Check the Business Details: Verify that the details displayed match the information you have about the business. This is important for cross-verification.

- Note Any Discrepancies: If there are any discrepancies in the information or if the GSTIN is not found, it could indicate an issue with the validity of the GSTIN.

GST Number Check: Fake or Real?

You have the option to check the GST Number using PAN through the following steps:

Step 1: Visit GST portal and click on ‘Search taxpayer’ option. Then ,click on ‘Search by PAN’ option.

Step 2: Enter the PAN and you will get a list of GST registrations under the PAN alongwith the state as well as the status of their registration.

What are the Benefits of Having a GSTIN?

Here are the key benefits of having a GSTIN:

- Legal Recognition: Possessing a GSTIN provides legal recognition to a business as a registered taxpayer under the GST regime, enhancing its credibility and legitimacy in the market.

- Reduction in Tax Burden: One of the most significant benefits of having a GSTIN is the ability to claim Input Tax Credit. This means businesses can reduce the GST they pay on their outputs (sales) by the amount of GST paid on their inputs (purchases), effectively lowering the overall tax burden.

- Ease of Doing Business: With a GSTIN, businesses can seamlessly conduct both interstate and intrastate transactions without any tax-related complications, facilitating smoother trade and commerce.

- Enhanced Compliance: GSTIN ensures compliance with GST laws and regulations, as it is mandatory for filing monthly, quarterly, and annual GST returns.

- Transparency in Transactions: It promotes transparency in business transactions, as GSTIN is required to be mentioned on invoices, making the tax component clear to the customers.

- Trust Among Customers and Vendors: A GSTIN enhances the trustworthiness of a business among customers and vendors, as it indicates compliance with tax laws and financial diligence.

- Ease of Online Processes: GSTIN allows businesses to leverage the GST portal for various services like filing returns, making payments, and applying for refunds, thereby facilitating digital compliance and ease of operations.

- Improved Financial Management: The process of obtaining and maintaining a GSTIN encourages better record-keeping and financial management practices within a business.

- Market Competitiveness: In a market where consumers are becoming more tax-aware, having a GSTIN can provide a competitive edge to businesses, especially in sectors where tax compliance is a key consideration for customers.

Can GST Number be Transferred?

No, it is not. In India, GSTIN is unique to each taxpayer and is not transferable. If a business is sold or transferred, the new owner must obtain a new GSTIN.

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio