All About Financial Statements: Type, Components and Guidelines

Financial statements are financial documents that explain different aspects of the business in a summarized manner. Through this article, you will learn about the types and components of all financial statements.

Table of Contents

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

- What are financial statements?

- Benefits

- Types of financial statements

- How do financial statements help in financial analysis?

What are financial statements?

Financial statements are summary-level reports that represent the organization’s financial position, cash flows, and financial results. Balance sheets, income statement, and cash flow statement are the three types of financial statements. Through these statements, the company can learn about the financial performance of the business.

Benefits of Financial Statements

The following are the benefits of financial statements:

- Through financial statements, businesses can assess the operational efficiency and profitability.

- One can learn about the details related to assets, liabilities and equity of the company.

- Lenders are able to evaluate the creditworthiness of the company by examining its credit history, sore and income stability of the borrower.

- Financial statements ensure that the company is compliant with the financial regulations and standards.

Types of Financial Statements

In this section, we will discuss the three financial statements that are used by financial analysts. Let us get started.

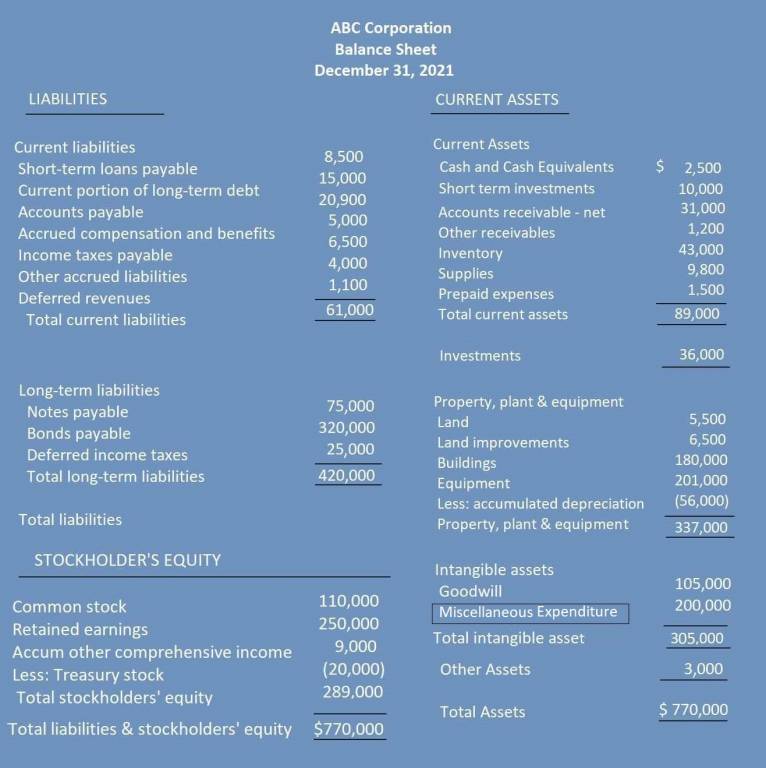

1. Balance Sheet

Balance sheet is a financial statement that provides the details of the company’s shareholder equity, assets, and liabilities at a specific time period. Through a balance statement, the company can identify its investments, assets, and liabilities.

A balance sheet provides an overview of a company’s finance at a particular moment in time. It can only provide financial information for longer time periods. Due to this, balance sheets must be compared with balance sheets from previous periods.

Accountants can use balance sheets with other financial statements to conduct fundamental analysis. A balance sheet provides the information on the company’s finances as of the publication date. Fundamental analysts use balance sheets for calculating financial ratios.

Investors can derive several financial ratios from the balance sheet to help them in understanding the financial health of the company.

Components of Balance Sheet

One of the most important equations in a balance sheet is:

Assets = Liabilities + Shareholder’s Equity

According to this equation, the assets of a company are paid by taking liabilities and shareholders’ money.

A balance sheet must always be balanced i.e. the assets should always be equal to the liabilities and equity of shareholders. In other terms, debits should be equal to credits. If these two do not balance, then there is an error.

Let us understand these three terms in the balance sheet equation.

1. Assets

In the balance sheet, assets are listed in order of their liquidity. These include current assets and non-current assets.

- Current assets include those assets that can be liquidated within the period of one year. These include cash and cash equivalents, marketable securities, accounts receivable, inventory, and prepaid expenses.

- Non-current assets include those assets that cannot be liquidated within the period of one year. They include fixed assets, intangible assets, and long-term investments.

2. Liabilities

These refer to the money that the company owes to external parties. These include bills, interest, rent, and salaries. These can be either current liabilities or long-term liabilities.

- Current liabilities must be paid within the period of one year. These include wages, salary, interest, dividends, earned and unearned premiums, accounts payable, and customer prepayments.

- Long-term liabilities include interest and principal on issued bonds, pension fund liabilities, and deferred tax liabilities.

Learn the difference between assets and liabilities

3. Shareholder Equity

It refers to the money that the company owner owes to its shareholders. These are net assets as they are equivalent to the difference between total assets and liabilities. Shareholder equity includes controlling and non-controlling interest.

- Controlling interest which includes issued capital and reserves attributable to the equity holders of parent company.

- Non-controlling interest in the equity.

Example of a Balance Sheet

Balance sheets are created based on either of the two internationally accepted accounting guidelines. A balance sheet may be created based on GAAP (for the US) or IFRS (outside the U.S.)

The GAAP-based balanced sheet requires that assets should be listed in the decreasing order of the liquidity. This means that a highly liquid asset will be placed above an asset with lower liquidity. The current assets are placed before non-current assets in the US GAAP.

The IFRS-based balance sheet reports assets in the increasing order of their liquidity. Assets with lower liquidity will be placed above assets with higher liquidity. That means non-current assets will be placed before current assets on the balance sheet.

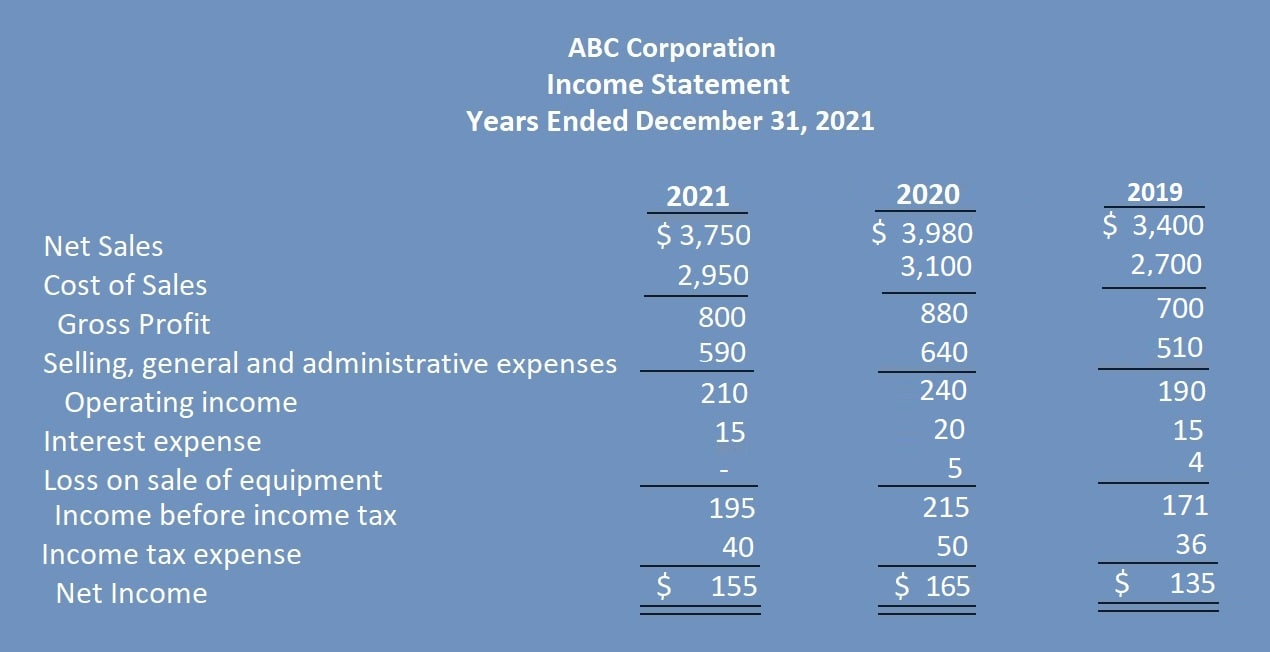

2. Income Statement

This is another financial statement that indicates the company’s income and expenditure. The income statement shows if the business is in profit or in the loss. This is why an income statement is also known as a profit or loss statement.

It reports income during a specific duration. This duration is mentioned in the income statement. The income statement must be submitted to the Securities and Exchange Commission since it is an important part of the company’s performance.

Types of Income Statements

Single-step and multiple-step statements are two types of income statements.

1. Single-Step Income Statement

This type of financial statement provides simplified information on the company’s revenue and expenses. It includes information on revenue, income, and net income.

Revenues and gains are put at the top of the statement. Losses and expenses are put at the bottom. This statement has its own disadvantage since it is not detailed such as there is no data on the source of expenses.

2. Multiple-Step Income Statements

These statements are detailed in nature. These include in-depth analysis of different factors and thus provide a more accurate representation. They categorize expenses as direct costs and indirect costs. Most public companies use Multiple-step income statements.

Through these statements, stakeholders can learn about the details of the business operation and can also compare the operating, gross and net margins. However, it is a time and effort-consuming statement since it includes detailed components.

Components of the Income Statement

The net income is calculated as the following:

Net Income = (Revenue + Gains) – (Expenses + Losses)

Let us understand each component of the income statement equation:

In an income statement, the focus is on expenses, revenue, losses, and gains. Let us take a detailed look at these aspects

1. Revenue

These include operating and non-operating revenue.

Revenue garnered through primary activities is the operating revenue. Operating revenue refers to the revenue made from the sale of products for those companies that sell products. For service providers, operating revenue comes from fees for services.

Non-Operating Revenue is the revenue realized through secondary activities. These may include revenue earned from interest, rental income on business property, royalty payments, etc.

2. Gains

Gains also make up the part of income. These include net income from one-time non-business activities. These may include activities such as subsidiary companies, unused land, etc.

3. Expenses

The cost borne by the business to continue its operations is known as an expense. These include primary activity and secondary activity expenses.

- Primary activity expenses incur from the normal operating revenue that is linked to the primary activity of the business. This includes general and administrative expenses (SG&A), research and development expenses, depreciation and amortization, and cost of goods sold (COGS). Other expenses include utility expenses, employee salary, etc.

- Secondary Activity Expenses include expenses from non-core business activities such as paying interest on loans.

4. Loss

It refers to the expenses made in products and services that did not perform well or loss-making sales of the long-term assets. It also includes unusual costs that do not have any returns.

Example of Income Statement

Guidelines Followed by The Income Statement

If an income statement follows GAAP guidelines, then it will represent three periods. Whereas, an income statement that follows the IFRS guidelines will present two periods.

Explore GAAP courses and IFRS courses

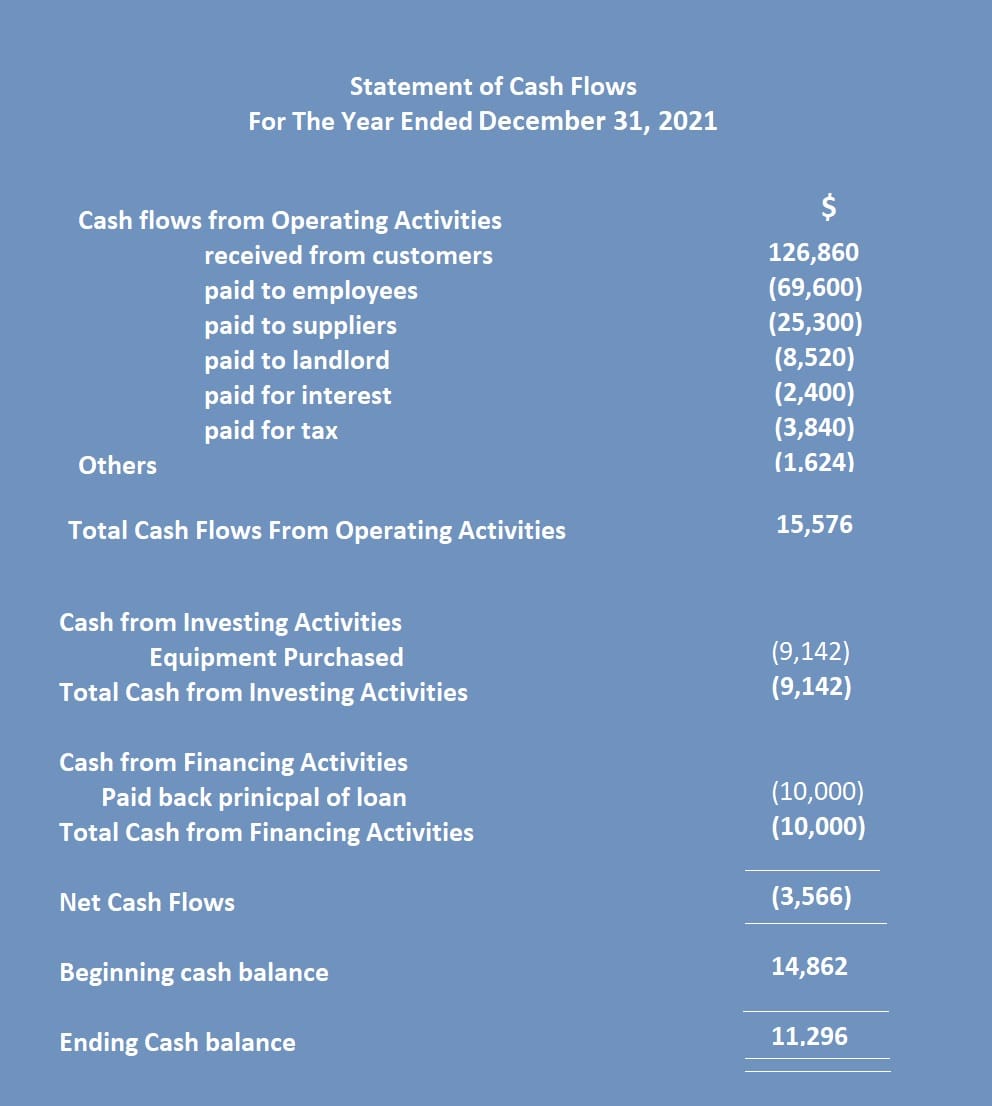

3. Cash Flow Statement

Cash flow statement is a financial statement that provides data related to the cash inflows and cash outflows. Through a cash flow statement, one can learn about the details of every financial transaction. Investors can determine the stock value of a company through this financial statement.

The cash flow statement is focused on the cash accounting method. It includes the net income which is the sum of cash earned by the business through investments, financing, and operations.

Cash flow is calculated using the following equation:

Cash Flow = Cash from operating activities +(-) Cash from investing activities +(-) Cash from financing activities + Beginning cash balance

Let us now understand each component of this equation in detail.

1. Cash Flow From Operating Activities

It covers all the transactions from operational business activities. It reflects the net income of the company in terms of cash. Cash inflows and outflows directly from business operating expenses such as employee salary and inventory sales and purchases are included.

It may also include amortization, prepaid items booked as expenses and revenue, depreciation, accounts payable, etc. Through this component of the statement, management can assess if the business is generating positive cash flow or not for operational growth. Based on this assessment, they may decide on financing for business growth.

2. Cash from Investing Activities

This is the result of cash flows from investment gains and losses. Through this section, financial analysts can identify changes in capital expenditure (Capex). Increased cash flow indicates reduced cash flow.

For investors, any business that is generating positive cash flow through business operations is preferable in comparison with a company that is generating cash flow through investing and financing.

3. Cash flow from Financing

This section provides the details of cash used in business financing. It also includes information on the source of cash flow from debt or equity. Financial analysts use this section of the financial statement to understand the amount of cash paid for dividends and share buybacks.

They can also assess how the company is raising cash for its operational growth. If the cash flow from financing is positive, then it indicates that the cash inflow is more. If the cash flow is negative, it indicates higher cash outflow.

Example of Cash Flow Statement

Guidelines Followed by The Cash Flow Statement

If US GAAP is being followed, then interest income, interest expense, and dividend income is included in the operating activities section. It requires dividends paid to be reported in the financing section.

For IFRS, greater discretion regarding the section in which these items can be reported in the statement is provided.

Check out accounting courses

How do Financial Statements Help in Financial Analysis?

Financial statements aid financial analysis by assessing profitability, liquidity, solvency, cash flow, trends, decision-making, and strengths/weaknesses for stakeholders. These statements help in the following ways:

- Financial statements offer insight into a company's financial health.

- They provide data for ratio analysis and financial modelling.

- Profitability, liquidity, and solvency can be assessed.

- Cash flow trends are tracked for future planning.

- Financial statements help stakeholders make informed decisions.

- Strong and weak points of the company's financial position are revealed.

Conclusion

Every financial statement includes important financial details related to the company. Yet all three financial statements are required to understand the overall financial situation of the company. Based on the study, assessment, and conclusion of these financial statements, the company can make wise business decisions.

FAQs

What is the purpose of a financial statement?

Financial statements provide detailed information about the financial situation of a company. Through the analysis of the statements, one can learn about the company's cash flows and if the company is in profit or loss.

What makes a balance sheet strong?

Intelligent working capital, balanced capital structure, positive cash flow, and income-generating assets make the balance sheet strong.

What is the meaning of accounts receivable?

Accounts receivable are funds that customers owe to the company for goods and services already invoiced. Accounts receivable are listed as current assets on the balance sheet.

How often are financial statements prepared?

Financial statements are usually prepared quarterly and annually.

How can you assess a company's liquidity from its financial statements?

To assess the company's liquidity, one must consider liquidity ratios, including the current ratio (current assets / current liabilities) and quick ratio ((current assets - inventory) / current liabilities).

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio

Comments

(1)

E

7 months ago

Report

Reply to Elkanah Mwaba

J

Report