Gross Profit Ratio Formula: Calculation and Example

Gross profit ratio or gross profit margin is a financial ratio that measures the performance as well as the efficiency of the business. This ratio is expressed in percentage by multiplying the result by 100. It is a profitability metric that reveals the efficiency of a company in managing its production costs in relation to its revenue.

The gross profit ratio is also known as the gross margin ratio and this financial ratio determines the performance and efficiency of the business.

Table of Contents

- What is a Gross Profit Ratio?

- Calculating GPR

- Importance

- High and Low Gross Profit Ratio

- Difference between Gross and Net Profit Ratio

- Limitations of Gross Profit Ratio

What is a Gross Profit Ratio?

Here, we will calculate the gross profit by subtracting COGS from revenue.

Divide gross profit by revenue. Then, multiply this by 100 to find out the gross profit ratio.

Here:

- Gross Profit is calculated as Revenue − Cost of Goods Sold (COGS).

- Revenue is the total income generated from the sale of goods or services.

- Cost of Goods Sold (COGS) is the total cost of producing the goods or services sold by the company.

Considering an Analogy

Imagine you are organizing a graduation party where you sell tickets to attendees to cover the costs of the event. The ticket price includes the costs for the venue, food, and entertainment, which are your direct costs or the Cost of Goods Sold (COGS).

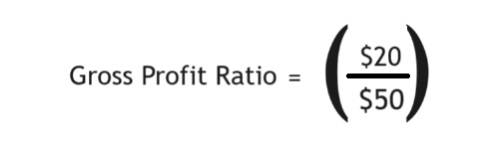

Let’s say you sell each ticket for $50, and the total cost to cover the venue, food, and entertainment per person is $30. The gross profit for each ticket would be:

Gross Profit = $50 − $30 = $20

- This means that for every dollar you earn from selling a ticket, you retain 40 cents as gross profit, which can then be used to cover other expenses like decorations or gifts for the graduates. In this analogy, organizing the graduation party is your business, the costs for the venue, food, and entertainment are the COGS, and the money you earn from selling each ticket is your revenue.

- The gross profit ratio helps you understand how much of your sales revenue is actual profit after considering the direct costs associated with organizing the event. It gives an insight into the core profitability of your graduation party business.

Best-suited Accounting and Control courses for you

Learn Accounting and Control with these high-rated online courses

Calculation Using Gross Profit Ratio Formula

A manufacturing company has reported the following financial data for the last fiscal quarter:

- Revenue (Sales): $500,000

- Cost of Goods Sold (COGS): $300,000

You are required to calculate the Gross Profit and its ratio for the company based on the data provided.

Step 1: Calculate Gross Profit

Using the formula:

Gross Profit = Revenue − COGS

Calculating the Gross Profit as follows:

Gross Profit = $500,000−$300,000 = $200,000

Step 2: Calculate Gross Profit Ratio

Next, we use the gross profit percentage formula:

- The company has a gross profit of $200,000 and a gross profit ratio of 40%.

- As per the gross profit formula, the company retains 40% of its revenue as gross profit, which can be utilized to cover operating expenses and other investments.

- It also signifies that the company earns a gross profit of 40 cents for every dollar of sales generated.

Related Read – Solvency Ratio: Formula, Interpretation, Examples, Tips to Improve it

Importance of GPR

The following points highlight the importance of the Gross Ratio:

- Profitability Analysis: It helps in assessing the profitability of a company. A higher gross ratio indicates that the company can generate a substantial profit from its sales, which is a positive sign of financial health.

- Cost Management: The ratio aids in evaluating the efficiency of cost management within the company. It can help identify if the cost of goods sold is increasing disproportionately compared to sales, which might necessitate cost-cutting measures.

- Pricing Strategy: It assists in formulating and adjusting pricing strategies. By analyzing the profit ratio, companies can determine whether they can increase prices without losing customers or if they need to reduce prices to increase sales volume.

- Investment Analysis: Investors and analysts often use the gross ratio to evaluate the potential profitability and risk of investing in a company. A stable or increasing gross ratio over time can be a positive indicator for potential investors.

- Benchmarking: The ratio is a benchmarking tool, allowing companies to compare their performance against industry peers and identify areas where they can improve. It helps in understanding the competitive position of the company in the market.

- Budgeting and Forecasting: It is a useful metric in budgeting and forecasting processes. Companies can use historical gross profit ratios to set targets and make projections for future financial performance.

- Resource Allocation: The gross ratio can guide decisions regarding resource allocation. Companies with higher gross profit ratios might have more resources to invest in growth opportunities, research and development, marketing, and other business expansion activities.

- Financial Planning: By monitoring the gross ratio, companies can make informed decisions about scaling production, entering new financial markets, or launching new products.

- Credit Analysis: Creditors and lenders may use the gross ratio to assess the creditworthiness of a business. A higher ratio might indicate a lower risk of default, as the company has a higher margin to cover its debts.

- Operational Efficiency: It helps in evaluating the operational efficiency of a business. A consistent gross ratio might indicate that the company is efficiently managing its production processes and controlling costs effectively.

Explore investing course

High and Low Gross Profit Ratio

A higher or lower profit ratio can indicate a company’s financial health and operational efficiency. Here’s what each indicates:

Higher Gross Profit Ratio

A high gross ratio can be indicative of:

- Better Profitability: A higher ratio indicates that the company can retain a larger portion of its revenue as profit, suggesting better profitability.

- Efficient Cost Management: It may signify that the company is managing its production or service costs efficiently, thereby retaining a larger margin.

- Pricing Strategy: It might indicate a successful pricing strategy where the company can charge higher prices for products and services without a corresponding increase in the cost of goods sold.

- Competitive Advantage: A higher ratio could also indicate a competitive advantage, where the company has unique products or services to maintain higher margins than competitors.

- Room for Investment: Companies with higher gross profit ratios might have more resources to invest in research and development, marketing, and other business expansion activities.

Lower Gross Profit Ratio

A low gross profit ratio can be indicative of:

- Lower Profitability: A lower profit ratio indicates that a smaller portion of revenue is retained as profit, suggesting lower profitability.

- Increased Production Costs: It could signify increased production or service delivery costs, which are eating into the revenues.

- Pricing Pressure: A lower ratio might indicate that the company faces pricing pressure from competitors, forcing it to reduce prices and consequently lower its margins.

- Market Strategy: Sometimes, a company might intentionally accept a lower profit ratio as a market strategy to increase market share by offering lower prices to customers.

- Potential Financial Distress: Persistently low gross profit ratios over time might indicate potential financial distress, as the company might not have enough margin to cover its operating expenses.

- Limited Resources for Expansion: Companies with lower gross profit ratios might have limited resources to invest in business expansion or other growth opportunities.

Difference between Gross and Net Profit Ratio formula

The following table discusses the difference between the gross and net profit ratio formulas:

| Aspect | Gross Profit Ratio | Net Profit Ratio |

|---|---|---|

| Definition | (Gross Profit / Revenue) x 100% | (Net Profit / Revenue) x 100% |

| Components | Revenue and Cost of Goods Sold (COGS) | Revenue, COGS, Operating Expenses, Taxes, etc. |

| Indicates | Profitability after accounting for COGS | Profitability after accounting for all expenses including operational costs and taxes |

| Usage | Used to analyze the core profitability of selling goods/services | Used to analyze the overall profitability of the business |

| Interpretation | A higher ratio indicates efficient production and pricing strategies | A higher ratio indicates efficient management of both production costs and operating expenses |

| Industry Comparison | Useful for comparing companies in the same industry to assess production efficiency | Useful for comparing the overall profitability of companies across different industries |

Limitations of Gross Profit Ratio

While the gross profit formula (Revenue - Cost of Goods Sold) is a useful tool for assessing a company's profitability from production, it has several limitations:

- Excludes Operating Expenses: Gross profit only considers the direct costs related to goods or services production. It doesn't factor in operating expenses like marketing, rent, salaries, utilities, and administrative costs. Therefore, it provides an incomplete picture of the overall profitability.

- Variability Across Industries: What is considered a healthy gross profit margin can vary significantly between industries. Comparing gross profit margins between companies in different sectors can be misleading due to differences in cost structures.

- Doesn't Reflect Long-Term Viability: Gross profit doesn't provide a complete view of a company's long-term financial health. To assess sustainability, you need to consider net profit, which accounts for all expenses, including taxes, interest, and operating costs.

- Ignores External Factors: Gross profit can be influenced by external factors including economic conditions, industry trends, and changes in supplier pricing. These factors can make it difficult to isolate internal performance issues based solely on gross profit.

- Doesn't Account for Non-Cash Items: The gross profit formula doesn't factor in non-cash items like depreciation and amortization, which can affect a company's overall financial health.

The Gross Profit ratio is a key indicator of the financial health of the company and its ability to generate profits from its operations, providing a foundation for further analysis of overall profitability and financial performance. This ratio measures the proportion of revenue remaining after the deduction of the direct costs associated with producing goods or services sold. By calculating this ratio, businesses and investors can gain valuable insights into a company's core profitability, its pricing strategies, and its ability to control production costs.

FAQs

Is a high gross profit ratio good?

Yes, a high gross profit ratio is good for most businesses.

Why does gross profit ratio increase?

The gross profit ratio can increase for several reasons, all of which are indicative of positive developments in a business. This includes improved cost control, effective pricing strategies, lower production cost and effective inventory management.

Explain what factors affect gross profit margin.

Factors that affect gross profit margin include the cost of goods sold (COGS), pricing strategies, production efficiency, economies of scale, and the product/service mix. These factors collectively influence a business's ability to generate profits from its core operations.

How can you increase gross profit ratio?

To increase the gross profit ratio, a business can reduce production costs through efficient operations and supplier negotiations, adjust pricing strategies to maximize margins, and strategically promote higher-margin products or services. These actions collectively enhance profitability from core business activities.

Can the gross profit ratio be negative?

Yes, when the cost of goods sold exceeds the total revenue it results in a gross loss.

How often should the gross profit ratio be calculated?

Gross Profit Ratio is calculated quarterly or annually, but more frequent calculations can provide better insights into business performance.

What factors can affect the gross profit ratio?

Factors that affect gross include pricing strategy, production costs, sales volume, and market competition.

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio