Private Equity – The Ultimate Guide

The private equity industry has grown steadily in India over the past few years. Bain & Company reports that the total value of private equity deals in India was $70 billion in 2022, a significant increase from $26 billion in 2019.

In this article, we will learn about private equity in detail.

Content

- What is Private Equity?

- What Types of Businesses Needs Private Capital Cover?

- How Does Private Equity Work?

- Top Private Equity Firms In India

- Advantages and Disadvantages of Private Equity

- How To Choose A Good Private Equity Company?

What is Private Equity?

Private equity (PE) is a type of investment fund. It equity is money invested directly in a company by individuals or institutions. This money, usually a combination of debt and equity, is combined with that of investors to acquire controlling interests in a company and maximize the value of that investment. It is, generally, contrary to what happens with venture capital,

PE funds enter into the management of the investee company through the placement of one of its partners in the administration. These investments are much smaller than those made by angel investors or venture capital firms. In Private Equity, shares or debt of the company can be acquired.

Best-suited Wealth Management courses for you

Learn Wealth Management with these high-rated online courses

What Types of Businesses Needs Private Capital Cover?

Private capital can be a great solution to overcome economic obstacles affecting both companies and individuals and remedy different needs:

Boost to companies: To reinforce new companies or companies already in operation.

Real estate promotion: To start a new construction or continue one already underway.

Tax incidents: To remedy tax debts.

Suspension of auctions: To stop active auctions, regain control in the event of impending foreclosures, and buy time to sell auctioned properties.

Acceptance of inheritances: To face the expenses derived from acceptances of inheritances, which can amount to high figures.

Cancellation of embargoes: To cancel the debt in embargo (Retention of assets as a security method to pay debts that may have been incurred) situations and bring the instalments up to date with payment.

Rehabilitation and reforms: To increase the value of properties intended for sale by improving their image, reforming or rehabilitating them.

Real estate investments. To invest in real estate opportunities for rent or purchase of auctions.

Companies that are targets for private equity investment –

- Companies dealing with higher costs and reduced efficiency

- Companies with hard assets that can be used as collateral for future debt

- Companies with little or no debt and strong cash flows

- Companies whose shares are undervalued

- Companies in a proven and mature market with high margins

- Companies with good management

- Companies that have assets that can be sold

How Does Private Equity Work?

Private equity works by injecting an economic contribution that varies in amount depending on the circumstances in a specific company.

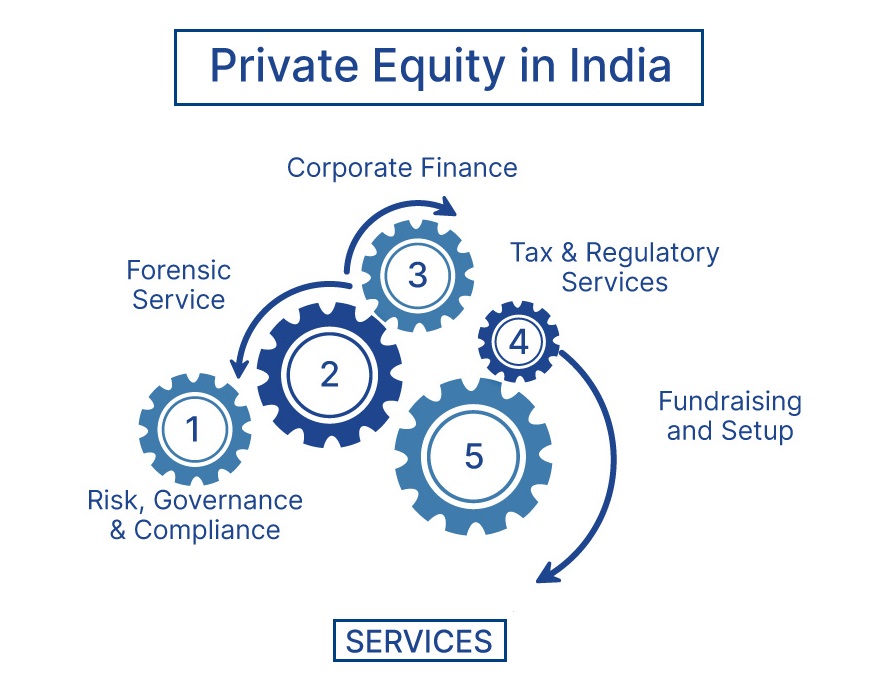

Depicted above are the major functions of private equity.

The objectives are always to multiply the value of the company in which they invest and generate a return in the short, medium or long term in the form of benefits for their investors.

An investment fund first studies the state of the company requesting the investment. If there are signs of obtaining benefits, they will invest in growing the company, hoping for the return that is the main objective of their activity.

Top Private Equity Firms In India

Here are some of the top PE firms operating in India:

- ICICI Venture Fund Management: A subsidiary of ICICI Bank. In the last decade, it has raised almost $3 billion. It invests in mid-market companies in India, offering a strong value proposition.

- Kotak Private Equity Group: This group invests in the Indian healthcare and infrastructure industry. Since 1997, it has raised over $2.8 billion and is among India’s most reputed PE firms.

- Chryscapital: Chrys Capital has invested in 50 projects and raised almost $2 billion in PE funds.

- Blackstone: Blackstone is a global PE firm that has invested over $14 billion in India. The firm has invested in various sectors, including real estate, technology, and healthcare.

- KKR: Kohlberg Kravis Roberts & Co., or KKR, is a global investment firm with investments of over $6 billion in India. The firm has a significant presence in the Indian market and has invested in various sectors, including healthcare, financial services, and consumer goods.

- Carlyle: Carlyle is a global PE firm that has invested over $3 billion in India. The firm has invested in healthcare, financial services, and consumer goods.

- Warburg Pincus: Warburg Pincus is a global PE firm that has invested over $5 billion in sectors like technology, healthcare, and financial services.

- Advent International: Advent International has invested over $2 billion in healthcare, technology, and financial services.

- Sequoia Capital: Sequoia Capital is a venture capital firm. It has invested over $3 billion in technology and healthcare.

- TPG: TPG has invested over $3 billion in India in healthcare, financial services, and consumer goods.

Advantages and Disadvantages of Private Equity

Private equity can offer many advantages, although it requires meeting some important requirements. Here are some advantages and disadvantages of private equity:

Advantages

- Speed and agility: Private capital is the fastest way to get a loan since the procedures are more agile than traditional banking. You can secure loans in as little as 48 hours.

- Flexibility and customization: Private capital can be adapted to each client’s economic and personal situation to adjust the repayment of the loan to the peculiarities of each operation.

- Diversification: Private equity investments can benefit an investor’s portfolio.

- Flexibility: Private equity firms are not bound to public companies’ regulations and reporting requirements. This gives them more flexibility to operate and make strategic decisions.

- Delinquency records do not matter: Unlike traditional banking, private capital does not consider lists of defaulters.

- Active involvement in the company: Private equity firms are actively involved in managing their portfolio companies, offering them strategic guidance, expertise, and access to their network of industry experts, thereby contributing to the overall growth of a company.

Disadvantages

- High-interest rates: Private equity usually has a higher interest rate than bank financing. This is because it implies a higher risk on the part of the financial institution.

- Requires guarantees: Private capital clients must give a sufficient guarantee to the financial company. In private capital, it is essential to mortgage a property that supports the operation.

How To Choose A Good Private Equity Company?

If you are interested in PE, you must follow these practices to ensure that your investment is in good hands and has the potential to generate attractive returns.

- Track record: Look for a PE firm with a strong track record of generating good ROI. You can ask for their historical performance data and compare it to industry benchmarks.

- Investment strategy: Different PE firms have different investment strategies, such as focusing on a particular sector, stage of company growth, or investment size. Choose a firm whose investment strategy aligns with your investment goals and preferences.

- Management team: The management team of a PE firm has a key role in its success. Look for a firm with experienced, knowledgeable, and reputed professionals with a strong professional record.

- Due diligence process: A good PE firm should have a rigorous process to evaluate potential investments. Ask about their process and ensure that they thoroughly assess each investment opportunity.

- Transparency and communication: A good firm should provide clear and timely updates on the performance of their portfolio companies and the general fund. Check out companies with a good track record of smooth communication and transparency.

- Fees: PE firms require an annual 2% capital fee for fixed and variable costs. Go through their fee structure and compare it to industry standards. Finalize the one that suits your budget.

- Reputation: Scrutinize firms basis their reputation in the industry. You can ask for referrals from other investors or industry professionals or research the firm’s reputation online.

Conclusion

Besides capital, private equity firms also provide valuable support to the companies they invest in, including strategic guidance, operational expertise, and access to networks and resources to help them scale up their operations, expand their reach, and achieve their growth targets.

Industry experts expect the PE industry in India to grow in the coming years as more investors seek opportunities in the rapidly developing Indian market.

Top Trending Finance Articles:

Financial Analyst Interview Questions | Accounting Interview Questions | IFRS Certification | CPA Exams | What is Inflation | What is NFT | Common Finance Terms | 50-30-20 Budget Rule | Concept of Compounding | Credit Cards Rewards System | Smart Budgeting Approaches

FAQs - Private Equity?

Who can invest in private equity?

Private equity investors can include -

-

High-Net-Worth Individuals (HNIs): Individuals with significant wealth who meet certain income and asset criteria.

-

Institutional Investors: Such as banks, insurance companies, and other financial institutions.

-

Foreign Institutional Investors (FIIs): Non-Indian entities allowed to invest in Indian securities and assets.

-

Private Equity Funds: Professional private equity firms that pool funds from various investors, including institutions and HNIs.

-

Accredited Investors: Individuals or entities that meet specific financial requirements as defined by regulatory authorities.

-

Qualified Institutional Buyers (QIBs): Institutions and high-net-worth entities that meet SEBI's (Securities and Exchange Board of India) criteria.

What are the primary strategies employed by private equity firms?

Private equity firms use various strategies, including buyouts (acquiring a controlling stake in a company), growth capital investments, and distressed asset investments.

How do private equity firms add value to the companies they acquire?

Private equity firms often bring in experienced management teams, implement operational improvements, and provide strategic guidance to enhance the performance and value of their portfolio companies.

What is the exit strategy for private equity investments?

Private equity exits can involve:

- Selling the portfolio company to another business.

- Conducting an initial public offering (IPO).

- Facilitating a management buyout (MBO).

What are the risks associated with private equity investments?

Private equity investments are illiquid and can be highly leveraged, increasing the risk. Additionally, there is no guarantee of returns, and the success of investments depends on the portfolio companies' performance.

How can individual investors access private equity investments?

Individual investors can gain exposure to private equity through private equity funds, exchange-traded funds (ETFs), or private placements, although access may be limited compared to institutional investors.

What are the potential benefits of investing in private equity?

Potential benefits of private equity investments include the potential for high returns, portfolio diversification, and the ability to invest in promising companies that are not publicly traded.

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio