Statutory Liquidity Ratio (SLR)

The Statutory Liquidity Ratio (SLR) is the percentage set by the RBI that suggests to banks how much of their total deposits should be kept as reserve. The RBI uses SLR to control the amount available for lending. It directly affects interest rates and the overall economy. The blog will discuss the Statutory Liquidity Ratio, how it is measured, its objectives, and its limitations.

- What is SLR?

- Components of SLR

- How to Calculate SLR?

- Objectives of Statutory Liquidity Ratio

- How Does Statutory Liquidity Ratio (SLR) Work?

- Real-world Example of SLR Adjustments in India

- Limitations of SLR

What is SLR?

The Statutory Liquidity Ratio (SLR) is the minimum percentage of deposits commercial banks in India must maintain in liquid assets such as cash, gold, and government securities. It is a tool used by the Reserve Bank of India (RBI) to regulate the money supply in the economy and to ensure that banks have enough liquid assets to meet their immediate obligations.

As of January 29, 2024, the current SLR in India is 18%. It suggests that for every ₹100 of deposits a bank holds, it must maintain at least ₹18 in the form of liquid assets.

Best-suited Capital Markets courses for you

Learn Capital Markets with these high-rated online courses

Components of SLR

- Cash: Cash is the immediate liquid funds for banks. It includes physical currency and funds deposited with the central bank (RBI in India). Cash provides quick access to funds in case of unexpected demands.

- Government Securities: These are bonds issued by the government. Government Securities are considered safe investments because they come with the government's guarantee and offer reasonable returns. Banks invest in government securities as part of their SLR requirements. These securities provide stability to banks' investment portfolios.

- Gold Reserves: Gold serves as a valuable asset for banks. It acts as a hedge against inflation and economic uncertainties. Gold's value tends to rise during economic downturns, providing banks with a valuable asset to rely on if needed. It adds diversity to banks' assets, reducing risk during financial turbulence.

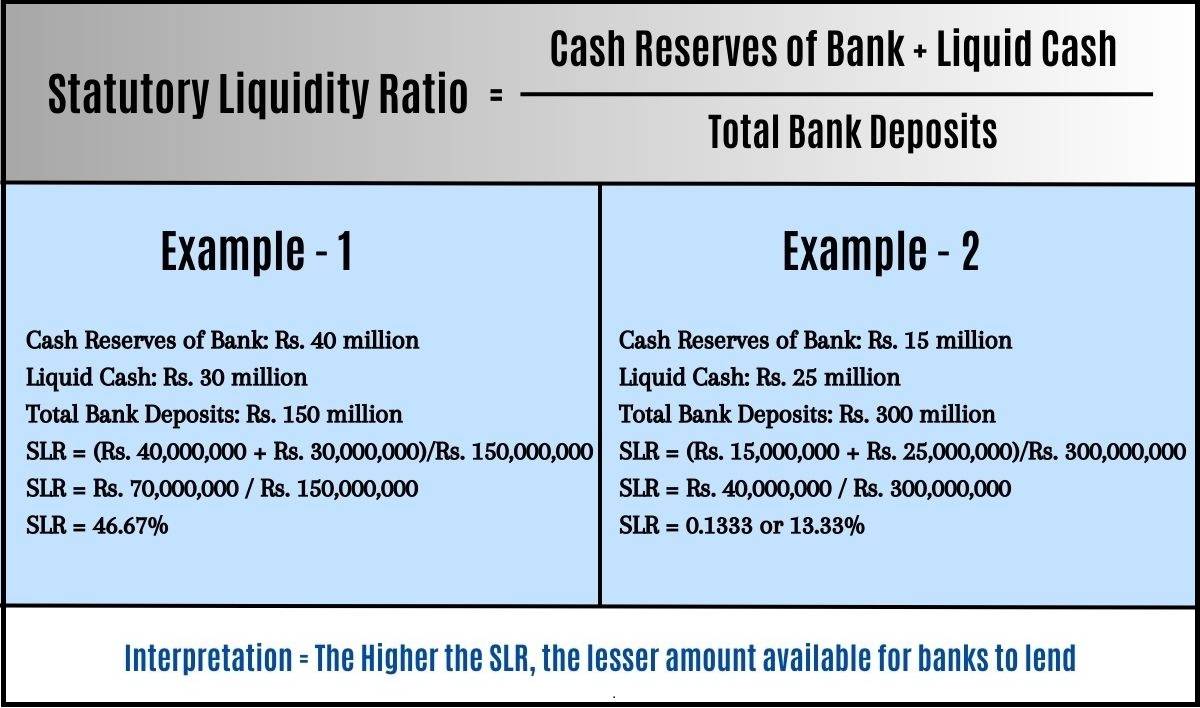

How to Calculate SLR?

Objectives of Statutory Liquidity Ratio

- Financial Stability: The primary objective of the Statutory Liquidity Ratio is to maintain banks' financial stability. The RBI mandates commercial banks to keep a portion of their assets in liquid form; SLR ensures that banks have sufficient funds to meet their customers' immediate cash needs.

- Maintaining Liquidity: SLR ensures banks have enough liquid assets to meet depositors' demands. This is crucial to avoid bank runs and maintain public confidence in the banking system.

- Monetary Control: The SLR is a tool for the central bank to control the money supply in the economy. When the central bank increases the SLR, banks must hold a higher percentage of their deposits as assets. By changing the SLR, the central bank can influence the amount of money available for lending in the economy.

- Promoting Investments in Government Securities: SLR encourages banks to invest in government-approved securities, which helps the government raise funds for various developmental activities.

- Credit Allocation: SLR also plays a role in influencing credit allocation by commercial banks. By specifying the type of assets that can be counted towards SLR, the central bank can direct banks to invest in specific sectors, such as government securities. It also guides the flow of credit towards productive sectors of the economy. A higher SLR may restrict lending to the private sector, while a lower SLR can free up funds for businesses and individuals.

- Promoting Government Securities: A primary objective of SLR is to promote the market for government securities. Banks often invest a significant portion of their SLR holdings in government bonds and securities. This way, governments can raise funds for various development projects and financial activities.

- Crisis Management: During financial crises or emergencies, SLR provides a safety shield for banks. They can quickly liquidate their SLR assets to generate funds, ensuring survival during turbulent economic times. This objective helps in maintaining the overall stability of the banking sector.

- Investor Protection: When banks are required to maintain a portion of their assets in liquid form, SLR serves as a tool to assure depositors that their money is safe and can be withdrawn when needed.

How Does Statutory Liquidity Ratio (SLR) Work?

- The RBI (central bank) establishes a regulatory requirement known as SLR for all commercial banks.

- Banks can maintain their SLR in various forms, including cash, gold, and specific government-approved securities, such as government bonds and treasury bills.

- The RBI specifies the percentage of their Net Demand and Time Liabilities (NDTL) that banks must set aside as SLR. This percentage can vary and is subject to adjustments made by the RBI.

- Banks allocate a portion of their funds as SLRs to ensure they have readily available liquid assets. These assets serve as a financial buffer, helping banks meet unforeseen liquidity demands and fulfil customer withdrawal requests.

- SLR plays a critical role in reinforcing banks' financial stability. It acts as a safeguard, ensuring that banks honour their financial commitments and maintain depositors' confidence.

- Banks must strike a careful balance between maintaining the required SLR and extending loans and investments to borrowers. This way, banks have sufficient liquidity while supporting economic activities through lending.

- The RBI actively monitors and enforces compliance with SLR regulations among banks.

Real-world Example of SLR Adjustments in India

Here is an example of when the adjustment of SLR in India led to some changes in market dynamics.

Reference: In 2022, inflation in India rose above the RBI's target range due to various factors like post-COVID supply chain disruptions, the Russia-Ukraine War, and extreme weather events impacting agricultural production. To address this, the RBI, among other measures, raised the SLR by 0.5% to 20.5% in August 2022. This move aimed to control inflation by tightening liquidity in the banking system and potentially discouraging spending.

Impact: The SLR hike reduced the amount of liquid assets available to banks, potentially leading to higher interest rates on loans. The SLR hike is a tool for the RBI to manage inflation by indirectly reducing economic demand through higher interest rates and reduced loan availability.

Repercussions:

- State Bank of India (SBI) reported a slight decrease in loan applications following the SLR hike, illustrating how the tightening of liquidity impacted lending activity.

- In 2022, following the SLR hike, some real estate developers in India reported a noticeable dip in inquiries and bookings for new homes, highlighting the potential dampening effect on the real estate market.

Limitations of SLR

- Reduces Lending Capacity: SLR limits the capacity of banks to lend money, thereby reducing their profitability.

- Distorts Asset Allocation: It can incentivise banks to prioritise government securities over potentially more productive loans or investments, hindering economic growth and diversification.

- Inefficient Tool: Some experts consider SLR less efficient than other monetary policy instruments like interest rate adjustments.

- Rigid Regulations: SLR regulations can be inflexible, limiting banks' ability to adapt to changing economic conditions.

- Complex Compliance: Meeting SLR's specific asset demands can be complex, requiring constant portfolio adjustments and dedicated resources for banks to ensure compliance.

- Impacts Profitability: Banks may experience reduced profitability due to the opportunity cost of holding assets in low-yield, liquid forms.

Explore these online degree programmes–

FAQs - SLR

How does SLR contribute to monetary control?

SLR influences monetary control by reducing the funds available for lending when increased, thus helping control inflation and monetary expansion.

Can the central bank change SLR?

Yes, the central bank can change the SLR percentage to control the money supply and influence the banking sector's behaviour.

What happens if a bank fails to maintain the required SLR?

Banks failing to maintain the required SLR may face penalties and restrictions on their banking activities, including paying penal interest on the deficit amount.

What are the eligible assets that banks can hold as part of SLR?

Eligible assets that banks can hold as part of SLR include government securities, cash, and gold reserves.

How often does the central bank review and change the SLR percentage?

The central bank periodically reviews and changes the SLR percentage based on economic conditions and policy objectives.

What is the purpose of SLR in the banking system?

The primary purpose of SLR is to ensure the liquidity and stability of banks, control the money supply, and influence credit allocation.

How does SLR affect interest rates for loans and deposits?

An increase in SLR can lead to higher interest rates on loans, as banks have less available for lending. Conversely, a decrease in SLR can lead to lower interest rates on loans and deposits.

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio