What is XIRR in Mutual Funds?

Unlike simpler metrics, XIRR accounts for the timing and amount of each cash flow, providing a more accurate picture of an investment's return.

Table of Contents

- What is XIRR in Mutual Funds?

- Difference between XIRR and CAGR

- How to Calculate XIRR Formula?

- XIRR Explained With Examples

- When to Use XIRR?

What is XIRR in Mutual Funds?

XIRR, or Extended Internal Rate of Return, is a key metric used in mutual funds to measure investment performance. It's especially useful for funds with irregular cash flows, like those with frequent contributions or withdrawals. This makes it ideal for evaluating Systematic Investment Plans (SIPs) in mutual funds, where investors regularly invest varying amounts. XIRR offers a comprehensive view of the fund's performance over time, considering each transaction's specific impact. It's a valuable tool for investors to understand the true returns of their mutual fund investments, helping them make informed decisions.

Best-suited Investment Banking courses for you

Learn Investment Banking with these high-rated online courses

Difference between XIRR and CAGR

Here is the list of differences between XIRR and CAGR:

| Aspect |

XIRR (Extended Internal Rate of Return) |

CAGR (Compound Annual Growth Rate) |

| Definition |

A method to calculate returns on investments with multiple cash flows at different times. |

A measure of the mean annual growth rate of the investment over a specified time period. |

| Use Case |

Ideal for investments like mutual funds with irregular cash flows, such as SIPs or lump-sum investments. |

Best suited for investments with a single initial investment and no further contributions or withdrawals. |

| Calculation Complexity |

More complex, as it accounts for the timing and amount of each cash flow. |

Simpler, as it only considers the initial and final values over a period. |

| Accuracy |

Provides a more accurate reflection of return for investments with non-periodic cash flows. |

May not accurately reflect the performance of investments with multiple cash flows. |

| Flexibility |

Highly flexible, can handle varying amounts and timings of cash flows. |

Less flexible, assumes a uniform rate of growth over the period. |

| Ideal For |

Investments with frequent contributions or withdrawals, like SIPs in mutual funds. |

Investments with a fixed duration and no additional cash flows, like a fixed deposit. |

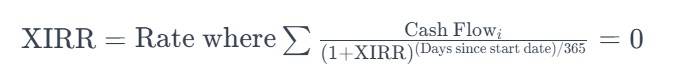

How to Calculate XIRR Formula?

The XIRR formula considers each cash flow's specific timing, making it a powerful tool for analyzing investments with irregular cash flows. Follow the below-given steps to use it:

- List All Cash Flows: Include each investment or withdrawal as a cash flow. Investments are negative numbers, and withdrawals are positive.

- Determine Dates: Note the date of each cash flow. The start date is typically the date of the first investment.

- Apply the Formula: The XIRR is the rate that makes net present value (NPV) of every cash flow equal to zero.

- Use a Financial Calculator or Spreadsheet: Most people use spreadsheet software like Excel, which has an XIRR function, to simplify this calculation.

XIRR Explained With Examples

Suppose you made the following investments and withdrawals in a mutual fund:

- January 1, 2021: Invested ₹10,000 (Cash Flow: -₹10,000)

- July 1, 2021: Invested an additional ₹5,000 (Cash Flow: -₹5,000)

- December 31, 2021: Withdrew ₹7,000 (Cash Flow: ₹7,000)

- December 31, 2022: The value of the investment is ₹15,000 (Cash Flow: ₹15,000)

Calculation

To calculate the XIRR for these transactions:

- List the Cash Flows and Dates:

- CF1: -₹10,000 on January 1, 2021

- CF2: -₹5,000 on July 1, 2021

- CF3: ₹7,000 on December 31, 2021

- CF4: ₹15,000 on December 31, 2022

- Apply the XIRR Formula:

- The formula is:

Calculate Days Since Start Date for Each Cash Flow:

- CF1: 0 days (start date)

- CF2: 181 days (from January 1, 2021, to July 1, 2021)

- CF3: 364 days (from January 1, 2021, to December 31, 2021)

- CF4: 729 days (from January 1, 2021, to December 31, 2022)

- Use a Financial Calculator or Spreadsheet:

- Input these cash flows and dates into a spreadsheet tool like Excel.

- Use the XIRR function to calculate the rate.

The XIRR function in Excel will compute the internal rate of return for these cash flows, considering their specific timing. This rate represents the annualized return of your investment in the mutual fund over the period from 1st of January, 2021, to 31st of December, 2022. This scenario demonstrates how XIRR takes into account the timing and amount of each investment and withdrawal, providing a comprehensive view of the investment's performance.

Explore investing courses

When to Use XIRR?

XIRR is used in the following scenarios:

- Systematic Investment Plans (SIPs): For mutual funds with regular investments, XIRR accurately measures performance over time.

- Irregular Cash Flows: When investments or withdrawals occur at different times and amounts, XIRR provides a realistic return rate.

- Comparing Investments: XIRR is ideal for comparing performance across different investments with varied cash flow patterns.

- Evaluating Portfolio Performance: It helps in assessing the overall performance of a portfolio that includes multiple investments with non-uniform cash flows.

- Financial Planning: XIRR aids in long-term financial planning by providing a clear picture of investment returns.

- Tax Planning: It can be used in tax planning scenarios to understand the after-tax returns of investments.

FAQs

How is XIRR different from CAGR?

Unlike CAGR, which calculates a simple average growth rate over a period, XIRR accounts for the timing and amount of each cash flow, making it more accurate for irregular investments.

When should I use XIRR for my mutual fund investments?

XIRR is ideal for analyzing mutual funds with SIPs (Systematic Investment Plans), lump-sum investments, or frequent withdrawals and dividends.

Can XIRR be used for all types of mutual funds?

Yes, XIRR can be used for all types of mutual funds, especially those with non-periodic and varied investment amounts.

How do I calculate XIRR for mutual fund investments?

You can calculate XIRR using financial calculators or spreadsheet software like Excel, which requires inputting all cash flows and their corresponding dates.

Is XIRR a reliable tool for mutual fund analysis?

Yes, XIRR is a reliable tool as it provides a more realistic view of the investment's performance by considering the specific timing of cash flows.

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio