How Does The 50-30-20 Budget Rule Work?

The 50-30-20 rule is one of the most popular budget rules out there. This budget rule will help you in creating a balance between needs and wants while keeping a portion of your savings. Over time, you will be able to see the positive impact of this budgeting method in ensuring a secure future. In this article, you will learn the importance of this rule and its results.

Suppose, a married couple with two kids earns 1.50 lakh per month together. After the deduction of tax, their monthly income amounts to 1 lakh rupees. The family spends 50,000 rupees per month on essentials, EMIs, utility bills and grocery shopping. They spend 30,000 on non-essential luxury items and activities that they want to do. At last, they save 20,000 rupees into their savings accounts for their kids and as emergency funds. This is a basic example of the 50-30-20 rule.

Senator Elizabeth Warren introduced the 50-30-20 rule in her book named ‘All your Worth: Ultimate Lifetime Money Plan’. This is a rule of thumb according to which the after-tax monthly income must be divided according to your necessities. After-tax income is the actual in-hand income that you receive after the deduction of state and federal taxes.

50-30-20 Rule At A Glance

- After-tax income should be split into 50% (needs), 30% (wants) and 20% (savings)

- It is an effective budget plan for achieving financial goals in the long run

- The rule helps in money management for emergencies and retirement planning

Different Sections of 50-30-20 Rule

As per this budget rule, your after-tax income should be divided into three sections: needs, wants, and savings. Let us discuss the division of monthly income into these sections in detail.

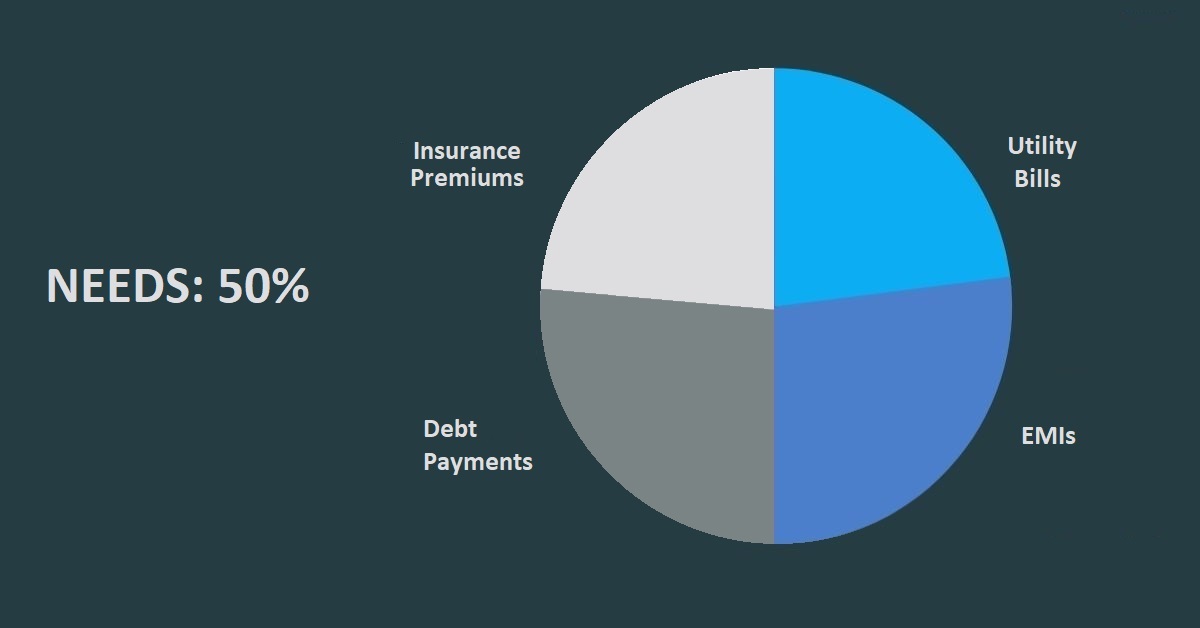

1. NEED: 50% of your after-tax monthly income

As per the 50-30-20 rule, 50% of your income should be used for needs which will include expenses related to:

- Mortgage and debt payments such as credit card debts

- Premiums for life and health insurance

- Utility bills such as electricity and grocery bills

- EMI payments (exclusive of EMIs for real-estate investments)

Needs will cover expenditures related to basic necessities. The funds allocated for the ‘need’ section WILL NOT include expenditures on leisures such as subscriptions for different OTT platforms, dining, outings, travels and other recreational activities.

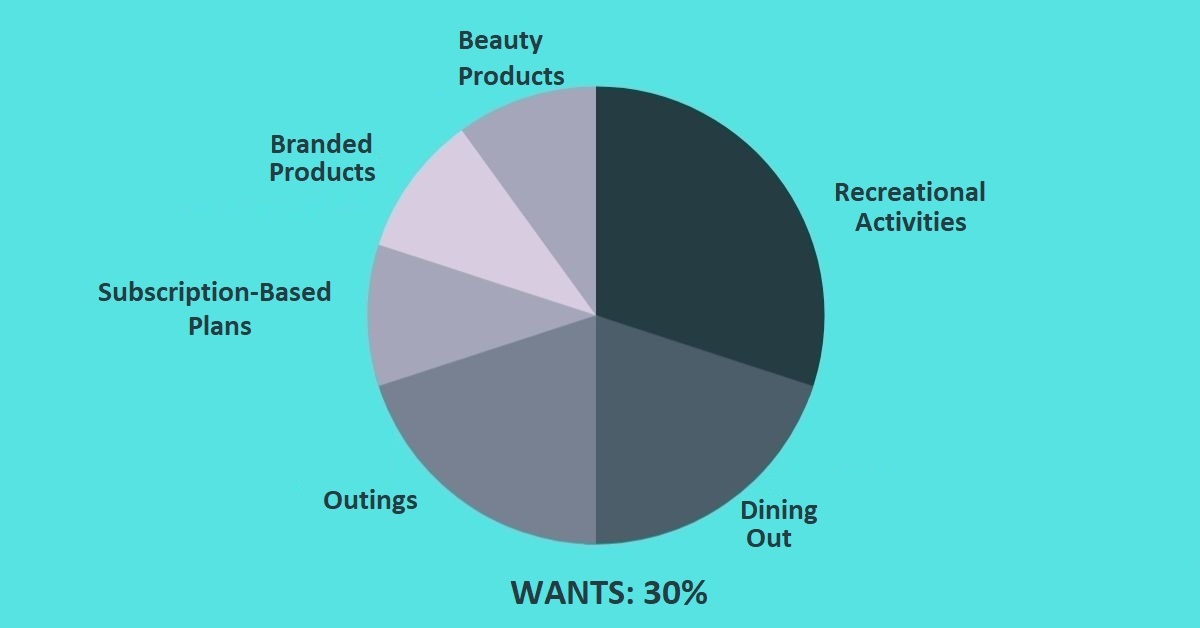

2. Wants: 30% of your after-tax monthly income

According to this budgeting method, you are allowed to spend only 30% of your after-tax income on activities and items that you want to have. These are the luxuries apart from your basic necessities such as:

- Recreational activities

- Dining out

- Outings

- Beauty products

- Branded products

- Subscription-based plans

You can still live without them but they are luxuries that you desire to own or enjoy. It is advisable to cut down on the ‘wants’ expenditure with time to plan out a better budget for the future.

Check out budgeting based online courses

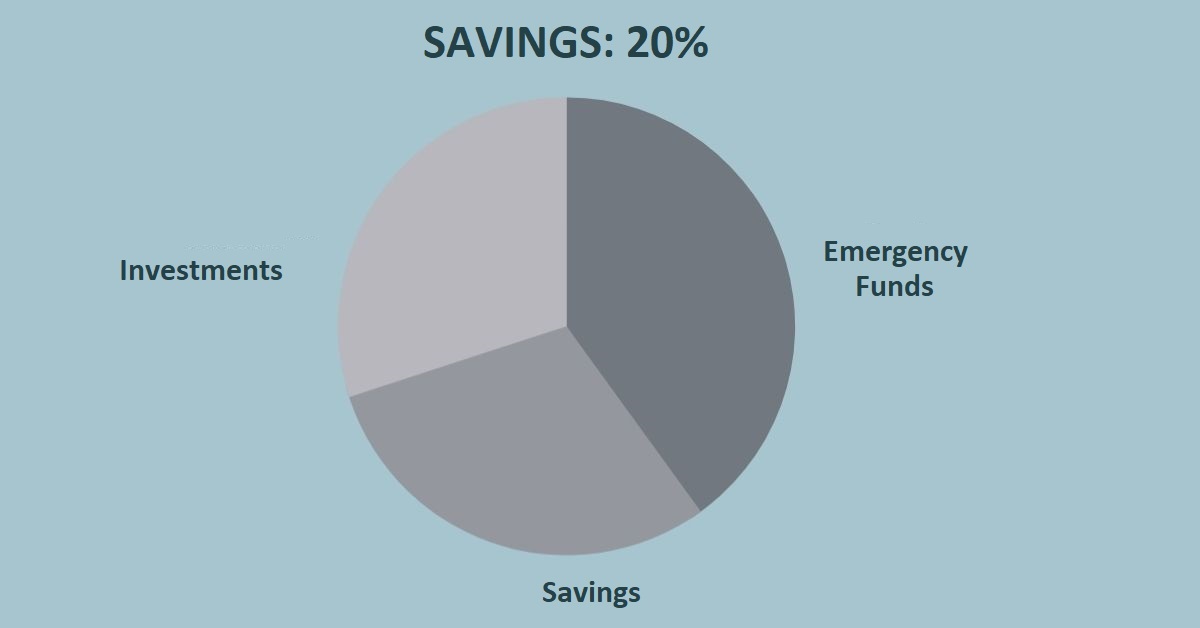

3. Savings: 20% of your after-tax monthly income

It is important to intelligently make up this portion in the budgeting method. You can start with saving up a certain amount as an emergency corpus for unfortunate circumstances such as medical or personal crises. Once you have an emergency fund, you can think of putting your funds in different investment plans. Ensure that these investment schemes have better and positive returns on investments over time.

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

Experience Based 50-30-20 Budget Rule

This rule of thumb states that the monthly income should be divided into three parts. Fundamentally it should be the division of 50-30-20. However, experts claim that with experience, you can change the proportions. For a fresher, the rule works effectively since these people have less income and more expenditure. Let us understand this with an example.

Suppose, the employee is earning 20,000 rupees per month. Now, as per the rule, the person will be spending 50% on the needs which is equivalent to 10,000 rupees. The person will spend 30% on ‘wants’ which will be 6,000 rupees. Now, the remaining amount will be saved, that is 4,000 rupees.

As a fresher, this saved amount will equate to 48,000 rupees annually. At the beginning of the career, the person can invest this small amount of funds and gain better returns on investment.

Let us now consider the case of an experienced employee. We can consider that experienced employees will have more income and they can shift more funds to the saving part. A good proportion will be 40-20-40 where less money is being spent on luxuries but the amount will still be more than before. Let us understand how.

Suppose the same fresher who used to earn 20,000 rupees per month is now earning 50,000 every month. Now, if this person uses 40% of the amount as ‘needs’, it will be 20,000 rupees which are way more than the initial amount being spent on ‘needs’.

Now, if that person only spends 20% on ‘wants’, that person is spending 10,000 rupees which is 4000 rupees more than before. This means that the lifestyle of that person has only improved while still saving more money. With more money as savings, the person can have more funds for future prospects.

The Importance of the 50-30-20 Rule

While we have already discussed how this budget rule works, we also need to understand why we need this rule. The rule is a way towards learning financial discipline. A number of factors contribute to the need for the 50-30-20 rule. Let us discuss the following:

- With time, companies are no longer providing retirement plans for their employees. Employees need to think about their financial independence in later years of life so that they have enough funds for leading a good lifestyle.

- Many people are now opting for unconventional career choices that may not guarantee a consistent source of income and result in financial instability. Due to this, there is a need for planning out a budget for rainy days.

- By following this rule thoroughly, you can not only save money but also wisely invest your money which will lead to compounding of funds. This means that over the course of time, your money would multiply and give you enormous gains in the coming years.

Conclusion

Besides the 50-30-20 rule, you can also adopt the 80-20 budgeting method where there is no segregation between the amount spent on ‘needs’ and ‘wants’. Do note that keeping at least 20% of the income as savings will still be applicable. It is important to understand that these methods are created for your convenience and can always be modified according to your expenditures. You may not see the results of this method initially. In later stages of life, you will definitely see the results of compounding through this rule.

FAQs

Is it possible to adjust the percentages in the 50-30-20 rule?

Yes, the 50-30-20 rule is flexible. Percentages are adjustable adjusted based on your personal financial situation and goals. For example, if you're in a high-cost living area, you might spend more than 50% on necessities, or you might prioritize savings over wants.

Is the 50-30-20 budget suitable for everyone?

While the 50-30-20 rule is a useful starting point, it might not fit everyone's needs perfectly. Factors like income level, financial goals, and personal circumstances can influence how you should allocate your money.

What are the benefits of using the 50-30-20 rule?

This rule helps simplify budgeting by clearly categorizing expenses. It can guide you to live within your means, ensure you're saving enough, and help you make conscious spending choices.

How can I track my spending according to the 50-30-20 rule?

Use budgeting apps, spreadsheets, or traditional pen and paper to track your expenses in each category. Regular monitoring helps adjust your spending habits and keeps you on the track of your financial goals.

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio