What is Income Tax and How to Calculate It?

Income tax is a tax levied by the government on individuals and businesses on their incomes. Many countries have an income tax system where higher income groups pay more tax.

Table of Contents

- What is income tax?

- How to Calculate Income Tax From Salary?

- Types of income tax

- New Tax Regime

- New Tax Regime Vs. Old Tax Regime

- How to file ITR?

What is income tax?

It is a direct tax that the government imposes on the citizens of the nation. According to the Income Tax Act, 1961, it is mandatory for the central government to collect the tax. Any changes in the tax slab are announced in the union budget on an annual basis.

Based on the tax slab in which the individual falls, they will have to pay the income tax. Income tax is proportional to the income. The higher the income, the higher will be the tax.

Best-suited Tax Law courses for you

Learn Tax Law with these high-rated online courses

How to Calculate Income Tax on Salary With Example?

Calculating income tax on salary in India involves several steps, but it's not as complex as it might seem! Here's a breakdown with an example:

Step 1: Calculate your gross salary:

This is your total salary before any deductions. Consider your basic salary, allowances, bonuses, and any other earnings received from your employer.

Example: An individual earns a basic salary of Rs. 50,000 per month, with Rs. 5,000 in house rent allowance (HRA) and Rs. 2,000 in travel allowance per month. Their annual gross salary would be:

(12 months * (50,000 + 5,000 + 2,000)) = Rs. 720,000

Step 2: Determine your deductions:

Certain expenses and allowances are deductible from your gross salary under various sections of the Income Tax Act. Common deductions include:

- Standard deduction: Rs. 50,000 for all taxpayers up to the financial year 2023-24.

- HRA exemption: A portion of your HRA is exempt based on your location and salary. For metro cities, the exemption is limited to 50% of basic salary or actual HRA received, whichever is lower. In non-metro cities, it's 40% of basic salary or actual HRA received.

- Professional tax: Varies depending on your state and salary.

Example: Assuming our individual lives in a metro city, their HRA exemption would be:

Min(50% of basic salary, actual HRA) = Min(50% * 50,000, 5,000) = Rs. 2,500

So, their total eligible deductions would be:

50,000 + 2,500 = Rs. 52,500

Step 3: Calculate your taxable income:

Subtract your eligible deductions from your gross salary to arrive at your taxable income.

Taxable income = Gross salary - Deductions

In our example:

720,000 - 52,500 = Rs. 667,500

Step 4: Apply income tax slabs:

India has a progressive tax system with different rates for different income brackets. Currently, for individuals below 60 years, the slabs are:

- Up to Rs. 2.5 lakh - 0%

- Rs. 2.5 lakh - Rs. 5 lakh - 5%

- Rs. 5 lakh - Rs. 10 lakh - 20%

- Above Rs. 10 lakh - 30%

Example: Our individual falls in the Rs. 5 lakh to Rs. 10 lakh bracket, so their income tax rate would be 20%.

Step 5: Calculate your income tax:

Multiply your taxable income with the applicable tax rate.

Income tax = Taxable income * Tax rate

In our example:

667,500 * 20% = Rs. 133,500

Step 6: Consider TDS (Tax Deducted at Source):

Your employer typically deducts TDS from your salary throughout the year and deposits it to the government on your behalf. Check your salary slips to determine the total TDS deducted.

Example: Let's say the individual's employer deducted Rs. 120,000 in TDS throughout the year.

Step 7: Calculate your net tax payable:

Subtract the TDS deducted from your calculated income tax to determine your net tax payable (if any).

Net tax payable = Income tax - TDS

In our example:

133,500 - 120,000 = Rs. 13,500

Therefore, this individual would need to pay Rs. 13,500 as income tax.

Types of Income Tax

There are different types of income tax imposed by the government:

1. Business Income Tax

In case, you are a Limited Liability Partnership with annual taxable income up to 1 crore, you will be taxed at 30%. For companies with more than 400 crores as turnover, you will have to pay the tax at 30%. If your company’s turnover is less than 400 crore, you will have to pay the tax at 25%. For businesses, in India, you will be charged a surcharge above income tax if your annual income is between 5 lakh to 1 crore rupees. If it is more than 1 crore, then there will be an additional 4% education and health cess.

| Condition | Income Tax Rate (excluding surcharge and cess) |

| Turnover or Gross Receipt in the previous tax year does not exceed ₹ 400 crores | 25% |

| If the company opts for Section 115BA | 25% |

| If the company opts for Section 115BAA | 22% |

| If the company opts for Section 115BAB | 15% |

| For Other Domestic Companies | 30% |

Chargeable Surcharge

| Conditions | Surcharge(%) |

| Taxable income is between ₹ 1 crore– Up to ₹ 10 crore | 7 |

| Taxable income is above ₹ 10 crore | 12 |

| Companies opting for taxability u/s 115BAA or Section 115BAB | 10 |

Learn why cess and surcharge are levied separately

2. Individual Income Tax

Individual or personal income tax is paid by individuals on their income. Different individuals come under different tax brackets. This may be levied on their wages or salaries. Many individuals are exempted from paying these taxes in case of exemptions, credits, and deductions. This tax is usually imposed by the state on the income earned by individuals. Some states have reciprocity agreements with other states. Such agreements allow taxation in the state of residence on the income earned in another state.

Explore GST and taxation courses

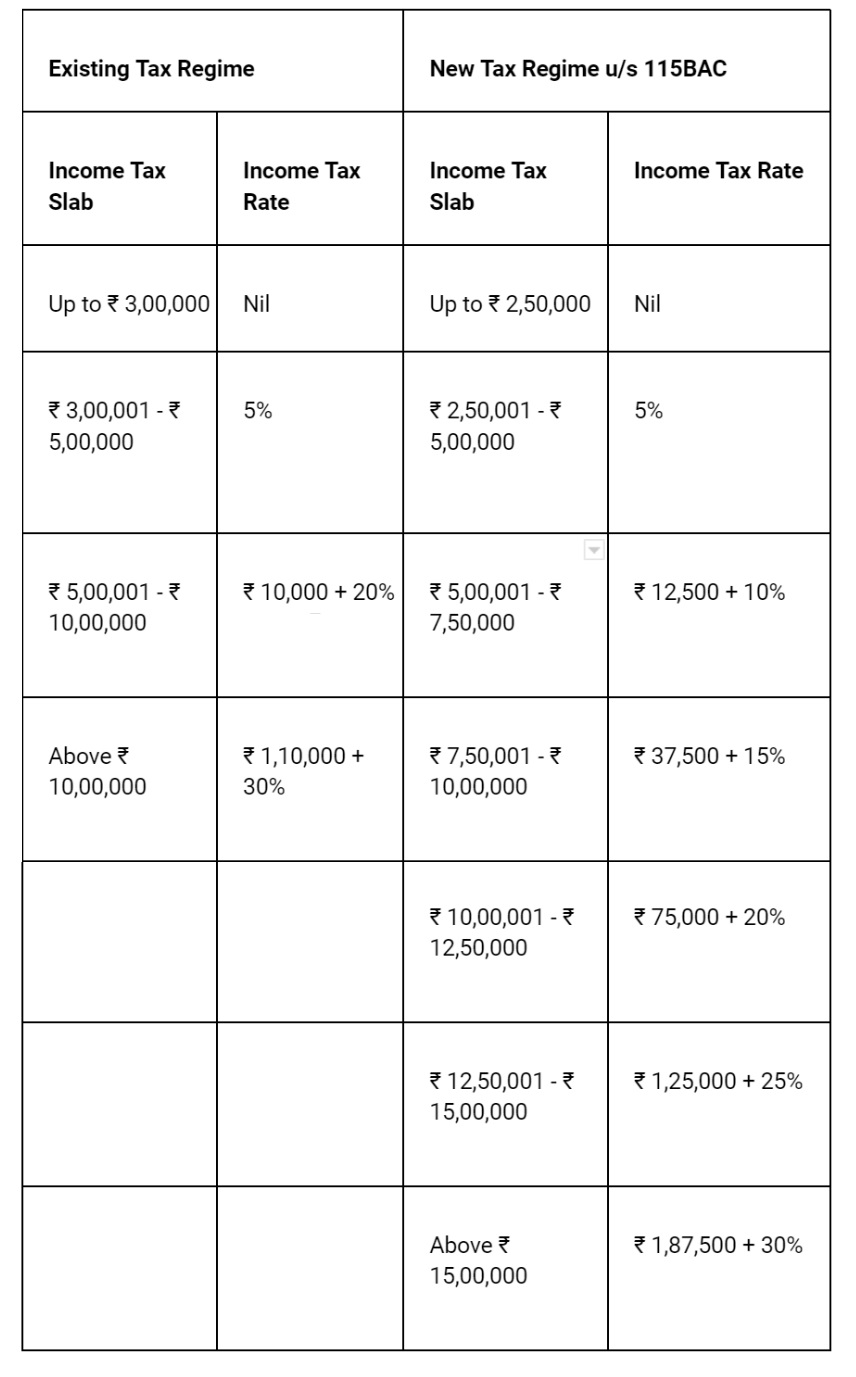

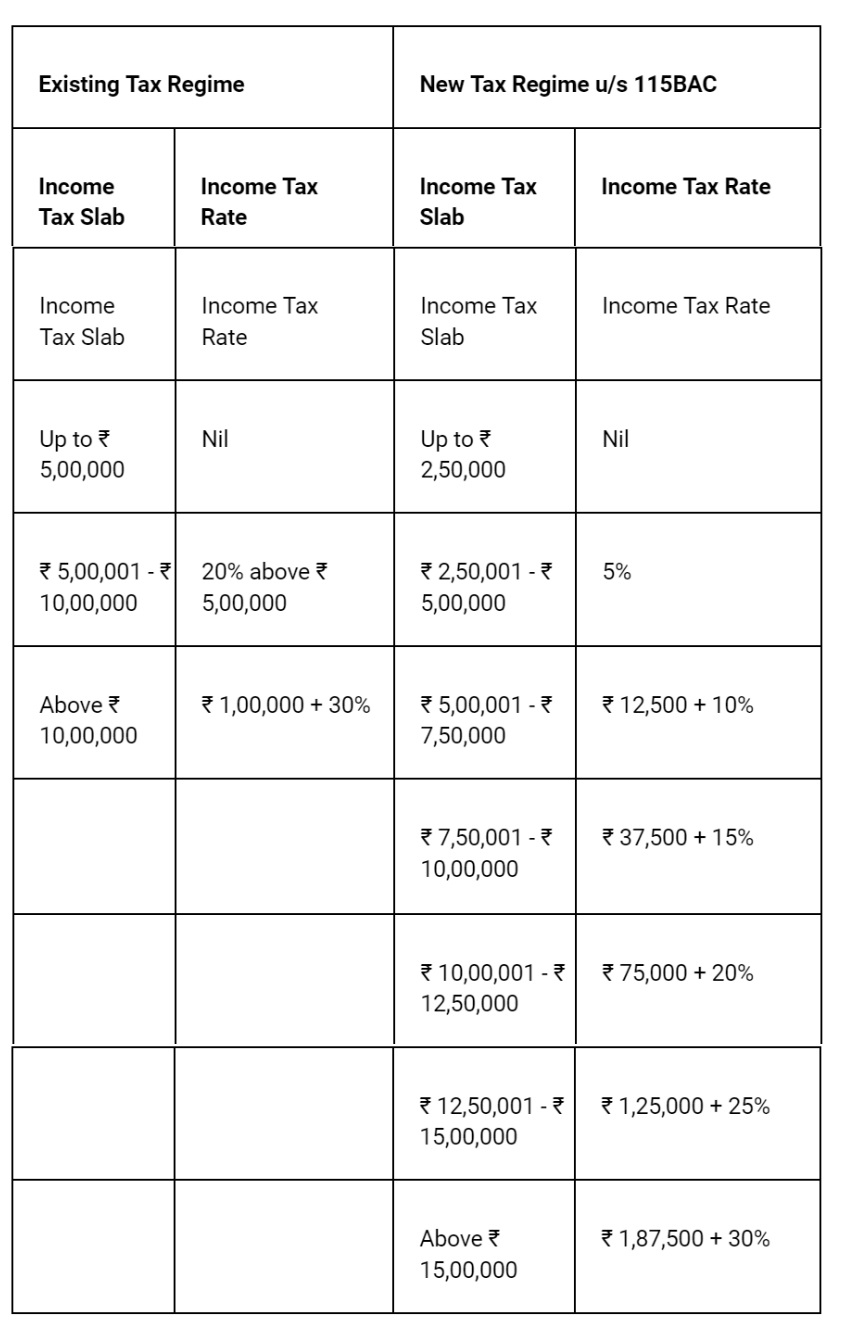

For Individual Less Than 60 Years of Age (as in the previous financial year)

For individuals who are above 60 years but less than 80 years of age (during the previous year)

For individuals who are 80 years of age or more (during the previous year)

New Tax Regime

At present, there are two different income tax regimes active in India: New tax regime and old tax regime. Let us learn about these two regimes. As of February 2022, there have been no new changes in the existing tax slabs and associated rates.

New Tax Regime u/s 115BAC

| Income Slab | Income Tax Rate |

| Up to ₹ 2,50,000 | – |

| ₹ 2,50,001 – ₹ 5,00,000 | 5% |

| ₹ 5,00,001 – ₹ 7,50,000 | ₹ 12,500 + 10% |

| ₹ 7,50,001 – ₹ 10,00,000 | ₹ 37,500 + 15% |

| ₹ 10,00,001 – ₹ 12,50,000 | ₹ 75,000 + 20% |

| ₹ 12,50,001 – ₹ 15,00,000 | ₹ 1,25,000 + 25% |

| Above ₹ 15,00,000 | ₹ 1,87,500 + 30% |

The slab system was introduced to maintain fairness in the tax system in the country. For the financial year 2022-2023, the following tax slab rates are applicable:

The new tax regime was introduced in 2020 where HUF family members and individuals had the option to pay taxes at a lower rate. However, they cannot claim deductions under different sections such as HRA, 80C, 80D, 80TTB. There is no discrimination based on age in this new tax regime.

However, under this new tax regime, one cannot claim up to 70 income tax deductions while calculating the taxes. Every person has to make calculations as per the old and new tax regimes and assess the regime beneficial to them based on investments made and returns that are earned on those investments.

Explore finance courses

If you plan to opt for the new tax slab, you must keep the following in mind:

- You can opt for this option on or before every previous year in case you do not have any business income as an individual or a member of HUF.

- Once you have opted for the new tax regime, you are not allowed to change it during the year. When you withdraw your option for the next tax regime. You can again opt for the new tax regime during the financial year again.

- For businesses, in case you have opted for the new tax regime, it will remain valid for the previous year and every subsequent year till the business continues in operation.

Calculation of Income Tax as Per the New Tax Regime

Let us consider an example of a 35-year-old person earning ₹11,00,000. This person has made investments under section 80C of ₹1,50,000 and under Section 80CCD of ₹60,000. He has also claimed the income tax deduction with medical and leave travel allowance of ₹40000 and HRA of ₹1,50,000 According to calculation, the tax payable under the old and new tax regimes will be as follows:

New Tax Regime Vs. Old Tax Regime

| Income slabs (Rs) | Old Regime (with exemptions and deductions) | New Regime (without exemptions and deductions) |

| Up to 2.5 lakh | Nil | Nil |

| 2.5-5 lakh | 5% | 5% |

| 5-7.5 lakh | 20% | 10% |

| 7.5-10 lakh | 20% | 15% |

| 10-12.5 lakh | 30% | 20% |

| 12.5-15 lakh | 25% | |

| Above 15 lakh | 30% |

How to File Income Tax Return?

ITR is one of the annual activities that is the moral responsibility of every citizen. It helps the government determine the amount of expenditure of citizens. It also provides a platform for assessing claim refunds. In certain states, registration of immovable properties requires the owner to submit proof of tax returns for the last three years.

Many loan providers even ask for proof of return to process your loans or to start transacting with you. In fact, returns help you in claiming adjustments against past losses. This is important since incurred losses may not be recorded in the tax return of a financial year. To know more, click here to learn the complete process of filing ITR.

FAQs

Who must pay income tax?

Anyone who earns above Rs. 2,50,000 is liable to pay the income tax. Senior citizens above 60 years and below 80 years must earn Rs. 3,00,000 and above to pay taxes. For individuals above 80 years of age, Rs. 5,00,000 is the limit beyond which they are required to pay income tax.

What income comes under tax free limit?

If you earn u20b92.5 lakh or less, then you are not required to file ITR.

What will happen if an individual fails to file ITR?

If an individual fails to file the ITR, they will have to pay the penalty for missing the date. As per the section 234F, you will have to pay a fine of Rs. 10,000 in case you fail to file tax returns.

Why should we pay tax?

People should pay taxes since the government uses these taxes for providing facilities for the needy section of society. Through taxes, government hospitals, schools, subsidy programs, etc are being successfully run in the country.

What will happen if you fail to pay taxes for number of years?

In such a case, there might be legal action against you such as filing a notice of federal tax lien, seizing of the property, forfeiting your refund, etc.

Can a student file ITR?

Yes, in case the student is also working, then he or she must file an annual ITR statement. If the student has below taxable income, then there filing the ITR is not mandatory.

Do employees need to file ITR?

If you are an employee, then filing the ITR is necessary even if there is no tax liability. This can help you in taking loans and other forms of credit in the future.

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio