Cash and Cash Equivalents – An Introduction

Cash and cash equivalents are essential for a company because they allow it to meet its short-term financial obligations. They also provide a company with a cushion in case of unexpected expenses. Learn all about cash and cash equivalents, including their definition, importance, and how they are accounted for in financial statements. Discover how businesses use these assets to manage liquidity and support day-to-day operations.

Content

- What is Cash?

- Examples of Cash

- Importance of Cash in Daily Transactions

- Risks Associated With Holding Cash

- What are Cash Equivalents?

- Characteristics of Cash Equivalents

- Examples of Cash Equivalents

- Risks Associated with Cash Equivalents

Must Explore – Investing Courses and Certifications

In many-to-many cardinality, multiple entities of first relation R1 are associated with multiple entities of second relation R2, and vice versa, i.e., multiple entities of second relation R2 are associated with multiple entities of first relation R1.

What is Cash?

Cash refers to physical currency, such as coins and notes, and bank deposits that users can withdraw without penalty at any given time. In accounting, cash is considered a highly liquid asset, easily converted into other assets or used to pay off debts. It is an important component of a company’s balance sheet.

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

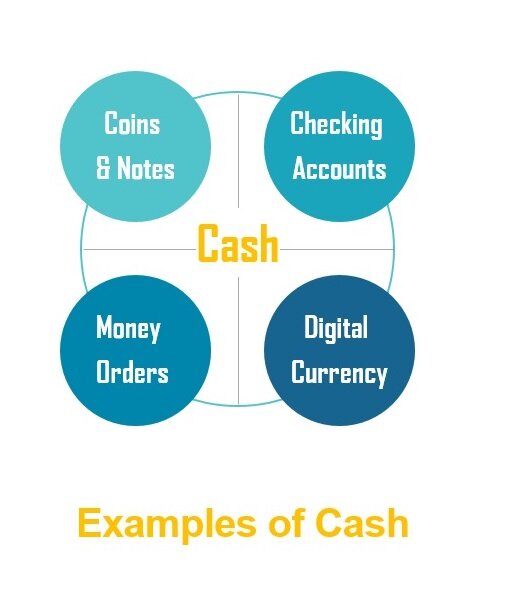

Examples of Cash

- Coins and Paper money: Banknotes and metallic coins issued by the government and central banks.

- Checks: Technically, checks are not cash but a form of payment you can deposit or encash at a bank.

- Money orders: Money orders are similar to checks in that they transfer funds from one person to another. You can purchase them from a post office, bank, or other financial institution. Though an old form of money transfer, money orders are still in use if a recipient does not have a bank account.

- Digital currency: While not physical, digital currencies such as Bitcoin and Ethereum are increasingly used as a form of payment for goods and services. They can be bought and sold on cryptocurrency exchanges and used to purchase goods or services online or in person.

Importance of Cash in Daily Transactions

Liquidity – Cash facilitates daily transactions between individuals and businesses. It is a tangible asset. Cash ensures immediate payments and is among the most preferred modes of payment worldwide.

Flexible – Remember the olden days when there was no dependency on third parties like a bank, internet connections or mobile phones to make payments? The use of cash ensures freedom to expenditure without any involvement of a third party.

Security – Since the use of cash does not require the involvement of any third parties, the use of cash is a secure form of payment as long as you keep it safe. You can avoid identity theft or fraud with cash because it is not connected to electronic accounts.

Budgeting: You can manage your budget effectively by using cash. You will know how much money you have and how much you are open to spending. This is helpful for those who struggle to keep their expenses in check when using credit or debit cards.

Emergencies – Cash can be helpful in emergencies such as medical treatments, power outages, no access to the internet, etc.

Supporting Small Businesses: Many small businesses prefer cash payments because they do not have to pay transaction fees or deal with chargebacks that can occur with credit or debit cards.

Related Read – Features of Money Markets

Risks Associated With Holding Cash

Holding cash also has drawbacks, such as the risk of theft or loss and the potential for inflation to erode its value over time. As a result, some individuals and businesses may choose to hold other forms of assets, such as stocks or bonds, to preserve and grow their wealth. Holding cash can expose you to several risks, including –

Inflation Risk: Cash held for an extended period can lose its value due to inflation, which means that the purchasing power of your money decreases over time.

Theft or loss: Cash can easily be stolen or lost. It can be difficult to recover the lost funds. Hence, you must keep it in a safe place. Let’s not forget the risk of theft or natural disasters like fire or flood.

Opportunity Cost: When you hold cash, you take advantage of the potential returns you could have earned by investing in other assets. In other words, cash earns little or no interest, so you could lose out on growth opportunities.

Currency Risk: The currency values always fluctuate, and if you hold cash in a foreign currency, you may suffer a loss. However, there are chances that you gain some value from that currency, but why take risks?

Liquidity Risk: In volatile markets or financial stress, you may find it challenging to convert cash into other assets. This can make it difficult to access funds when you need them the most.

You must balance holding cash for emergencies and consider investing in assets with growth potential and protection against inflation.

What are Cash Equivalents?

Cash equivalents are short-term investments you can easily convert into cash. Examples include treasury bills, commercial paper, and money market funds.

Also read: Instruments of Money Market: Meaning and Types

Characteristics of Cash Equivalents

- They can be converted to money in less than 90 days.

- There are no restrictions or penalties to convert it into cash.

- The risk of loss of value of these investments should be minimal.

- They must meet short-term obligations.

Examples of Cash Equivalents

- Commercial Paper. A commercial paper is a short-term bond or debt issued by corporations. It has a maturity of up to nine months (270 days) and varying interest rates as per the creditworthiness of the issuing body.

- Banker’s Acceptance. A banker’s acceptance is a financial instrument that the bank guarantees for payments at a future date.

- Money Market Account. A money market account is a higher-interest deposit account that financial institutions offer. However, they often require huge minimum deposits and can have some restrictions on the account.

- Certificates of Deposits. Certificates of deposits can be cash equivalents based on their maturity dates.

- Preferred Shares of Equity. This can be a cash equivalent if purchased shortly before the redemption date.

- Marketable Securities. Marketable securities is a broad term that includes financial assets you can easily purchase and sell, such as stocks, bonds, and mutual funds. Companies usually present these investments together on their balance sheets.

Risks Associated with Cash Equivalents

While they are generally considered a safe and low-risk investment, there are still some risks associated with them:

- Interest Rate Risk: Cash equivalents such as money market funds, certificates of deposits, commercial paper, etc., are subject to interest rate risk and decreased purchasing power.

- Credit Risk: They are also subject to credit risk, which is the risk of default by the issuer. If the issuer defaults, the investor may be unable to recover their investment.

- Inflation Risk: Although cash equivalents are safe for funds, they may not sometimes protect against inflation. Inflation can degenerate the value over time, reducing their purchasing power.

- Market Risk: Market risk refers to the possibility that investment values may fluctuate due to fluctuations in market conditions. Some cash equivalents, such as money market funds, are subject to market risk.

- Liquidity Risk: Although cash equivalents are highly liquid, they are still subject to liquidity risk. Without sufficient market buyers, investors may be forced to sell these cash equivalents at lower prices and lose money.

Considering these risks when investing in cash equivalents and diversifying one’s portfolio to reduce risk is essential.

How are Cash and Cash Equivalents Recorded on Financial Statements?

Cash and cash equivalents are typically recorded on a company’s financial statements under the “Current Assets” section, as they are the most liquid assets. The amount reported on the balance sheet is the sum of all cash on hand and all cash equivalents.

Below is the annual financial statement of Tata Motors. As you can see, Cash and Cash Equivalents are mentioned under the “Current Assets” section.

Conclusion

Cash and cash equivalents are crucial elements of financial reporting. They are usually reported together on the balance sheet as a single line item. They provide a transparent and detailed picture of an organization’s available liquid assets, making it easier to assess its financial health and make investment decisions.

FAQs

What Are Cash Equivalents Used for?

When a company has a cash surplus, it can resort to these short-term investments as part of cash planning. Now it's not just about having surplus cash, but there are other reasons why companies may hold cash equivalents, including: Net capital: Net capital is part of the company's net working capital (current assets - current liabilities). It is used to buy inventory, cover operating expenses, and make other purchases. Cash Reserve: Cash reserves offer a backup for the business to convert them into cash if times turn bleak quickly. Finance acquisitions: Cash equivalents are kept in reserve to purchase assets.

Why is cash important to a business?

Cash is important to a business because it is required for day-to-day operations, paying bills, investing in new opportunities, and meeting short-term obligations.

What is the difference between cash and cash equivalents?

The main difference between cash and cash equivalents is that cash is a physical currency, while cash equivalents are short-term investments that can be quickly converted into cash.

Can cash equivalents lose value?

Yes, cash equivalents can lose value due to changes in interest rates, credit risks, or other factors that affect the value of the investment.

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio