Simple Interest: Definition, Formula, and Examples

Simple Interest is a basic but fundamental concept used in finance to calculate the interest on the principal amount (the initial sum of money) over a specific time. If you are looking to learn how to implement the simple interest formula, then this article is for you. It contains questions from very basic to advanced that will help you clear your doubts and gain a better understanding.

Simple Interest is one of the most common yet frequently used terms in Finance to calculate the interest on the principal amount of a loan or investment. Simple Interest is calculated based on the principal amount, rate of interest, and time the money is borrowed or invested. In this article, we will learn simple interest, its formula, and some related examples to understand simple interest better. Later in the article, we will learn how to calculate simple interest using Python.

Must Read: What is Finance?

Explore finance courses

So, let’s get started with the formal definition of Simple Interest.

Table of Content

What is Simple Interest?

Simple Interest is a basic but fundamental concept used in finance to calculate the interest on the principal amount (the initial sum of money) over a specific time. Simple Interest is widely used due to its straightforward nature and ease of calculation.

- It is good for short-term loans or investments since the interest doesn’t accumulate over time.

- It does not capitalize on the power of computing, i.e., simple interest is not the best choice for long-term investments as the return will be lower.

Formula of Simple Interest

Simple Interest = (Principal * Rate * Time) / 100

where,

Principal (P): The initial amount of money that is borrowed or invested

Rate (R): The annual interest rate.

Time (T): The time for money borrowed or invested, generally expressed in years.

Now, let’s take some examples to understand simple interests better.

Simple Interest Questions

Question-1: Vikram invested INR 1000 in a saving account with an annual interest rate of 3%. How much interest will he earn after 1 year?

Here we have,

Principal = 1000

Rate = 3%

Time = 1 year

Now, substituting the values in the formula, we get

Simple Interest = (1000 * 3 * 1)/ 100

=> Simple Interest = 30

Hence, at the end of a year, Vikram will earn INR 30 interest after 1 year.

Ques-2: Hitesh took a loan of INR 5000 with an annual interest rate of 5%. How much will he save to pay back after 3 years?

Here, we have:

Principal Amount = 5000

Rate of Interest = 5%

Time = 3 Year

Substituting the value in the formula, we get:

SI = (5000 * 5 * 3) / 100

=> SI = 750

Therefore, the total amount to be paid back will be = Principal + SI = 5000 + 750 = 5750.

Ques – 3: Sanjeev has invested 8000 in a 4-year bond with a simple annual interest rate of 4%. How much money will he have at the end of the bond term?

Here, we have

Principal = 8000

Rate = 4 %

Time = 4 Years

Now, substituting the value in the formula, we get:

SI = (8000 * 4 * 4) / 100 = 1280

=> SI = 1280

Hence, the total amount Sanjeev will have at the end of 4 years = 8000 + 1280 = 9280.

Ques-4: Vivek invested a certain amount at a simple rate of 6% per annum. After 2 years, he received a total of INR 1130 which included his initial investments and interest. How much did Vivek initially invest?

Here, we have

Total Amount = 1130

Time = 2 Year

Rate = 6%

Since, Total Amount = Principal Amount + Simple Interest

=> Principal = Total Amount – Interest… (i)

and since, SI = (P * R * T)/100

=> Principal = Total Amount – [(P * R * T)/100] = 1130 – [(Principal * 6 * 2)/100]

=> (1+0.12) Principal = 1130 => Principal = 1130/1.12 = 1008.9285

Hence, the Principal investment is INR 1008.9285.

Ques-5: Vikas borrowed a certain amount of money. He paid back INR 3360 after 2 years, which included an interest of 360. What was the annual interest rate on the borrowed money?

Here, the Total Amount = 3360

Time = 2 Years,

Total Interest Paid = 360

As we know:

Total Amount = Principal + Interest

=> Principal = 3360 – 360 = 3000

and since, Simple Interest = (Principal * Rate * Time)/100

=> Rate = SI*100/ P*R = 360*100/ 3000 * 2 = 6%

Hence, the annual rate of interest will be 6%.

Now, it’s time to automate the process, i.e., how to calculate the simple interest using Python.

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

Simple Interest Calculator

# Simple Interest Calculator# Simple Interest Calculator in Python

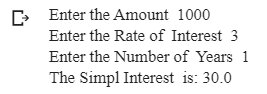

P = float(input("Enter the Amount ")) #Principal Amount or initial amountR = float(input("Enter the Rate of Interest ")) # Rate of InterestT = int(input("Enter the Number of Years ")) # Time

# Simple Interest Formula

SI = (P * R * T)/100

# print the output

print("The Simpl Interest is:", SI)

Output

Must Read: Difference Between Simple Interest and Compound Interest

Conclusion

In this article, we have discussed what is simple interest, its formula, and examples to get a better understanding of how to calculate it. The article also covers, how to calculate simple interest using Python.

Hope you will like the article.

Keep Learning!!

Related Reads

Vikram has a Postgraduate degree in Applied Mathematics, with a keen interest in Data Science and Machine Learning. He has experience of 2+ years in content creation in Mathematics, Statistics, Data Science, and Mac... Read Full Bio