Understanding the Internal Rate of Return

Internal Rate of Return (IRR) is a way to measure how much money an investment can make over time. It's the interest rate at which the money you expect to get back from an investment equals the amount you spend on it. Think of IRR as the yearly growth rate an investment is predicted to have.

Calculating IRR Step-by-Step

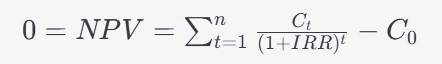

The IRR is calculated by setting up the NPV of the cash inflows and outflows over the life of the investment to zero and solving for the discount rate. The formula is expressed as:

Where:

- Ct represents the cash inflow during period t

- C0 is the initial investment cost

- IRR is the internal rate of return

- t is the time period

Due to the nature of this formula, calculating the IRR usually requires iterative methods or the use of financial calculators or software, as it involves determining the roots of a polynomial equation, which is not straightforward algebraically.

Imagine a company is considering a project that requires an initial investment of $150,000. The project is expected to generate a cash inflow of $50,000 at the end of each year for the next four years. The goal is to calculate the IRR for this investment.

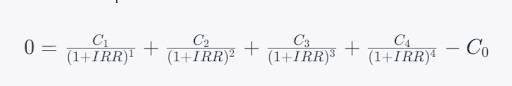

The formula for IRR sets the NPV of all cash inflows and outflows throughout the investment's lifespan to zero:

To calculate the Internal Rate of Return (IRR) for the given project, we need to find the discount rate that sets the Net Present Value (NPV) of the cash inflows equal to the initial investment of $150,000. The cash flows are as follows:

- Initial Investment (Year 0): -$150,000 (cash outflow)

- Year 1 Cash Inflow: $50,000

- Year 2 Cash Inflow: $50,000

- Year 3 Cash Inflow: $50,000

- Year 4 Cash Inflow: $50,000

Here is how we can calculate the IRR step-by-step:

Step 1: Set Up the NPV Equation for IRR

The NPV equation at the IRR is:

Where:

- C0 is the initial investment ($150,000).

- C1, C2, C3 and C4 are cash inflows for consecutive 4 years respectively $50,000 every year.

- IRR is the internal rate of return.

Step 2: Substitute the Cash Flows into the Equation

After inputting the values into the equation, we will get:

Step 3: Solve for IRR

Solving for IRR requires an iterative process, as there's no algebraic solution for IRR in this equation. We can use financial calculators, Excel, or specific software to find the IRR. However, for illustrative purposes, let's assume we are using a trial-and-error method to estimate:

- Guess an IRR to start, say 10% (0.10 as a decimal).

- Calculate the NPV using this guessed IRR.

- Adjust the IRR up or down based on whether the NPV is above or below zero, and calculate again.

Step 4: Use Trial and Error or Financial Calculator

Using a financial calculator or Excel's IRR function would give us the precise IRR, but let's illustrate an approximation:

Assume an IRR of 10%:

NPV = (50,000/1.10 + 50,000/1.21 + 50,000/1.331 + 50,000/1.4641) - 150,000

NPV = 45,455 + 41,322 + 37,562 + 34,149 − 150,000

NPV = 8,488

Since the NPV is positive, our IRR is too low. We need to try a higher rate.

If we try 15%:

NPV = (50,000/1.15 + 50,000/1.3225 + 50,000/1.5209 + 50,000/1.749) - 150,000

NPV = 142,769 − 150,000

NPV = -7,231

Now the NPV is negative, which means our IRR is too high.

Step 5: Narrow Down the IRR

Through this process, we would continue to adjust the IRR between 10% and 15% until the NPV is as close to zero as possible. The exact IRR is where the NPV equals zero, and this typically requires a more precise tool or method to find the exact percentage.

For the exact calculation, you would use a financial calculator by entering the cash flows and solving for IRR, or you could use the IRR function in a spreadsheet program like Excel, which uses iterative methods to calculate the IRR accurately.

Best-suited Investment Banking courses for you

Learn Investment Banking with these high-rated online courses

Applications of IRR

The following are the applications of IRR:

Benchmark for Profitability

- Evaluating Investment Prospects: The IRR is instrumental in assessing and ranking multiple projects or investments based on their potential returns. Providing a single percentage figure simplifies the comparison, even among diverse investment opportunities with varying scales and timelines.

- Strategic Financial Planning: Organizations often use IRR to forecast the profitability of different strategic options, ensuring that they commit resources to the investments that promise the highest returns relative to their costs.

Guiding Investment Choices

- Determining Financial Feasibility: IRR is a critical factor in the investment decision-making process. It helps investors and financial managers determine whether an investment is likely to yield the desired target rate of return, adjusting for the time value of money.

- Threshold for Acceptance: By setting a predetermined acceptable IRR, often referred to as the hurdle rate, decision-makers can quickly rule out investments that do not meet the minimum required return, focusing on those that offer more attractive growth prospects.

Indicator of Capital Efficiency

- Assessing Return on Investment: The IRR offers a clear indication of how well an investment is expected to perform by measuring the efficiency of capital allocation. A higher IRR suggests that the investment will generate a proportionally greater return on each dollar invested.

- Long-Term Financial Health: In the long run, a portfolio of investments with strong IRRs can signal robust financial health and strategic acumen, as it implies that the company is generating substantial value from its investments over and above the cost of capital.

What Does IRR Signify?

IRR signifies the following:

Good IRR

- Exceeds the Hurdle Rate: A good IRR is one that is higher than the hurdle rate, which is the minimum acceptable return on an investment set by management or investors.

- Surpasses Cost of Capital: It should be greater than the cost of capital, which is the rate of return required to compensate investors for the risk of the investment. If the IRR is above this rate, the investment is expected to add value to the company.

- Outperforms Benchmarks: A good IRR also often means that the investment is expected to perform better than alternative investments or benchmarks, indicating a relatively high efficiency of the investment in generating returns.

Bad IRR

- Falls Below the Hurdle Rate: A bad IRR does not meet the minimum rate of return expected by the investors or required to make the investment worthwhile.

- Lower than Cost of Capital: If the IRR is less than the cost of capital, the investment might result in a net loss for the company when considering the opportunity cost of capital.

- Underperforms Relative to Benchmarks: An IRR that is lower than the return rates of alternative investments with similar risk profiles is considered poor, as it suggests that there are better options available for the use of the capital.

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio