How to File ITR (Income Tax Return)?

ITR is a tax return form that is used by taxpayers to report income and assets to the Indian Income Tax Department.

When you file the Income Tax Return, you are sharing your personal and financial data as a taxpayer. It is the self-declaration by taxpayers about their income, assets and the applicable taxes paid. Generally, the ITR form is submitted through online mode but in certain cases, the offline option is also available.

Table of Contents

These forms do not have attachments. This means that taxpayers do not need to attach any documents along with the return of income. It is advisable to taxpayers that they keep these documents handy to furnish them when required in situations like assessment or inquiry.

Who Should File the ITR?

The following entities can file the ITR:

- Companies

- Individuals who are residents and ordinary Indian residents if they:

- Hold any asset located outside India

- Have signing authority in any account that is located outside India

- are the beneficiary of any asset (including any financial interest in any entity) located outside India

- have deposited more than INR 1 crore as aggregate

Exemption Criteria

The following people are exempted from filing ITR

- For normal taxpayers, the exemption limit is till ₹2.5 lakh

- ₹3 lakhs for senior citizens

- For super senior citizens, it is ₹5 lakhs

Income brackets above this limit are under taxable income.

Late Fee Penalty

If you file the ITR after the due date, you will be levied with 1% additional interest every month under Section 234A of the Act on remaining unpaid tax. It is advisable to timely pay taxes to avoid penalties and late filing fees as per Section 234F. Late fees may be applicable up to 10,000 rupees if you skip the due date to file the ITR beyond the stipulated timelines. You may also have to bear other penance as per the act.

Registration Process To File The ITR

The process of filing Income Tax Returns (ITR) via the internet is E-filing. It is a quick and easy process. Now, you will gain an understanding of the stepwise registration process on the e-filing portal.

- Visit the official e-filing website: incometax.gov.in/iec/foportal.

- Register to e-file your returns by clicking on the ‘Register’ Yourself’ button.

- Click on ‘Taxpayer’. Enter your PAN details and then, click on ‘validate’. After that, click on ‘Continue’.

- Enter your name, gender, date of birth, address, residential status, etc.

- Enter your Email ID and mobile number.

- Click on ‘Continue’ after filling the form.

- Verify the details by entering the 6-digit OTP that is sent to your registered mobile number and email id.

- Follow the instructions and complete the registration process.

- After the verification of OTP, a new window will open up. You need to verify your details. Over here, you can change any errors in your details. If you modify any details, you will receive another OTP to validate the change.

- Set up a password and then, secure login message.

- Click on ‘Register’ following which you will receive an acknowledgment message stating that the registration process has been completed successfully.

How to File ITR?

According to the provisions of income tax laws, you need to calculate your income tax liability. Summarise your TDS payment using Form 26AS for each quarter of the assessment year. According to the definition by the Income Tax Department (ITD) for every ITR form. Now, determine the category in which you fall and choose the ITR form accordingly.

Steps of Filing ITR Online

You can follow these steps to e-file Income Tax Returns on the website:

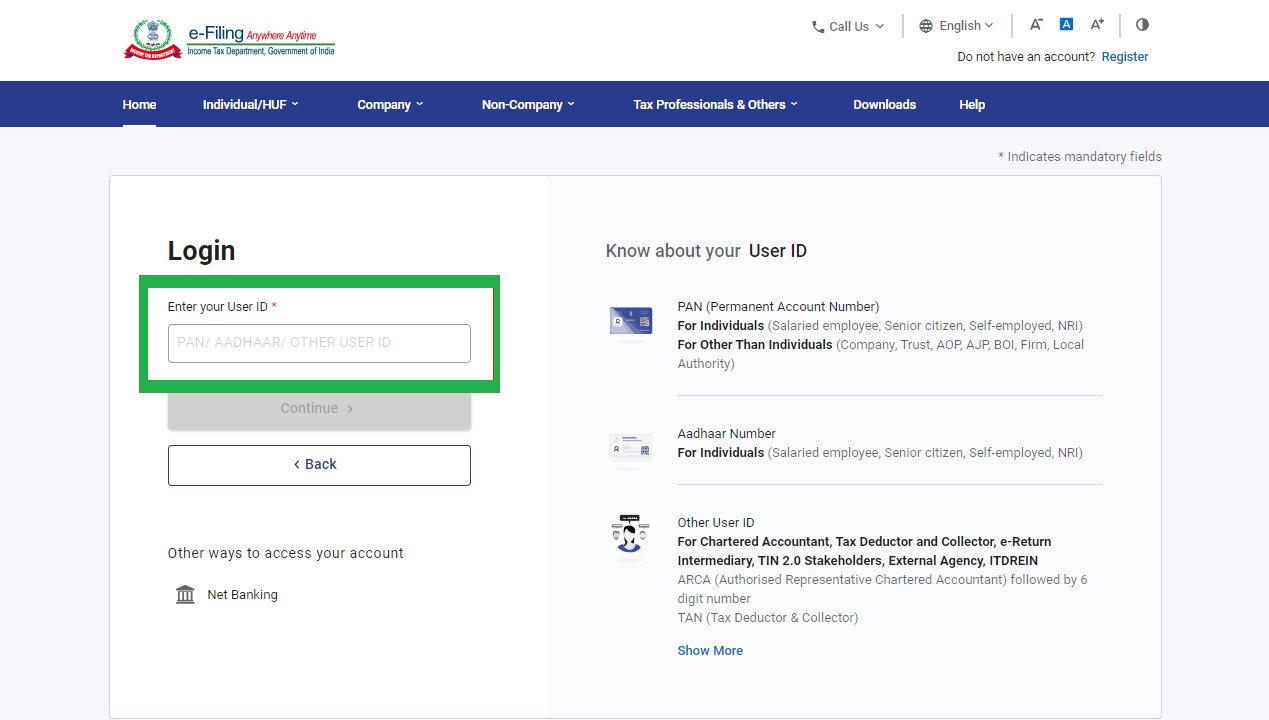

- Click on the ‘Login’ button on the official website.

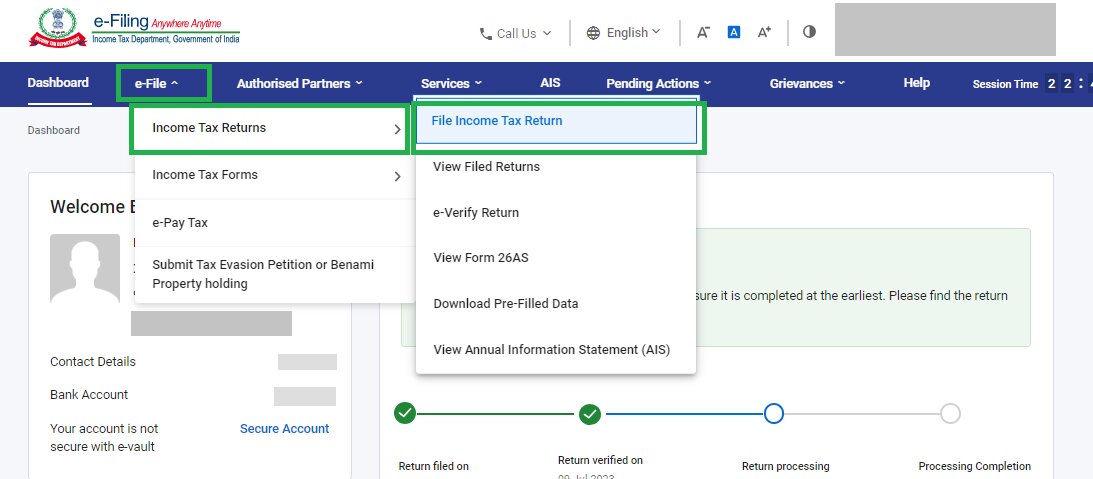

2. After logging in, click on the ‘e-file’ tab. Click on ‘File Income Tax Return’.

3. Select the year of Assessment year for which you have to file the income tax returns. Then, click on ‘Continue’.

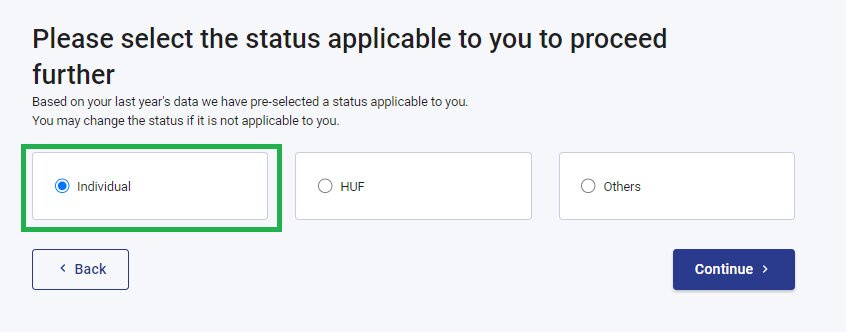

4. Select the preferred filing status. Choose your type as either an individual, Hindu Undivided Family (HUF), or others to file an income tax return.

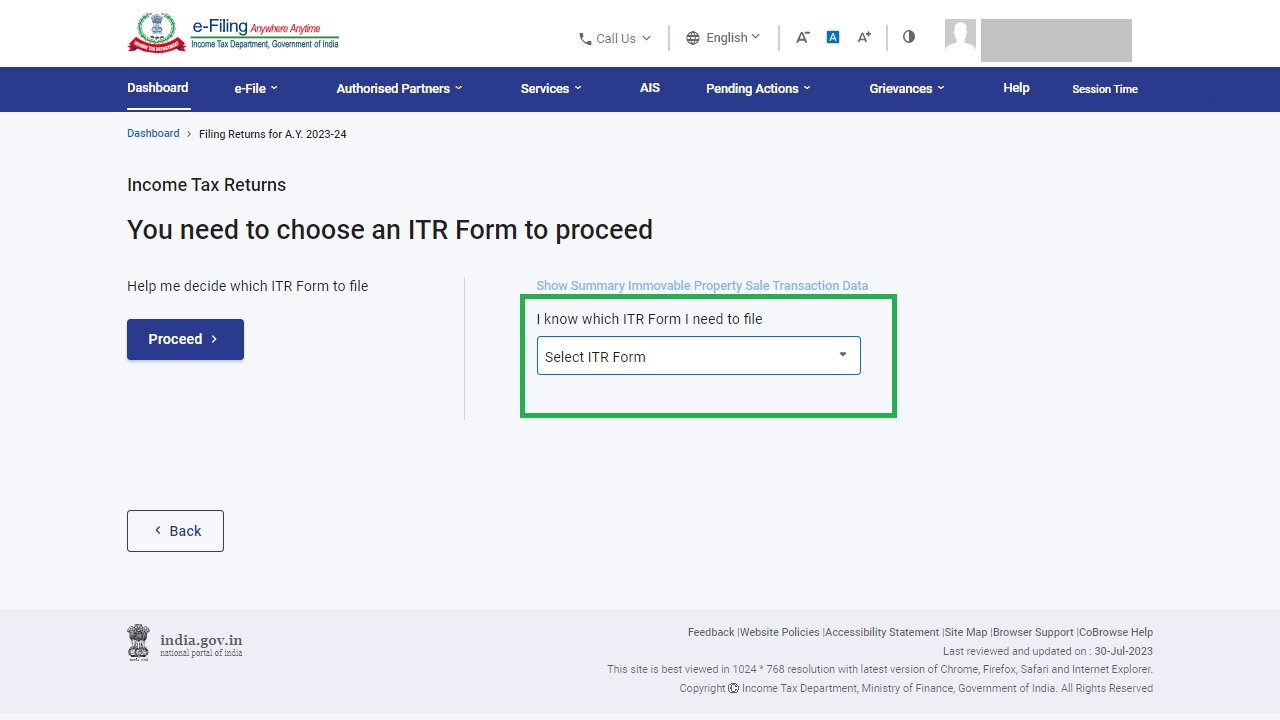

5. You will have the option to choose the type of ITR you want to file.

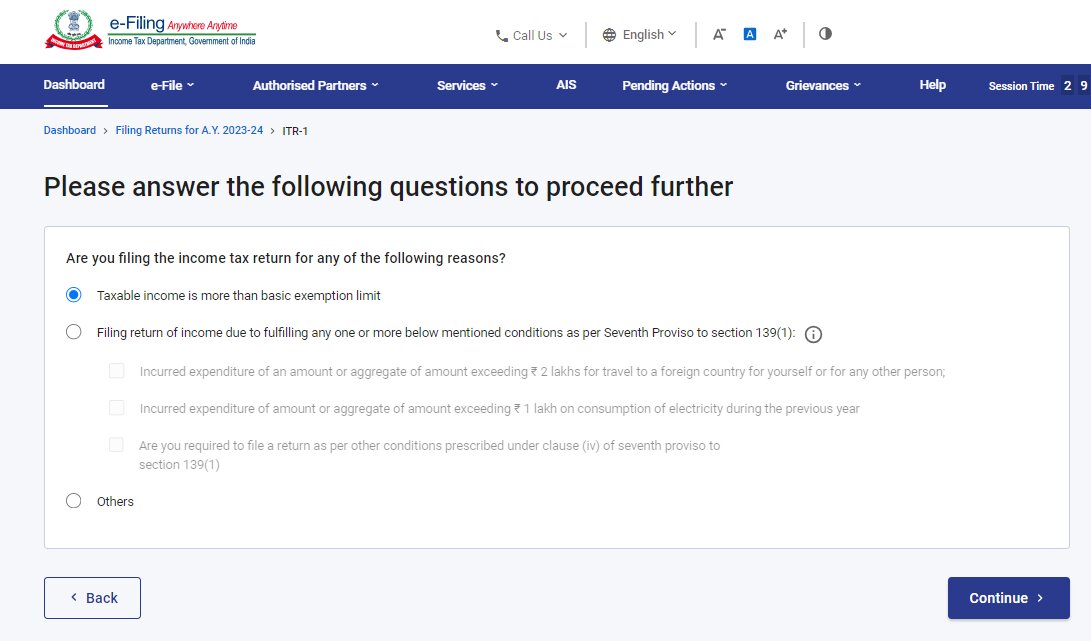

6. You will be asked the reason for filing returns above the basic exemption limit or due to the seventh provision of Section 139(1).

7. As per the section, the person can file their income tax returns if:

- the aggregate deposited amount by an individual is more than Rs.1 crore in one or more current accounts annually,

- is more than Rs.2 lakh on a foreign trip,

- payment above Rs.1 lakh is made on electricity bills,

- Make sure you choose the right option as per your eligibility.

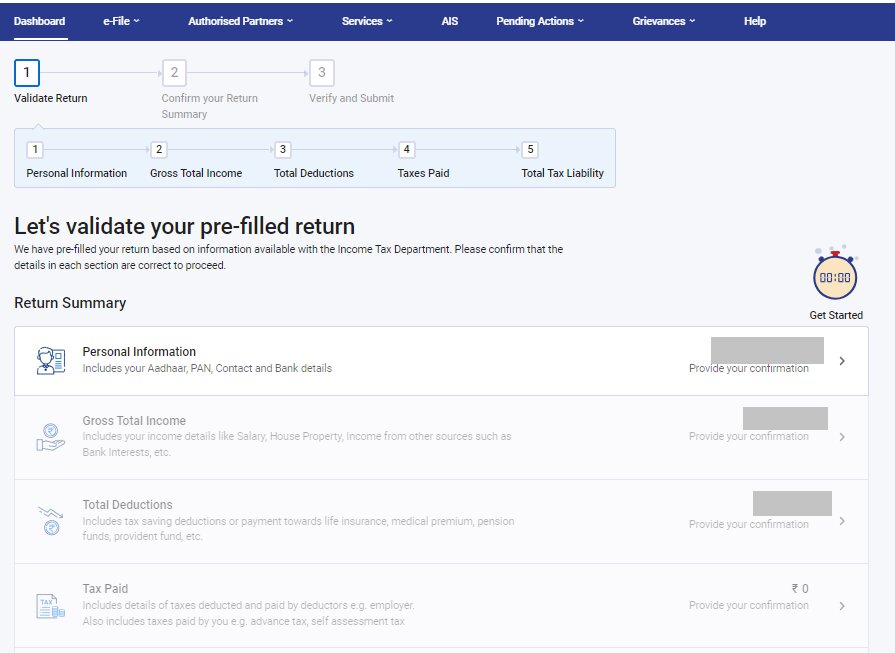

9. Now, you need to enter your bank details. You will have to pre-validate your details if you have already submitted the details. You will be directed to a page for filing your income tax returns. A lot of details will be already filled in on this page. Verify all the details and confirm the summary of your returns. After that, validate it.

10. At the end, you need to verify your return. Send the hard copy to the Income Tax Department. This is a mandatory verification process.

For Super Senior Citizens

Super senior citizens are individuals 80 years and above. These people can file ITR offline during a financial year. An individual or HUF with less than Rs.5 lakh income and is not entitled to refund, can also file ITR offline

Following are the steps to file income tax returns through offline mode:

- You will have to request Form 16.

- Submit the ITR returns in the paper form at the Department.

- You will receive an acknowledgement slip after submitting the form to the Income Tax Department.

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

Benefits of Filing the ITR

- Carry forwarding losses: Any business can incur a loss during the fiscal year. Companies can file IT returns to compensate for the loss. If you file the ITR within the stipulated due date, you will be able to carry forward current year’s losses to the next financial year.

- Claiming refund: Individuals can claim tax refund from the IT Department if they file ITR. This is beneficial for high-income employees.

- Ease of loan processing: Financial institutions will ask for previous year ITR receipts to process loan applications. It is a supporting document to the borrower’s income statement. It is important to file ITR if you plan on securing a loan.

- Easy visa processing: ITR receipt is important in the process of visa applications. Many embassies ask for ITR receipt to know if the individual is tax compliant or not. As this document is a proof of the applicant’s income. Embassies verify income details to ensure if the applicant is capable of bearing travel expenses.

- Medical insurance: Those who file ITR enjoy deductions up to ₹50,000 on health insurance premiums paid in a specific fiscal year. This is as per the Section 80D of Income Tax Act.

FAQs

How to determine appropriate ITR form?

Before you start filing your ITR, you need to identify which ITR form is applicable to your income situation. ITR forms vary based on income sources, amount, and other factors.

What documents are needed for filing ITR?

It is recommended to keep documents like Form 16, Form 26AS, bank statements, etc., handy while filing your ITR. These documents contain vital information needed to fill out your tax return.

How to e-verify ITR-V?

ITR-V is the acknowledgement of your filed ITR. It must be verified within 120 days of filing. You can e-verify using methods like digital signature, OTP, or by sending it to CPC Bangalore.

Should you file ITR without income?

It is advised to file an ITR even if you don't have taxable income, as it keeps your tax record straight and can be beneficial for loan applications, visa processing, and more.

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio