Types of Reserves: Meaning and Examples

Table of Content

What is Reserve?

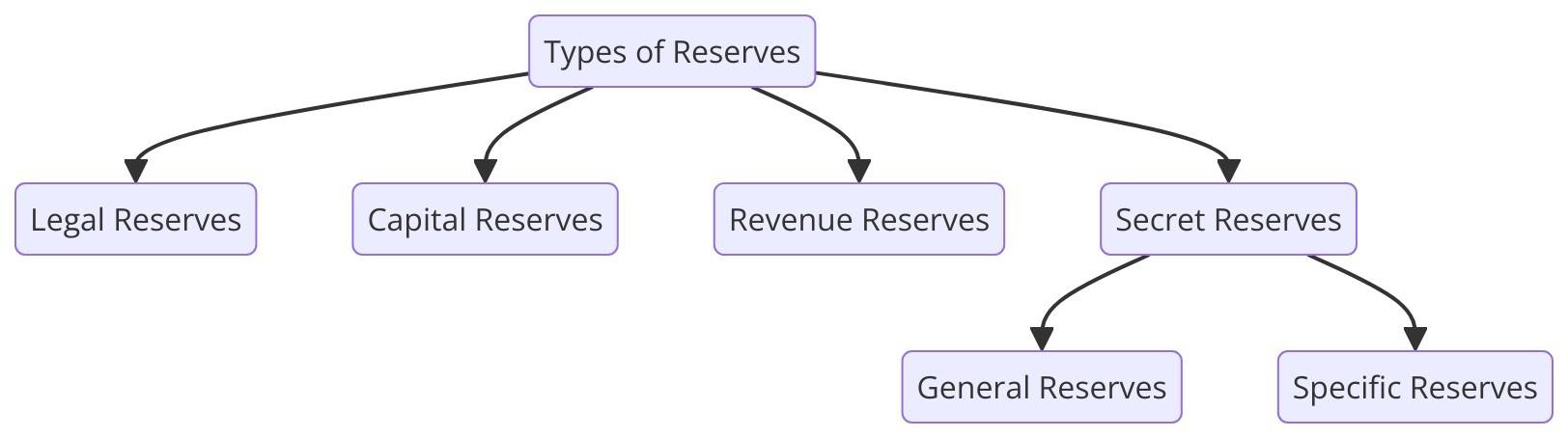

A reserve is a portion of earnings set aside by a company to strengthen its financial position, manage future liabilities, or cover unforeseen expenses. It acts as a financial safety net, ensuring stability and sustainability. Reserves can be classified into various types, including legal, revenue, capital, and secret reserves, each serving distinct purposes within an organization's financial strategy and planning process.

Best-suited Accounting and Control courses for you

Learn Accounting and Control with these high-rated online courses

Types of Reserve

1. Legal Reserve

A legal reserve is a mandatory savings account required by law for companies to protect shareholders and creditors by ensuring financial stability. A portion of the company's profits cannot be distributed as dividends and must be retained within the company. The size and requirements for legal reserves vary by jurisdiction, reflecting a measure of prudence and risk management mandated by regulatory authorities.

Example of Legal Reserve

In India, a company earns a net profit of ₹50 lakhs in a financial year. According to the Companies Act, it's mandated to transfer 5% of this profit, i.e., ₹2.5 lakhs, to its legal reserve fund. This action ensures compliance with Indian law, safeguarding the company's financial health and stakeholders' interests.

2. Capital Reserve

Capital Reserve is formed from capital profits not generated through regular business operations. It typically arises from non-operational activities like profits from the sale of fixed assets, revaluation of assets, or proceeds from issuing shares above their face value. Capital reserves are used for funding expansion, issuing bonus shares, or writing off capital expenses. Unlike revenue reserves, they are not derived from the company's earnings and generally cannot be distributed as dividends.

Example: A company sells a piece of land at a profit of ₹1 crore, significantly above its book value. This exceptional gain is allocated to a capital reserve, a non-recurring financial boost. This fund is used for purposes like writing off capital expenses or issuing bonus shares without affecting the regular profit and loss account.

3. Revenue Reserve

A revenue reserve represents the portion of earnings that a company retains from its operational profits after paying dividends. These reserves are used for reinvestment into the business, funding expansion projects, research and development, or cushioning against future financial downturns. Unlike capital reserves, revenue reserves are generated from the company's regular business activities, reflecting its ongoing financial health and operational success.

Example: An Indian IT firm reports an annual net profit of ₹10 crores. After distributing a 20% dividend, it allocates ₹2 crores into its revenue reserve. This strategic move enables the firm to finance future expansion plans, upgrade technology, and strengthen its market position without depending on external borrowing.

4. Secret Reserve

A secret reserve is a financial buffer deliberately not disclosed in a company's public financial statements, created by undervaluing assets or overvaluing liabilities. This conservative accounting practice, often used by banks and insurance companies, enhances financial stability and can help absorb future losses. However, it's controversial due to the lack of transparency it introduces into financial reporting.

Example: An Indian bank decides to report a loan portfolio at ₹90 crores, though its market value is ₹100 crores. The bank creates a secret reserve of ₹10 crores by undervaluing assets. This reserve can later cushion against loan defaults without revealing its financial strategy to competitors or affecting public confidence.

- General Reserve

A secret reserve is an unreported fund that a company maintains by deliberately understating assets or overstating liabilities in its financial statements. This practice, common in industries like banking and insurance, aims to create a financial cushion for future uncertainties or losses. While it strengthens internal financial resilience, it raises concerns over transparency and accuracy in financial reporting.

Example: An Indian manufacturing company earns a net profit of ₹5 crores in a fiscal year. It decides to allocate ₹1 crore to a general reserve, a decision aimed at strengthening its financial health. This reserve serves as a safeguard for future expansions or unforeseen financial needs without specifying a particular purpose.

- Specific Reserve

A specific reserve is allocated for a designated purpose, contrasting with general reserves that serve broader financial stabilization roles. This type of reserve is set aside to cover known liabilities, future investments, or specific projects, ensuring funds are available when needed. Examples include reserves for asset replacement, warranty claims, or debt repayment, reflecting a strategic approach to financial planning and risk management.

Example:

An Indian construction company, anticipating the need for new machinery in two years, allocates ₹50 lakhs from its annual profits to a specific reserve for equipment purchase. This strategic allocation ensures that the necessary funds are available for the upgrade, minimizing financial strain and avoiding the need for external financing.

Conclusion

Reserves are vital financial tools for companies, offering a buffer against future uncertainties and supporting growth initiatives. From legal and capital reserves, ensuring compliance and leveraging non-operational gains to revenue, secret, general, and specific reserves, each serves a unique purpose in strengthening financial health and strategic planning. Understanding these reserves is key to effective financial management and long-term stability.

Top FAQs on Types of Reserve

What is a Legal Reserve?

Legal reserves are mandated by law, intended to protect the company's financial stability and its stakeholders. They cannot be distributed as dividends.

How does a Capital Reserve differ from a Revenue Reserve?

Capital reserves are created from capital profits, such as selling assets, whereas revenue reserves come from operational profits and can be used for dividends, expansion, or as a safeguard.

What purpose does a Revenue Reserve serve?

Revenue reserves are earmarked for reinvestment into the company, funding expansion projects, or safeguarding against future downturns, enhancing the firm's sustainability.

Why would a company create a Secret Reserve?

Companies create secret reserves to strengthen their financial position discreetly, which can be useful for absorbing future losses or unexpected financial downturns without public knowledge.

Chanchal is a creative and enthusiastic content creator who enjoys writing research-driven, audience-specific and engaging content. Her curiosity for learning and exploring makes her a suitable writer for a variety ... Read Full Bio