Smart Budgeting Approaches That You Must Know

The word 'SMART' indicates Specific, Measurable, Attainable, Relevant, and Time-bound. Your budget should have all these qualities to ensure that you are becoming financially secure over time. Budgeting is an important aspect of money management. Effective budgeting approaches can improve your finances in the long term. It is one of the most fundamental methods for managing finances.

It is a method of recording your income and expenses through which you aim to achieve a financial goal. This goal can be related to building emergency funds, investing money or leading a luxurious lifestyle. Through this article, you will learn the different aspects of budgeting including the following:

- What is Budgeting?

- 6 reasons Why Budgeting Is Important

- 5 Simple Budgeting Approaches to boost your savings

- Which Approach is The Best?

What is Budgeting?

The following points sum up the definition of budgeting:

- It is a plan to manage your money to achieve a specific financial goal.

- A budget is only effective till the time you invest your time and effort.

- It is important to diligently abide by the budget for its actual results.

- The budget should be modified with time and requirements.

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

6 Reasons Why Budgeting Is Important

Budgeting is a fundamental functions of financial management that you all have learnt from your homes. Effective budgeting helps in improving your financial health over time. Let us find out the other benefits of learning budgeting approaches:

- You can monitor your finances and find out areas where you can cut down your expenses.

- Over some time, your savings improve and it helps in building financial security.

- You can manage your money for building emergency funds and other requirements.

- You can save money for making big purchases in the future.

- By adopting an effective budget approach, you can identify and differentiate between your necessities and wants. This will prevent you from unnecessarily spending money.

- You can invest the pool of money that will compound over time into bigger amounts.

Explore finance courses

5 Simple Budgeting Approaches To Boost Your Savings

You can adopt one of the following approaches depending on your need and lifestyle. These will include the following:

1. Traditional Budgeting

It is one of the most basic and oldest approaches that aim to reduce expenditure and maximise savings. In this approach, you will need to know the exact figures related to your expenditure. You can calculate your average income in case it is not fixed.

In this method, the previous year’s budget is taken as a reference for the current year’s budget. You need to make modifications to the budget as per the current inflation rate, market situation and newer requirements.

This approach is effective for those who have a consistent budget every month. You can also adopt this approach if there are very few modifications in your previous year’s budget.

However, this approach lacks room for any changes related to new policies or changes in market conditions. This approach fails if the previous budget is not per newer policies.

2. Zero Based Budgeting

Zero-based budgeting is one of the smart approaches. You will provide a specific purpose to the entire income. The entire income should be divided into ‘needs’ and ‘costs’. You will be creating a budget based on the monetary need for next month.

In this approach, you decide how you will put your income to use. You will have to allocate a certain amount for expenditure, savings, investment, emergency and retirement funds. This method is effective for those who keep a record of their spending history. However, it is not effective for those who have fluctuating incomes.

Explore budgeting courses

3. Proportional Budgeting

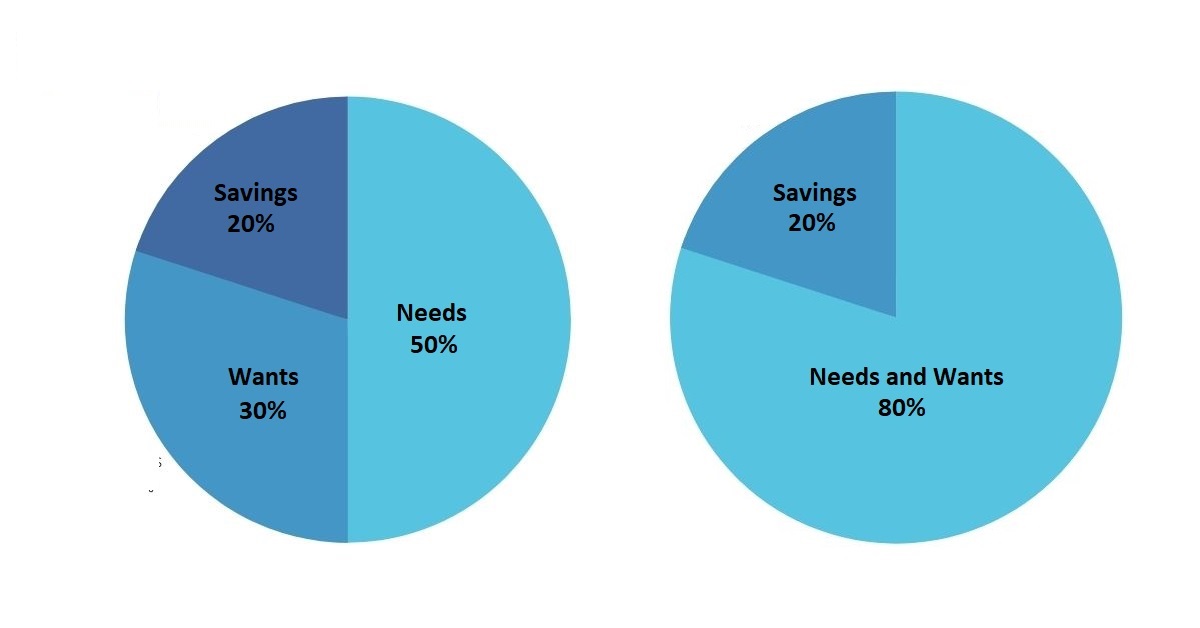

This is one of the most popular approaches which is used for managing expenses and savings. In this approach, after-tax deduction, you will divide the monthly income into proportions. The two most adopted proportional budgeting approaches include the 50-30-20 and 80-20 budget rules.

In the 50-30-20 rule, income is divided into needs (50%), wants (30%) and savings (20%). In the 80-20 rule, 20% of the income is saved while 80% can be used as required for your wants and needs.

4. Reverse Budgeting

In this approach, your budget is focused on achieving one goal every month. For example, during one month, you will be saving the entire amount apart from the budget set for needs. The next month, you might spend the rest of the income (excluding needs) on a trip to Bali.

Once you have spent funds on the monthly goal, you will spend the remaining amount on other expenses. It is a simple method that does not require complex calculations.

You would not be able to track your expenditures through this method. On the contrary, you might overspend on your monthly goals. This method is also ineffective if you want to build an emergency corpus of funds for investments and insurance.

Explore insurance courses

5. Value-Based Budgeting

It is the most different among the rest of the budgeting approaches. In this method, you allocate the portion of income as per your priority. You will allocate more funds to the things or activities that are most valuable to you. For example, if buying a house is your priority, then, you need to allocate the most amount to it. If travelling is your priority, you should allocate most of the salary to it.

It is a self-centric method that aims at emotional fulfilment. It is an impractical budget if you want to save money or if you want to build an emergency fund and investment portfolio.

Which Approach is The Best?

After learning about the different budget approaches, you might be confused about choosing the smartest one among these. If your needs consume the majority of your income, then approaches such as reverse and value-based budgeting will not be suitable for you. On the other hand, you can choose methods such as proportional budgeting to save money while still having money to maintain a good lifestyle.

It is important to understand that these approaches work differently for every individual. To choose the smart budgeting approach, you need to identify your requirements and wants. In addition to that, you need to look at your spending habits to choose a suitable budgeting method.

Explore capital budgeting courses

FAQs

What are some of the popular budgeting tools?

The following are some of the popular budgeting tools:

- Google sheets: Spreadsheets for maintaining the budget with its variety of budgeting template.

- Personal Capital: Budgeting and investment application used by investors that tracks spending and wealth.

- Goodbudget: Envelop method style application where users can plan their household spending.

- GNUCash: Desktop software for tracking income, expenses, investment as well as invoicing.

Which are the four walls of budgeting?

These are the things that are essential and inevitable for living. These may vary from individual to individual. Fundamentally, these include shelter, basic clothing, shelter and basic transportation.

What are the three types of budgets?

The three types of budgets include a balanced budget, surplus budget and deficit budget.

Which are the four types of expenses?

There are essentially four types of expenses including:

- Variable expenses: These can vary in amount but occur every month including gas, electricity, grocery and clothing.

- Fixed expenses: These remain the same every month such as internet and cable bill, EMIs, house rent, etc.

- Intermittent expenses: These occur at different times throughout the years and are heavy amounts such as a house or car repair costs.

- Discretionary expenses: These are the non-essential expenses including dining out, recreational activities, snacks etc.

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio