How to Link PAN Card with Aadhar Card?

This comprehensive guide will walk you through linking your PAN (Permanent Account Number) card with your Aadhar card. This crucial step is mandatory for all Indian citizens and can significantly affect your financial transactions and taxation. Learn through the step-by-step instructions.

Linking your PAN (Permanent Account Number) card with your Aadhaar card is mandatory in India. It helps the government track financial transactions and curb tax evasion. You can link your PAN card with the Aadhaar card through various methods, online and offline. In our step-by-step guide, learn how to link a PAN card with an Aadhar card.

Table of Content

"Unlock Your Future as a FinTech Expert - Enroll in Our Online FinTech Programme Today!"

1. Online Method of Linking PAN with Aadhaar Card

Linking your PAN (Permanent Account Number) with Aadhaar on the Income Tax Department’s website is convenient and straightforward.

Here are the steps to the Aadhar PAN card link online:

- Step 1 – To link Aadhar to PAN card, visit the official Income Tax Department’s website: https://www.incometax.gov.in/iec/foportal/

If you are not registered, click the “Register Yourself” button and complete the registration process.

- Step 2 – Log in to your account using your PAN, password, and captcha code. Click Validate.

- Step 3 – You will be redirected to Continue to Pay Through E-Pay Tax. Click it.

- Step 4 – Enter your PAN/TAN, confirm your PAN, and your registered mobile number to receive OTP.

You will be redirected to the e-Pay Tax page.

- Step 5 – Hover to the Income Tax tile and click Proceed.

- Step 6 – Select the Assessment Year and Type of Payment as Other Receipts. Click Continue.

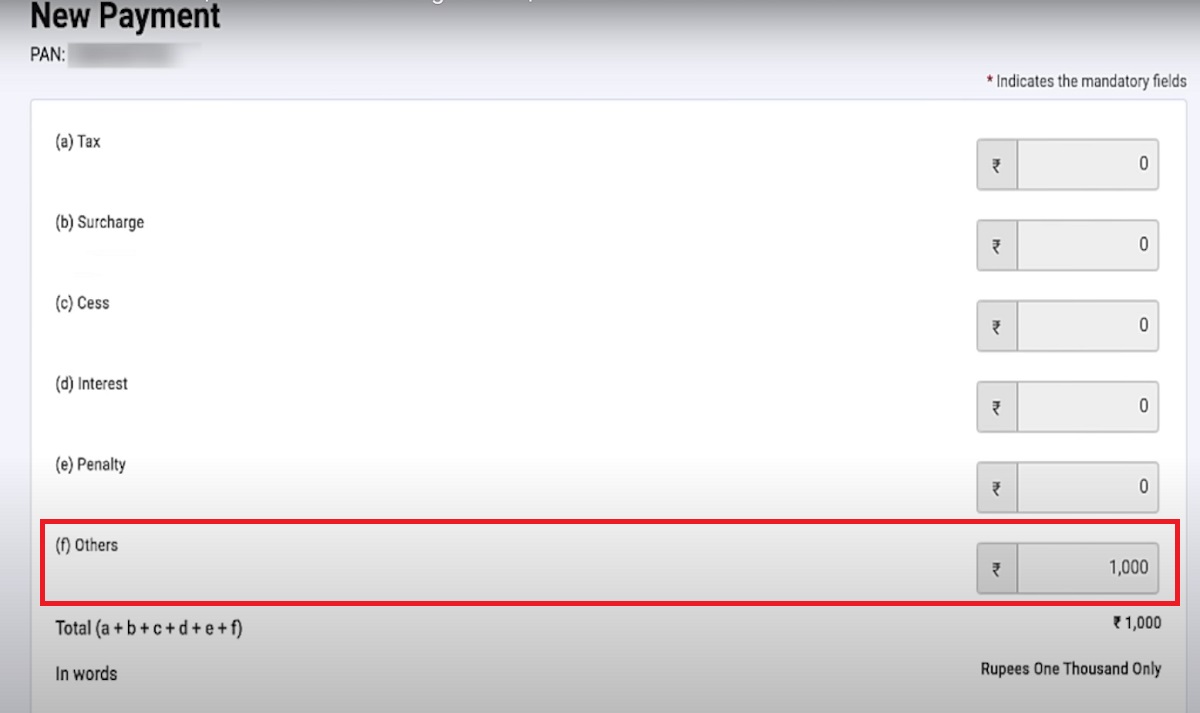

- Step 7 – In Others, you will find that the amount is pre-filled. Click Continue.

This will generate a new challan. You can now make the payment on the bank website. After you have made the payment, you can link your Aadhaar with your PAN on the e-Filing Portal.

- Step 8 – Again, go back to the e-filing Portal > Login. On the Dashboard, in the Profile section, under the Link Aadhaar to PAN option, click Link Aadhaar.

- Step 9 – Fill in the necessary details, such as your mobile number, name as per Aadhaar, etc. and click “Link Aadhaar”.

- Step 10 – Validate the phone number. Your request to link your PAN to Aadhaar has been submitted successfully.

- Step 12 – After validating PAN and Aadhaar, a message will pop up – “Your payment details are verified”. Click Continue on the pop-up message to submit an Aadhaar PAN linking request.

- Step 13 – Check the Aadhar card PAN card link status.

- Step 14 – Enter your PAN and Aadhaar details. Click View Link Aadhaar Status.

If your validation fails, click Link Aadhaar on the Status page and repeat the previous steps to link your PAN and Aadhaar.

- Check again later if your request to link PAN and Aadhaar is pending with UIDAI.

- You may need to contact the Jurisdictional AO to delink Aadhaar and PAN if:

- Your Aadhaar is linked with some other PAN.

- Your PAN is linked with some other Aadhaar.

After successful validation, you will get the following pop-up regarding your Aadhar PAN card link status.

Best-suited Banking, Finance & Insurance courses for you

Learn Banking, Finance & Insurance with these high-rated online courses

2. Offline Method of Linking PAN with Aadhaar Card

You can also link your PAN with your Aadhaar offline by visiting a PAN service centre or a designated Aadhaar Enrollment Center. Here’s how:

- Visit the nearest PAN service centre or the Aadhaar Enrollment Center.

- Fill out the “PAN Aadhaar Linking Form” (Form 49A) or provide the necessary details to the staff.

- Submit the form and a self-attested copy of your PAN and Aadhaar cards.

- The staff will verify your documents and process the linking request.

- You will receive an acknowledgement slip with a reference number. Keep this slip for future reference.

You will receive a confirmation message or email once you have successfully linked your PAN with Aadhaar. Ensure that the details on both cards match to avoid any discrepancies. It is important to link your PAN and Aadhaar to avoid any inconvenience and to comply with government regulations. We hope this article on how to link PAN card with Aadhar card was helpful!

Related Reads

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio

Comments

(2)

R

2 months ago

Report Abuse

Reply to Ruchi Sharma

M

7 months ago

Report Abuse

Reply to Md tarique