Partnership Definition, its Different Types, and Benefits

Partnership refers to a cooperative relationship between two or more individuals, organizations, or entities who come together to pursue common goals. It involves sharing resources, expertise, risks, and rewards and often includes mutual decision-making and collaboration to achieve shared objectives.

When two or more persons decide to start a business together to share the profits earned, it is called a Partnership. A partnership between persons can be established through an agreement that can be either written or oral. Unlike sole proprietors, where every contribution is made by one person, in partnership, partners of the firm can contribute capital and other resources as required. You will learn about the partnership definition and its related concepts here.

Explore: Online Law courses and certifications

Table of Content

- Partnership Definition

- Types of Partnership

- Advantages of Partnership

- Disadvantages of Partnership

- How to Form a Partnership

Partnership Definition

A partnership is a business form in which two or more people share ownership, management, and the company's income or losses. Partners may contribute capital, labour, skills, and experience to the business. They may have unlimited legal liability for the partnership’s and its partners’ actions.

Also read: What is Business Law?

A partnership splits its profit or loss among its partners. They are responsible for filing and paying taxes for their portion of the partnership profit.

Check popular courses:

| Popular Corporate Law Courses | Popular Intellectual Property Courses |

| Popular Legal Online Courses & Certifications | Popular GST and Taxation Courses & C |

Best-suited Corporate Law courses for you

Learn Corporate Law with these high-rated online courses

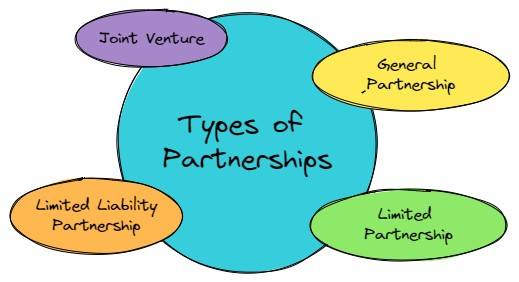

Types of Partnerships

Types of partnerships represent different business arrangements where two or more individuals or entities collaborate to share profits, losses, and responsibilities. Key types include General Partnership, Limited Partnership, Limited Liability Partnership, and Joint Venture, each with unique structures and liability protections suited to varying business needs and goals.

General Partnership

The most fundamental type of partnership is a general partnership. Creating a corporate legal entity with the state is optional. Most of the time, partners enter into a partnership agreement to establish their business. Although the partners may include alternative parameters in the partnership agreement, ownership and profits are distributed equally.

In a general partnership, each partner can independently bind the company to agreements such as loans and contracts. A partner is also individually liable for the company's debts and legal obligations, meaning they are held accountable for all the company’s debts.

Limited Partnership

The state has granted limited partnerships (LPs) the status of official business entities. They have one or more limited partners who contribute capital but are not actively involved in running the firm, and at least one general partner must be present who is responsible for it.

Limited partners make financial investments in the company but are exempt from liability for their debts and obligations. Due to the limited responsibility of the silent partner, limited partners are only liable for their initial investment and any gains. Limited partners could not be eligible for pass-through taxation in some states.

Limited Liability Partnership

Like a general partnership, a limited liability partnership (LLP) manages the company actively with all partners, but it restricts their legal responsibility for one another’s conduct.

The partners are not liable for their fellow partners' acts or omissions but are fully accountable for the company's debts and legal liabilities.

LLPs aren’t allowed in all states and are frequently only available to people in specific professions like medicine, law, and accounting.

Joint Venture

A joint venture (JV) is an agreement between two or more parties to combine resources to achieve a specific objective. This task can be a new project or any other commercial activity.

Each joint venture member is accountable for the venture’s gains, losses, and expenses. However, the endeavour exists independently of the participants’ existing business ventures.

Advantages of Partnership

Shared Risk and Responsibility

Every partner will contribute their unique expertise, abilities, contacts, and prior industry experience to the company, giving it a higher chance of success than any partners operating independently.

Partners can divide up the work, with each partner focusing on what they do best and love most. If one partner has experience in finance, they might concentrate on keeping the company’s accounts. In contrast, another might have had substantial sales experience and thus assume responsibility for that area of the organization. As a sole proprietor, you would have to handle all of this yourself (or manage someone you employ to do some of it).

In a partnership, as opposed to going it alone, the company gains from the distinct viewpoints that each partner brings. In business, having two perspectives while discussing a problem may result in a better solution than either partner could have come up with.

Availability of Resources and Knowledge

A potential partner might inject some cash into the company. The other individual might be more connected strategically than you are. This could assist your business in luring new investors and raising funds to expand. The right company partner could also improve your capacity to obtain financing for business expansion. It is beneficial to consider these financial considerations while assessing a potential mate.

Having a company partner can enable you to divide the financial responsibility for operating costs and capital investments. Doing this might save more money than you would if you went it alone.

More Opportunities for Development and Growth

Sharing labor is one benefit of having a business partner. Having a partner increases productivity and gives you the comfort and freedom to pursue more business opportunities. The adverse effects of opportunity costs might even be eliminated.

Opportunity costs are prospective benefits or commercial prospects that you could be obliged to forgo in favour of exploring other options. You must pick where to devote your attention and resources as a one-person band. A partner can free up your time to explore more opportunities.

Disadvantages of Partnership

Potential for Conflict and Disagreement

Working with a partner can be challenging due to various potential problems. For instance, conflicts may develop due to disagreements over ideas or unequal efforts to advance the company. One partner might need to do their fair share of the work. Relationships can end badly. Consider your feelings when assessing the benefits and drawbacks of a partnership.

However, you can avoid emotional issues by picking your partners wisely. Try to find someone who shares your vision, who has similar values to yours, who has the same work ethic as you, and where the thought process is identical. This can help avoid unforeseen issues to a great extent.

Limited Liability for Some Partners

A partnership will frequently find it more challenging to acquire money than a limited business, even though a combination of partners is likely to be able to contribute more capital than a sole proprietor. Banks may prefer the increased accounting transparency, distinct legal personality, and sense of permanency that a limited company offers.

A bank will either refuse to lend to a partnership business or only do so in less favourable conditions if considered riskier. Partnerships can’t use a few other long-term financing options. Unlike a limited business, the main difference is that they cannot offer shares or other instruments in exchange for investments.

Difficulty in Termination and Dissolution

In unfavourable circumstances, if you want to sell the company and one of the partners is uninterested, this may cause problems. By having an exit strategy in the partnership agreement, you may prepare for such a situation. For instance, you might insert “a right of first refusal” if your business partner sells their stake to a third party.

This guarantees you can accept the offer and stops a stranger from working for the company. An exit strategy can address many other concerns, including a partner’s bankruptcy, infirmity, or desire to leave the nation.

How to Form a Partnership

Choose a Business Structure

As mentioned, there are multiple types of partnerships to choose from. They include:

- Limited partnership

- General partnership

- Limited liability partnership

- Joint Venture

Each type of partnership has its pros and cons. Discuss the types of partnerships with your partner(s) to determine the best fit.

Select Business Partners

You must pick your partner(s) carefully while beginning a partnership. After all, you’ll be collaborating closely with them. When selecting your companion or partners, take your time. Look for a companion by considering factors like:

- Strengths and abilities

- Knowledge

- Credibility

You should choose a financially secure partner who shares your goals and can provide resources for the partnership (e.g., industry connections).

It will help if you wait before choosing a partner for your partnership firm. Consider the following: What do they bring to the table? Can we coexist? Do we hold similar values? The more time you spend thinking about these issues, the better.

Create a Partnership Agreement

It is optional to have a partnership agreement to form a partnership. But it’s crucial to keep misunderstandings between you and your partners to a minimum. Even sincere partners with the best intentions may find themselves in a legal dispute if they do not have a carefully designed partnership agreement.

The following is a summary of pointers that you need to include in your partnership agreement:

- The contribution of each partner to the partnership.

- The division of profits, losses, and draws.

- The partners’ authority and management responsibilities.

- The voting procedures for admitting new partners, bankruptcy, withdrawal from the partnership, or death, and resolving disagreements.

If events or conditions change, you can easily modify your agreement later.

Conclusion

The decision to form a partnership firm depends upon the nature and objective of the business. This blog has familiarized you with the partnership definition, advantages, and disadvantages. You have the partners to share business liabilities and offer support and resources. Partnerships can be helpful for organizations, but as everything has pros and cons, it also has some disadvantages. Hence, you must evaluate the potential risk before forming a Partnership firm.

Check this course to become Certified Business Law Analyst?

Read more:

Top FAQs on Partnership

What is a partnership in business?

A partnership is a legal form of business organization where two or more individuals or entities collaborate to manage and operate a business. Partners share profits, losses, and responsibilities.

What are the types of partnerships?

Common types include General Partnership (GP), Limited Partnership (LP), and Limited Liability Partnership (LLP). Each has different liability and management structures.

Is a partnership a separate legal entity?

In a general partnership, it's not a separate legal entity; partners have personal liability. In an LLP or LP, it can be a separate entity, limiting partner liability.

How is a partnership formed?

A partnership is formed when two or more individuals or entities agree to conduct business together, sharing profits, losses, and responsibilities. This often involves drafting a partnership agreement that outlines roles, contributions, profit distribution, and terms of the partnership. Registration with relevant authorities may also be required, depending on location.

What are the tax benefits of a partnership?

Partnerships are usually taxed as pass-through entities, meaning income is only taxed at the individual partners' level, avoiding double taxation. Partners report their share of profits or losses on personal tax returns, which can lead to lower overall tax obligations.

How is liability distributed in different partnerships?

In a General Partnership, all partners are fully liable. Limited Partnerships offer limited liability for some partners, while general partners have full liability. In an LLP, all partners have limited liability, and in a Joint Venture, liability is typically limited to the specific project.

Chanchal is a creative and enthusiastic content creator who enjoys writing research-driven, audience-specific and engaging content. Her curiosity for learning and exploring makes her a suitable writer for a variety ... Read Full Bio