How DeepSeek, China's Low-Cost AI Model, Can Disrupt Global Financial Markets

The rapid popularity of the Chinese AI model DeepSeek is shaking global financial markets, triggering a major sell-off in U.S. tech stocks and raising concerns about shifting AI dominance. As DeepSeek’s free, open-source assistant gains traction, investors are questioning long-held assumptions about AI-driven demand for high-end chips and data centers, which are the key pillars of the current AI investment boom. In this blog, we will discuss about DeepSeek’s potential to disrupt global financial markets.

Table of Content

- What is DeepSeek?

- Immediate Market Movement with DeepSeek’s Advent

- DeepSeek’s Potential Impact on Financial Markets

- Case Study: Nvidia's Market Crash Due to DeepSeek

What is DeepSeek?

DeepSeek is a Chinese AI start-up founded in 2023 by Liang Wenfeng, co-founder of the hedge fund High-Flyer, which specializes in AI-driven market predictions. The company focuses on developing large language models (LLMs) and artificial general intelligence (AGI) to compete with leading U.S. AI firms like OpenAI and Google. Its primary product DeepSeek-R1 is creating all the ripples in the market.

DeepSeek-R1: The Next Evolution in AI

DeepSeek-R1, the flagship model of DeepSeek, has left the tongues wagging for its efficiency, cost-effectiveness, and accessibility.

Key Features of DeepSeek-R1

- Cheaper and More Efficient: DeepSeek-R1 uses lower-cost computing power than its Western counterparts, making it more accessible for businesses and developers.

- It is Open Source: DeepSeek-R1 is open-source, unlike proprietary models that exist in the market developed by OpenAI and Google.

- Competitive Performance: Benchmarks indicate that it performs at par with the best AI models in natural language processing, coding assistance, and market analysis.

- Potential for Financial Disruption: Because of its affordability and power, DeepSeek-R1 can democratize access to AI, influencing finance, trading, and risk assessment.

To make yourself more acquainted with the latest AI trends and understand the concepts better, we recommend that you keep up with the latest market events and also consider taking online AI courses. You can also read how LLMs work!

Best-suited Fintech courses for you

Learn Fintech with these high-rated online courses

Immediate Market Movement with DeepSeek’s Advent

DeepSeek arrived, and how? It sent shockwaves through the entire AI market. What makes DeepSeek different is the company's claim that the training of DeepSeek-V3 required less than $6 million worth of computing power from Nvidia H800 chips. Here are some of the immediate market changes it led to -

Market Shock and Tech Sell-Off

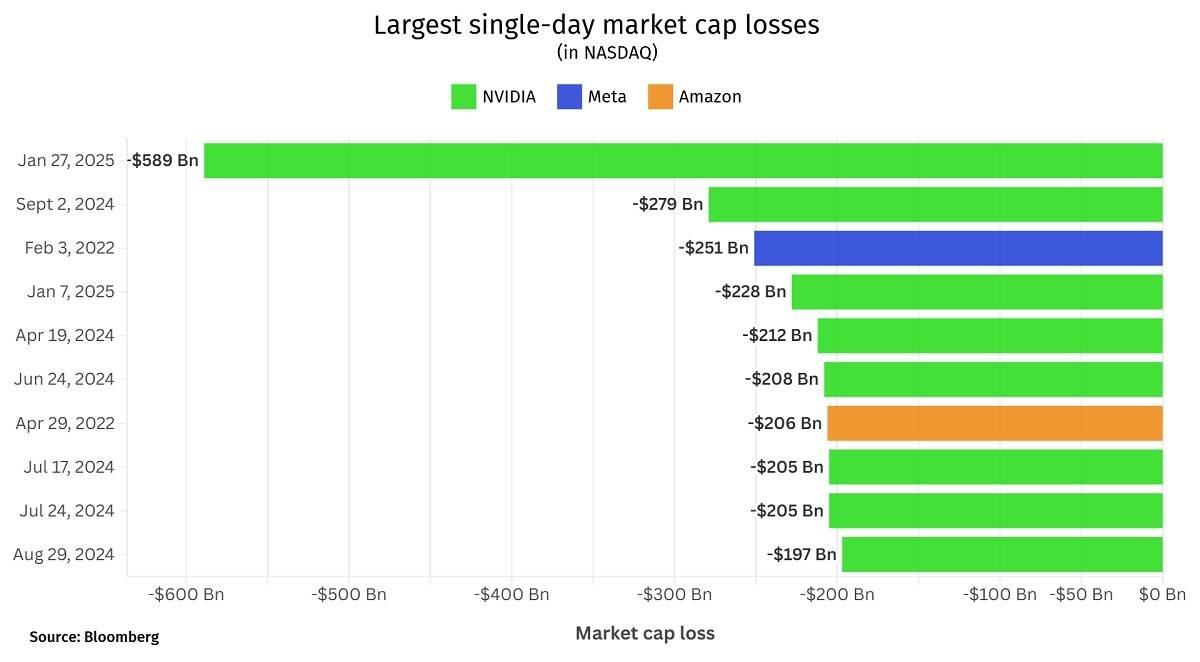

DeepSeek’s emergence led to a historic market reaction on Jan 27, 2025, with -

- Nvidia losing nearly $600 billion in market value, the largest one-day decline in U.S. history.

- The S&P 500 fell 1.44%

- The tech-heavy Nasdaq Composite plunged 3.04%.

Meanwhile, the Dow Jones Industrial Average gained 0.67% as investors shifted toward non-tech sectors.

Disrupting AI Economics

DeepSeek’s ability to operate on cheaper chips and less data challenges the business models of major AI firms like Nvidia, which has thrived on high-performance computing demand. If AI can function efficiently without advanced GPUs, chipmakers, cloud providers, and AI-driven fintech firms could see long-term valuation shifts, altering global capital flows.

Highest Ever App Downloads

DeepSeek’s Potential Impact on Financial Markets

The emergence of DeepSeek reflects broader trends in the global AI race that have implications for financial markets and US competitiveness. Here's the analysis from a financial point of view:

Impact on Global Financial Markets

- AI-Driven Commodity Speculation: DeepSeek's predictive analytics would enable traders to predict commodity shortages more accurately, such as metals or energy. Hedge funds and algorithmic trading platforms based on such tools could front-run supply-demand imbalances, which may boost speculative activity in futures markets. It can lead to a surge in the prices of copper, lithium, or rare earth metals by 10 - 30% depending on the scale of its impact on mineral exploration and extraction efficiency. (Source: International Energy Agency)

- Shift in Investment Decisions: Imagine if DeepSeek's analytics find their way into Asian financial hubs; it could redirect global capital toward regions or sectors flagged by the algorithms as having high potential. This could indeed be a wake-up call for companies based out of the West.

- Data Dominance: DeepSeek has access to vast, diverse datasets. It has improved data processing capabilities, which may influence market sentiment analysis, affecting asset valuations worldwide.

- Volatility from Geopolitical Insights: DeepSeek’s models analyzing geopolitical risks (e.g., U.S.-China tech decoupling, Taiwan Strait tensions) might trigger preemptive market reactions, such as hoarding critical materials, further straining supply chains.

- Regulatory Focus: The increasing applications of AI in finance will lead to an increased focus on transparency, bias, and systemic risks related to the use of AI. For example - the European Union's AI Act or US SEC guidelines on AI-driven trading may change the compliance framework, directly affecting market operations.

Deepen your understanding of data analysis and forecasting techniques, explore financial modelling courses and gain the skills and knowledge needed to excel in financial decision-making.

A Threat to U.S. AI Dominance?

The recently elected president of the U.S., Donald Trump, said it was a "wake-up call" for US companies who must focus on "competing to win." Below are some of the challenges that companies in the US might have to face if China's DeepSeek is to lead the AI model market from the front.

- Technological Competition: DeepSeek's sudden progress highlights China's rapid AI advancements, challenging the historical dominance of the US. To come to the forefront, American firms must accelerate R&D in AI infrastructure (e.g., quantum computing, next-gen algorithms) to avoid dependency on foreign technologies.

The worries of Donald Trump stem from the fact that he talked up a joint venture investing around $500 billion for infrastructure tied to AI by a new partnership formed by OpenAI, Oracle and SoftBank just a few days back, and the advent of DeepSeek shook the AI market.

- Market Share in Financial Services: If DeepSeek's tools gain traction in Asia-Pacific markets, US fintech giants (e.g., Bloomberg, BlackRock) could face competition in analytics and asset management, pushing them to innovate or form strategic partnerships.

- Data and Ethical AI: US companies must balance innovation with ethical AI practices (e.g., transparency, privacy) to differentiate themselves from Chinese models perceived as state-aligned. This could shape investor trust and regulatory approval in Western markets.

- National Security and Supply Chains: Dependence on foreign AI for critical financial infrastructure can be a significant cybersecurity concern. The US may incentivize domestic AI development through policies like the CHIPS Act or export controls on advanced chips, which can affect corporate business strategies.

- Global Talent and Collaboration: With the AI talent war heating up, US companies may have to invest in international talent pools and collaborate with academia/governments to maintain an edge while navigating restrictions on China-related partnerships.

Rising Raw Material Costs

The AI boom, fueled by companies like DeepSeek, will increase the cost of semiconductors and the raw materials required to produce them. Curious about the chain reaction? Here it is-

AI Hardware Demand → Semiconductor Scarcity

DeepSeek’s AGI research requires massive computing power, relying on advanced GPUs like Nvidia’s H100/A100 chips. Global AI firms (including Chinese rivals like Huawei) are racing to secure these chips, straining production capacity.

Semiconductor manufacturing depends on raw materials such as:

- Silicon wafers (high-purity silicon).

- Rare earth metals (neodymium, dysprosium) for chip components and data center magnets.

- Specialty gases (helium, neon) for lithography.

Increased competition for these materials could lead to increased costs, especially as suppliers struggle to scale extraction and refining.

Case Study: Nvidia's Market Crash Due to DeepSeek

Overview: On January 27, 2025, Nvidia Corporation experienced a dramatic stock crash, losing 17% of its value in just two days. This decline was primarily triggered by the emergence of DeepSeek, a Chinese AI startup that introduced a powerful AI model, DeepSeek R1, which rivals established models like OpenAI's ChatGPT but operates at a significantly lower cost.

Key Events

- Stock Performance: Nvidia's shares fell from about $142 to about $116, leading to a loss of about $600 billion in market capitalization. It was one of the biggest single-day declines in the company's history.

- Market Reaction: The introduction of DeepSeek's technology instilled fears that Nvidia's demand for energy-intensive AI infrastructure might drop. Investors acted fast, and sell-offs spread across the board, especially concerning AI and semiconductors.

What are the potential risks for AI and the semiconductor market if DeepSeek becomes widely adopted?

The potential risks for AI and semiconductor companies if DeepSeek becomes widely adopted include:

- Reduced Demand for High-End Chips: With DeepSeek showing that more powerful AI models are possible with fewer resources, companies like Nvidia could see a drop in demand for the expensive, high-performance chips they depend on.

- Increased Competition: The low-cost and open-source approach might allow the entry of new players into the AI market, making the competition even more intense for established players. Increased competition might force the existing players to lower prices or innovate more quickly, squeezing profit margins.

- Valuation Pressures: DeepSeek success may bring investors to a redetermination of traditional AI firms and semiconductor firms' high valuations. Stock prices from such companies will come under downward pressure if high-performance AI can be achieved without massive investments.

- Strategic Rebalancing: DeepSeek's disruptive model may require companies to rebalance their strategies, shifting from hardware-centric solutions to more software-driven approaches, leading to a change in their existing operational plans and a significant investment in new technologies.

- Long-term growth uncertainties: DeepSeek's rise has created a market shift towards more efficient, effective and cheaper AI solutions that would keep the firms with laggard approaches miles behind.

Though it is not possible to anticipate such events, but some knowledge about keeping yourself prepared for such market fluctuations dynamics can be helpful. Explore risk management courses today to enhance your understanding of market dynamics and develop strategies that safeguard your investments.

What Do Market Experts Recommend about DeepSeek?

With the recent initial success of DeepSeek AI models, investors are wrestling with apprehensions over potential AI price wars, Big 4's AI capex intensity, and how to navigate investments. International brokerage Union Bank of Switzerland (UBS) said, "With few details about DeepSeek and its business model available currently, we recommend investors to focus on the upcoming tech company results for more guidance, instead of panicking."

In a Nutshell

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio