Swing Trading Guide For Beginners

Swing trading is a dynamic and versatile strategy bridging the gap between long-term investing and short-term trading. It is suitable for individuals seeking to profit from price movements in financial markets. Swing trading combines elements of technical analysis, timing, and risk management. Let us learn more about swing trading in our blog.

Swing trading is a strategy involving buying and selling financial assets like stocks or currencies within relatively short timeframes. It typically holds positions for several days to weeks. Swing trading aims to capture price "swings" or short-to-medium-term price movements within a larger trend.

Instead of guessing, swing traders use charts and patterns to decide when to buy and sell. They also limit how much money they are okay with losing to avoid getting into big trouble.

How Swing Trading Works?

The swing trading method works by capitalising on price oscillations or swings in financial assets. Here's a step-by-step explanation of how it operates:

Identifying Swing Highs and Lows

Swing traders study price charts of financial assets. They look for patterns where the asset's price moves in a "zig-zag" pattern.

When the price reaches a peak and then starts to decline, that point is called a "swing high." Conversely, when the price hits a low and rises, it's called a "swing low."

These swings are critical for swing traders, providing potential entry and exit points.

Recognising Market Trends

Swing traders aim to identify overall price trends for their respective assets. They assess whether the asset is generally moving upward (an uptrend), downward (a downtrend), or sideways (a range-bound market). Recognising such trends helps them make informed trading decisions.

Designing Entry Points

When swing traders spot a swing low in an uptrend or a swing high in a downtrend, they look for an entry point.

For example, if the asset is in an uptrend and has just formed a swing low (indicating a potential upward swing), traders might consider buying it.

Managing Exit Points

Swing traders also plan their exit strategy. They typically set a target price at which they plan to sell the asset to make profits. Conversely, they set a stop-loss level, a predetermined price where they will sell to limit potential losses if the trade goes against them.

Managing Risks

Managing risk is crucial in swing trading. Swing traders calculate the risk-reward ratio for each trade to ensure that potential gains are worth the risk. They also use stop-loss orders to protect their capital if the trade doesn't go as planned.

Monitoring and Adjusting Price Movements

Swing traders closely monitor the asset's price movements once a trade is executed. They take action if the price reaches its target or stop-loss levels. If the trade is profitable, they might adjust their target price to capture more gains if the trend continues.

Repeating the Process

Swing traders look for new swing highs and lows as the asset's price moves. They repeat the process of identifying trends, entering and exiting trades, and managing risk.

Best-suited Stock Analysis & Trading courses for you

Learn Stock Analysis & Trading with these high-rated online courses

Advantages of Swing Trading

- Swing trading allows traders to make money when prices go up or down, enabling you to earn in different market situations.

- Unlike waiting for years, like in long-term investing, swing trading looks at making profits within a shorter time, like a few days to weeks.

- Swing traders usually follow a pattern in how prices move, which makes it easier to plan when to buy and sell.

- Swing traders use safety nets called stop-loss orders to limit how much money you can lose without risking too much at once.

- You can spread your risk by trading different things, like stocks, currencies, or commodities. If one doesn't do well, the others might.

- You don't need to watch the market all day like day traders, so it's suitable for people who can only sometimes be glued to the screen.

Disadvantages of Swing Trading

- To be good at swing trading, you need to understand technical analysis. It's like learning a new language for some.

- Making the right calls and protecting your money takes practice and learning from mistakes. It's not easy, especially at the beginning.

- Sometimes, the market behaves differently than expected, and you might lose money even when you do everything right. It's like playing a game where the rules can change suddenly.

- Unexpected news or significant events can mess up your plans and lead to losses. It's like trying to predict the weather when a surprise storm can show up.

- While not as demanding as day trading, you still need to check on your trades regularly, which might only be possible for some.

- Keeping your cool and sticking to your plan is hard when your money is on the line. It's like keeping your emotions in check during a sports game.

- Swing trading can be like learning advanced math. It's not something you can master overnight, and it takes time and effort to get good at it.

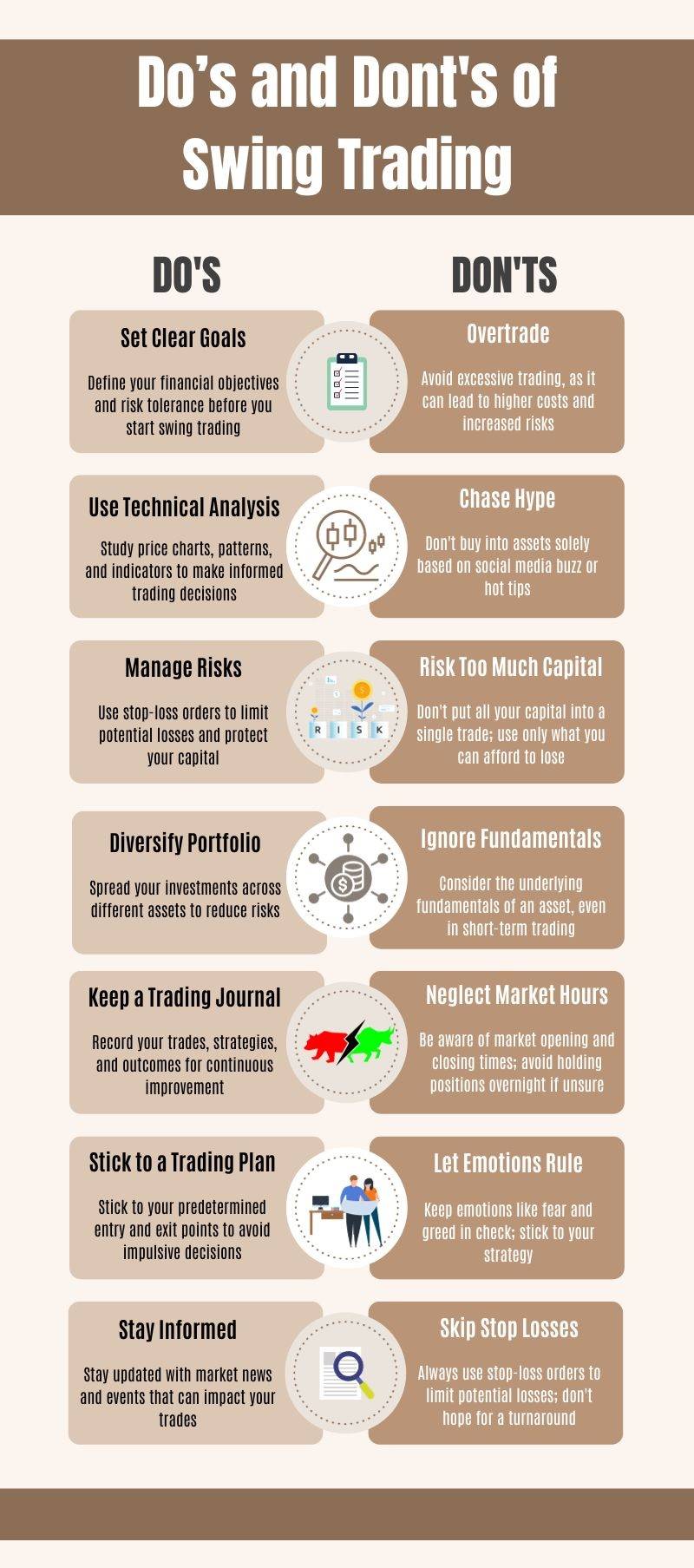

Do's & Dont's of Swing Trading

Key Takeaways

- In swing trading, the prices of financial assets are determined by the constant interaction of buyers and sellers based on their beliefs about the asset's value.

- Price fluctuations create temporary imbalances in this negotiation, resulting in swing highs (price peaks) and swing lows (price troughs). Swing traders focus on these oscillations, representing opportunities to profit from short-term price movements within the larger market context.

- Swing traders employ specific indicators, chart patterns, and technical analysis tools to identify these price imbalances and predict which side of the market (bulls or bears) will likely gain dominance, indicating the direction of the following price swing.

- Swing traders seek to align themselves with the market side expected to drive the price in their favour. If they anticipate an upward price swing, they might buy, while if they expect a downward move, they might sell short or avoid buying.

FAQs - Swing Trading

How does swing trading differ from day trading?

Day trading involves buying and selling assets within the same day, while swing trading involves holding positions for longer, typically days to weeks. Swing traders aim for more significant price movements.

What assets can I swing trade?

You can swing trade a wide range of assets, including stocks, currencies, commodities, and cryptocurrencies. The choice depends on your market knowledge and preferences.

Do I need a large amount of capital to start swing trading?

No, you don't need a large amount of capital to start swing trading. However, it's essential to manage risk properly and only invest what you can afford to lose.

How do I identify swing trading opportunities?

Swing traders typically use technical analysis and chart patterns to identify entry and exit points. Key indicators include moving averages, RSI, MACD, and support/resistance levels.

What is the typical holding period for swing trades?

Swing trades are typically held for several days to a few weeks. The holding period can vary based on your trading strategy and the asset being traded.

What are the risks of swing trading?

The principal risks of swing trading include market volatility, potential losses, and the challenge of accurately timing entry and exit points. It's essential to have a well-defined strategy and risk management plan.

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio