Your Guide to Portfolio Management

Investing can be daunting, especially for beginners. With so many options and potential risks, it's natural to feel unsure about how to proceed. This is where portfolio management comes in, playing a crucial role in your investment journey. In this blog, you will learn what portfolio management is, its types, its different stages, and factors influencing investment portfolio management.

Content

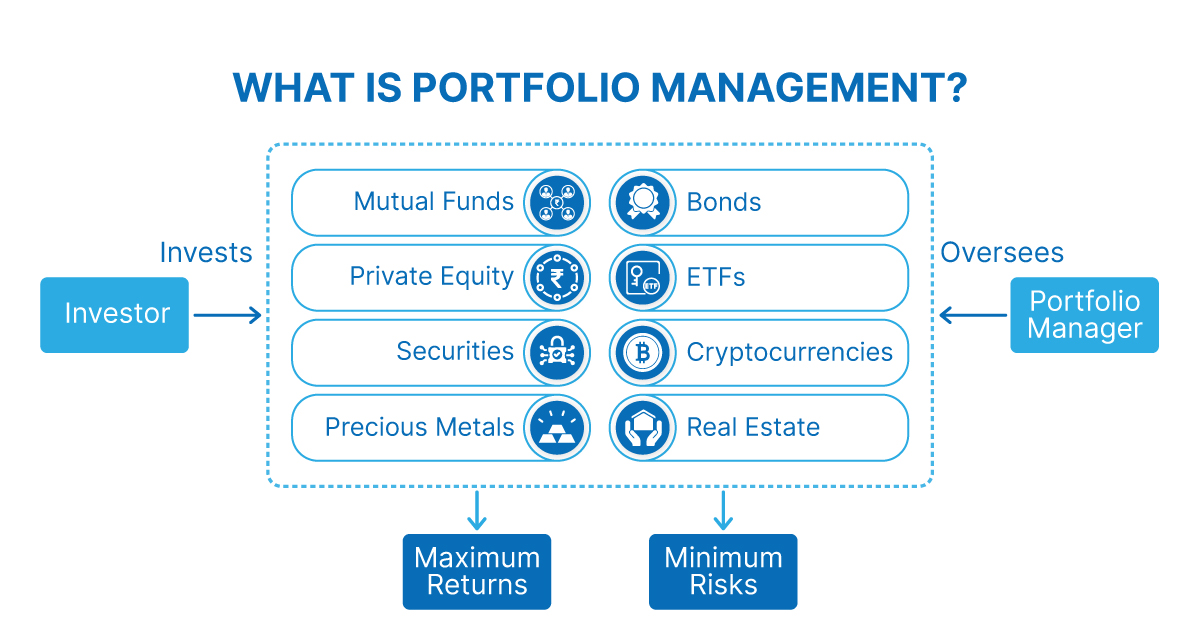

What is Portfolio Management?

Portfolio management is a professional activity that involves the administration and management of a set of financial assets by specialized professionals. This activity aims to reduce risk and maximize returns for investors by making informed investment decisions and employing effective trading strategies. Managing a portfolio involves strategically monitoring our investments to ensure they are aligned with both our short-term and long-term objectives.

What Should You Know About Portfolio Management?

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

There are five rudimentary aspects that you should consider to manage your portfolio effectively:

- Risk tolerance: The higher the risk, the higher the return. If you take a lot of risks, you may win or lose a lot of money, but if you avoid risk altogether, you will not likely win or lose. The ideal portfolio should carefully balance risk depending on the investor’s tolerance for risk.

- Performance Measurement: Benchmarking and performance measurement of your investment enable you to track potential errors and understand your risk-reward ratio. While choosing a portfolio manager, consider their investment knowldge and style.

- Asset Allocation: Varying assets have varying levels of stability. Selecting a mix of assets can reduce risk and maximize return by weighing volatility and investing accordingly.

- Diversification: The volatility of markets and the associated risks can be mitigated by investing in a variety of stocks, markets, and sectors. If a market crashes, you will not lose all your capital.

- Restructuring: The market price of securities fluctuates over time, impacting the return on your investments and their allocation within your portfolio. Regularly restructuring your portfolio ensures a balance between risk and return by returning the asset weights to their initial levels.

Types of Portfolio Management

1. Active Portfolio Management – In active portfolio management, portfolio managers actively buy and sell stocks, bonds, and other assets using quantitative or qualitative methods. They help to maximize profits for their clients by making strategies to outperform the stock market index. This can be achieved by purchasing undervalued securities and selling them at a higher price.

2. Passive Portfolio Management – The portfolio manager builds and manages a fixed portfolio of index funds, such as exchange-traded funds, that conform to current market conditions. However, these funds offer lower returns but are considered more consistent and profitable in the long term.

3. Discretionary Portfolio Management – Portfolio managers make financial decisions depending on their clients’ goals and risk appetite to maximise earnings. It may also include paperwork and filing in addition to investment management.

4. Non-Discretionary Portfolio Management – Portfolio managers are responsible for only providing advice on the best investment plans. Decision-making authority lies entirely with investors.

5. Mixed Portfolio Management: Mixed Portfolio Management involves creating and managing a portfolio that combines both active and passive management strategies. In this way, in addition to diversifying across different assets, you also diversify through various investment strategies.

Stages of Portfolio Management

There is no fixed portfolio management strategy, as one size does not fit all. Every individual or company requires a unique investment portfolio that depends on a customized and strategic investment plan. Here are the different stages of portfolio management:

Planning

- Identify goals: The portfolio manager understands the client’s long- and short-term goals and clearly defines financial objectives.

- Factor in limitations: Calculate associated risks, liquidity prospects, and expected returns from different asset combinations

- Develop a robust strategy: Involves strategic and customized asset allocation based on investment goals and market behaviour.

Execution

- Invest in profitable revenues: Thoroughly assess the securities’ fundamentals, liquidity, and credibility and invest in the selected portfolio.

- Minimize risks: Diversifying the investment mix based on budget, timeline, and financial goals.

Feedback

- Evaluate efficiency: Monitor and analyze the portfolio’s ratio of risk to return to determine its effectiveness.

- Rebalance the composition: Revise the portfolio based on current market conditions to maximize earnings.

Factors Influencing Investment Portfolio Management

To manage your portfolio effectively, consider six key factors directly related to our investor profile. These factors are:

- Age: It is essential to consider our age, as a young person may take more risks than someone close to retirement age.

- Personal and professional situation: Investment decisions must be made by assessing your current and future situation. For example, a person living alone and without a mortgage can afford to invest in riskier, yet more profitable, assets. On the other hand, a person with a family and a mortgage will have to assess lower-risk investment options.

- Risk aversion/tolerance: When investing, it is essential to be clear about your level of risk tolerance. If your tolerance level is relatively low, you should opt for a less risky investment model. Conversely, if you are more risk-tolerant, you can opt for the riskiest assets.

- Investment horizon: This refers to the time frame during which you will need the money. Before making any investment decision, you must consider your time horizon. For example, if you know you will need the money in less than a year, you should look for an investment that you can recover before the deadline. This is a critical point to keep in mind.

- The comfort of investment: Some investment strategies, such as active management, require much more dedication than others. That is why you should assess whether you are willing to investigate the companies or products you want to invest in, or prefer to invest using a less demanding strategy.

-

Diversification: Regardless of your profile, create a portfolio that includes several assets with diverse characteristics. This way, you get a diversified portfolio and can minimize the risk of default (the most extreme risk with which you can suffer more significant losses). That is why you should assess which assets you feel most comfortable with when diversifying your portfolio (stocks, ETFs, investment funds, real estate assets, raw materials, etc.).

Conclusion

Effective portfolio management enables investors to develop the optimal investment plan tailored to their income, age, and risk tolerance, making it essential. With professional investment portfolio management, investors can reduce their risks effectively and avail customized solutions against their investment-oriented problems. It is, thus, an inherent part of undertaking any investment venture.

FAQs - Portfolio Management

What is diversification, and why is it important in portfolio management?

Diversification involves spreading investments across different asset classes and securities to reduce risk. It helps protect a portfolio from the poor performance of a single asset or asset class.

How do I assess my risk tolerance for portfolio management?

Assessing risk tolerance involves considering factors such as investment goals, time horizon, financial situation, and willingness to accept volatility. It helps determine the appropriate level of risk in a portfolio.

What are the different investment strategies in portfolio management?

Investment strategies can include passive strategies (e.g., index investing), active strategies (e.g., stock picking and market timing), value investing, growth investing, income investing, and more.

How do I monitor and evaluate the performance of my investment portfolio?

Portfolio performance can be evaluated by comparing its returns to benchmark indices, assessing risk-adjusted returns, and reviewing the portfolio's alignment with your financial goals. Regular monitoring and rebalancing are essential.

What are some common mistakes to avoid in portfolio management?

Common mistakes in portfolio management include not diversifying adequately, overtrading, reacting to short-term market fluctuations, neglecting to rebalance, and not considering tax implications. It's important to have a well-thought-out investment strategy and stick to it.