Understanding Inventory Turnover Ratio

The inventory turnover ratio is a cornerstone in financial analysis, that helps in assessing a company’s operational efficiency. At its core, this ratio quantifies how effectively a firm manages its stock in relation to the sales it generates.

Before discussing inventory turnover ratio, let us discuss what exactly is inventory turnover.

What is Inventory Turnover?

Inventory turnover refers to how efficiently a company manages its stock of goods. It measures how many times does a company sell and replace its inventory during a year. It is a crucial metric in financial analysis that assess a company's operational efficiency and profitability.

Imagine your company is a lemonade stand. You buy a certain amount of lemons, sugar, and water (your inventory). Throughout the day, you sell lemonade which indicates the turnover of inventory. The more lemonade you sell (which means that turnover is higher), the more efficient you are at managing your inventory.

When we discuss inventory levels in sync with market demand, we are discussing the company’s ability to ensure that it neither overstocks, which can tie up capital and increase holding costs, nor understocks, which can lead to potential lost sales and customer dissatisfaction.

Best-suited Financial Planning & Analysis courses for you

Learn Financial Planning & Analysis with these high-rated online courses

What is Inventory Turnover Ratio?

The Inventory Turnover Ratio is a key financial metric used by businesses to gauge the efficiency of their inventory management. Essentially, it measures the number of times a company’s inventory is sold as well as replaced over a specific period, typically a year.

Let us learn about this financial ratio in depth with the help of the following videos:

What does this ratio tell us?

- If you’re eating and refilling your chocolate bars every day, it means you really love them and always want them on hand. This is like a shop that sells its products quickly and always restocks – it has a high inventory turnover ratio.

- But, if by the end of the week, you still have many chocolate bars left, it means you didn’t eat (or sell) them as fast. Maybe you bought too many, or you’re not as fond of them anymore. This is like a shop that doesn’t sell its products quickly – it has a low inventory turnover ratio.

In Simpler words, this ratio is like seeing how often you eat and refill your chocolate bars. If you are always finishing and refilling, you are managing your snacks well. But if you have too many left over, maybe you need to think about how many you buy or if you still like them as much.

Significance of Inventory Turnover Ratio

- Inventory Management Mastery: The Inventory Turnover Ratio acts as a direct reflection of how well a company manages its inventory. A high ratio indicates that the company is selling its inventory quickly and replenishing it efficiently. This suggests that the company has a good grasp on predicting demand and is neither understocking (leading to stockouts) nor overstocking (leading to excess inventory). Efficient inventory management is crucial as it ensures that capital isn’t tied up unnecessarily and reduces storage costs.

- Cash Flow Rhythms: The speed at which inventory is sold and turned into sales directly impacts cash inflows. A rapid inventory turnover means that the company is quickly converting its inventory into sales, leading to faster cash inflows. This enhances the company’s liquidity position and ensures smoother cash flow management, which is vital for meeting operational expenses, investing in growth opportunities, and returning value to shareholders.

- Operational Excellence Indicator: The ratio provides insights into the company’s operational efficiency and its responsiveness to market dynamics. A company that consistently maintains a high Inventory Turnover Ratio demonstrates its ability to adapt to market shifts and consumer demands. It indicates that the company’s operations, from procurement to sales, are streamlined and efficient.

- Spotting Potential Issues: A consistently low or decreasing Inventory Turnover Ratio can highlight potential challenges in inventory management. If the ratio is dwindling, it may signal that the inventory is not moving as quickly as it should. This could be due to stagnant or outdated inventory, indicating that the products are no longer in demand or have become obsolete. Recognizing this early allows companies to make strategic adjustments, such as diversifying product offerings, adjusting pricing strategies, or revamping marketing efforts.

- Industry Benchmarking: Comparing a company’s Inventory Turnover Ratio with industry benchmarks provides a relative performance assessment. By benchmarking against industry standards, companies can gauge their competitive positioning. If their ratio is significantly higher or lower than the industry average, it prompts further investigation. It allows companies to identify areas of strength and potential areas for improvement in comparison to their peers.

Calculating Inventory Turnover Ratio

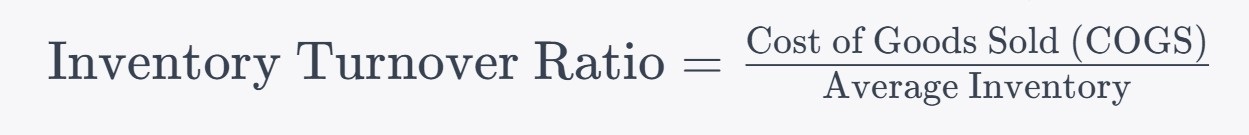

The following formula is used while calculating inventory turnover ratio:

Components of the Formula

1. Cost of Goods Sold (COGS)

- COGS represents the direct costs associated with producing goods that a company has sold during a particular period. This includes costs like raw materials, direct labor, and manufacturing expenses, but excludes indirect expenses like distribution costs and sales force costs.

- Importance: COGS gives an accurate picture of how much the company spends to produce the goods that have been sold, which is crucial for determining the efficiency of production and sales processes.

2. Average Inventory

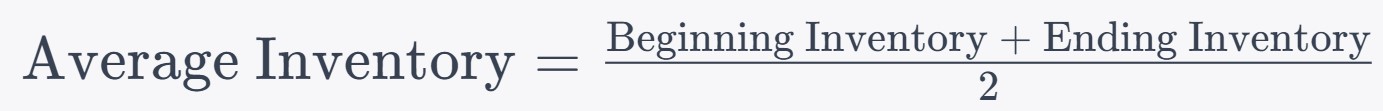

- This is the mean value of inventory held by a company over a specific period. It’s calculated by adding the beginning inventory and the ending inventory for a period and then dividing by two.

- Importance: Using the average inventory accounts for fluctuations in inventory levels throughout the period, providing a more balanced view of inventory management.

Example

Let us consider an example to calculate Inventory turnover ratio:

Example:

A company has a COGS of $100,000 and an average inventory of $50,000.

By applying the formula, we know that:

Inventory Turnover Ratio = $100,000 / $50,000 = 2.0

This means that the company sells and replaces its inventory twice a year.

Interpreting the Ratio

- Higher Inventory Turnover Ratio indicates the efficiency of a company in managing its inventory, selling and replacing it frequently. This is generally seen as a positive sign, suggesting that the company’s products are in demand and that it’s not tying up too much capital in unsold goods.

- Lower Inventory Turnover Ratio suggests that the company’s inventory is selling more slowly. This could be due to overstocking, decreased demand for the products, or inefficiencies in the sales or production processes. A consistently low ratio can be a red flag, indicating potential problems in inventory management or product demand.

Explaining the Inventory Turnover Ratio

The Inventory Turnover Ratio provides insights into the efficiency of a company’s inventory management. Specifically, it explains:

- Inventory Management Efficiency: The ratio indicates how effectively a company manages its inventory. A higher ratio suggests that inventory is being sold and replaced frequently, pointing to efficient inventory management. Conversely, a lower ratio may indicate that products are sitting in inventory for extended periods, which could be a sign of overstocking or decreased demand.

- Liquidity and Cash Flow: A higher turnover ratio can imply faster cash inflows, as products are sold quickly. This can enhance a company’s liquidity position and facilitate smoother cash flow management.

- Operational Efficiency: The ratio serves as a barometer for a company’s operational prowess. A consistently high ratio indicates that the company is adept at aligning its production and procurement processes with market demand.

- Product Demand: A high turnover ratio can suggest that the company’s products are in high demand and are being sold quickly. In contrast, a low ratio might indicate declining product popularity or market saturation.

- Potential Overstock or Stockouts: While a high ratio is generally seen as positive, an excessively high ratio might indicate that the company is at risk of stockouts. On the other hand, a very low ratio can signal overstocking, leading to increased holding costs and potential obsolescence.

- Market Dynamics Adaptability: The ratio can shed light on how well a company adapts to market changes. Companies that can adjust their inventory levels in response to market shifts will typically have a more favorable turnover ratio.

- Financial Health Indicator: A persistently low turnover ratio can be a red flag for investors, as it might indicate slow-moving inventory, which ties up capital and can lead to decreased profitability.

Explore corporate finance courses

FAQs

What is a Good Inventory Turnover Ratio?

The definition of good inventory turnover ratio varies by industry. For example, wholesale trade-durable goods may have an average annual ratio of 21, whereas bars and restaurants might have a ratio as low as 3. It is crucial to compare within the same industry.

How to optimize inventory turnover ratio?

Optimization strategies include adjusting ordering cycles to match demand, using software for data analysis, bundling products, and adapting marketing and promotion strategies.

How to improve inventory turnover?

Improvements can be made through better demand forecasting, identifying and addressing supply chain issues, increasing customer demand, optimizing the supply chain, and product bundling.

How do companies use inventory turnover ratio in business?

Companies use ITR for demand forecasting, identifying supply chain issues, and improving inventory management. For example, by understanding historical sales data, a business can better prepare for future sales and manage inventory accordingly.

Jaya is a writer with an experience of over 5 years in content creation and marketing. Her writing style is versatile since she likes to write as per the requirement of the domain. She has worked on Technology, Fina... Read Full Bio