Form 16 Meaning: Your Tax Certificate Explained

Form 16 is a certificate issued by the employer to the employee certifying the amount of tax deducted at source (TDS) on the employee’s salary during the financial year. It is a mandatory document that employees need to file their income tax returns. According to the Income Tax Act, 1961, employers in India must deposit TDS with the government. Form 16 will help you, as a taxpayer/employee, understand and verify if the TDS was deposited with the government. Learn about the meaning of Form 16 and why it is crucial for filing your tax returns.

Table of Content

- Form 16 Meaning

- Components of Form 16

- Form 16 Eligibility

- Benefits of Form 16

- How to Get Form 16?

- FAQs on Form 16

What is Form 16?

Form 16 Meaning: Form 16 is the certificate of Tax Deducted at Source (TDS). These certificates provide details of TDS/TCS for various transactions between the deductor and deductee. The employers issue Form 16 annually at the end of the financial year.

Best-suited Tax Law courses for you

Learn Tax Law with these high-rated online courses

Components of Form 16

Form 16 comprises of two parts:

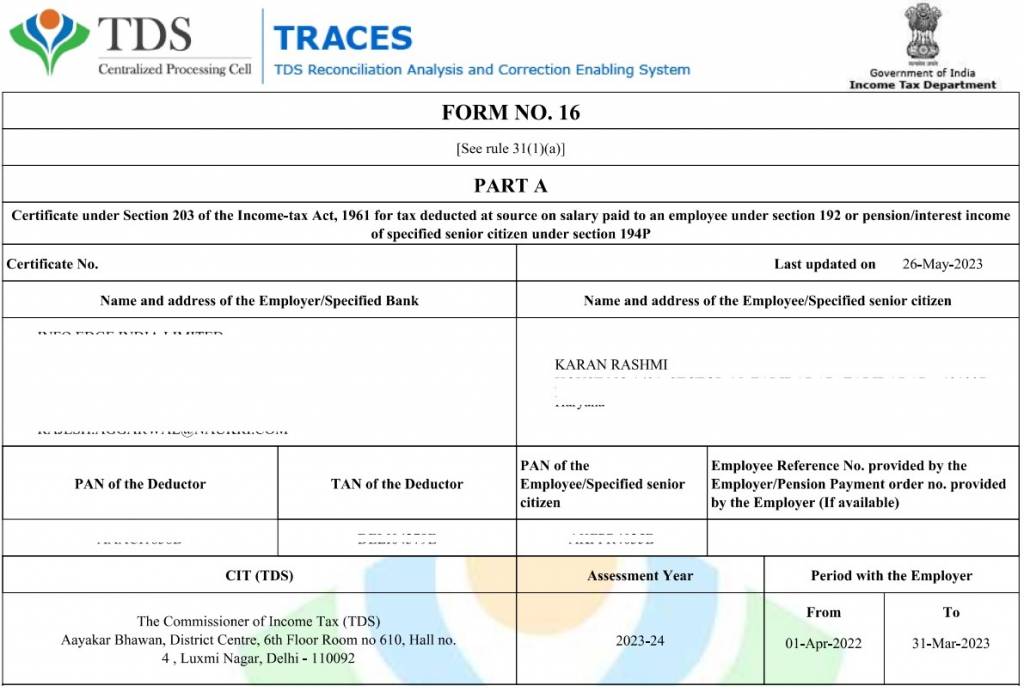

Part A

Part A of Form 16 is helpful for taxpayers to get a quick overview of their income and tax deductions. It contains the following information:

- PAN of the employer and the employee.

- Name and address of the employer.

- The financial year for which the employer issues the TDS certificate.

- Total salary paid to the employee.

- The amount of TDS deducted from the employee’s salary.

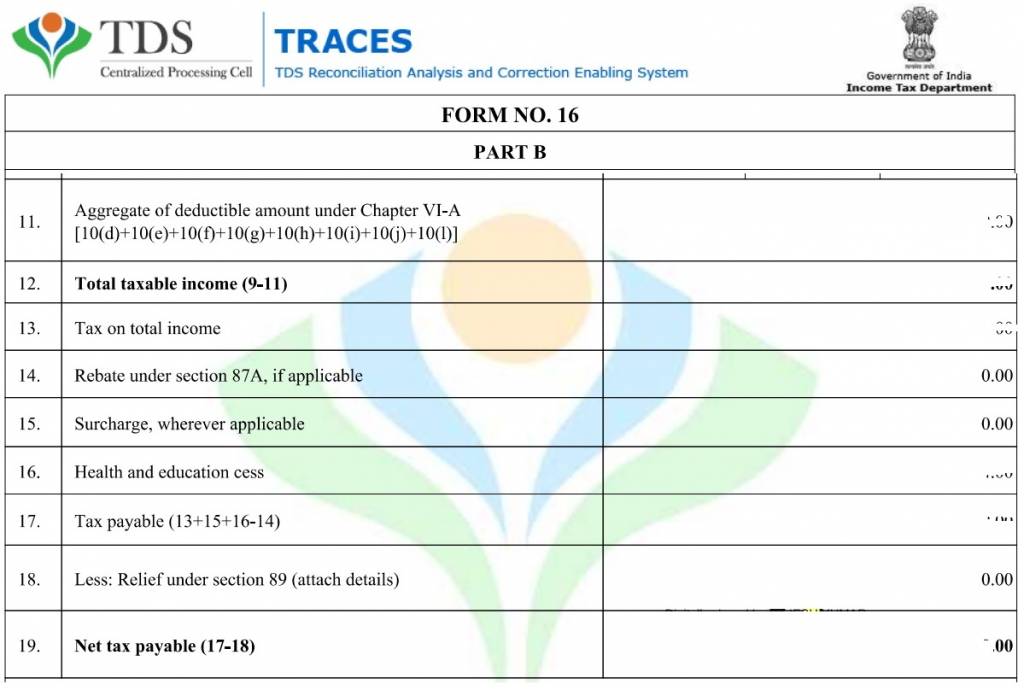

Part B

Part B of Form 16 contains helpful information for taxpayers to understand salary deductions and claim any tax deductions they may be eligible for. Here is what the Part B includes –

- A detailed breakdown of the employee’s salary, including basic salary, house rent allowance (HRA), leave travel allowance (LTA), medical allowance, etc.

- TDS on each salary component.

- Tax payable

- Net tax payable

Must Read – TDS Returns – Eligibility, Filing Dates, Process, Form Details

Form 16 Eligibility

- Any salaried person (both government and private employees) whose tax has been deducted at source (TDS) by the employer can get Form 16.

- Even if your income falls below the taxable slab, your employer must issue you Form 16 if TDS has been deducted from your salary.

You are eligible to get Form 16 by June 15 of the following financial year.

Here are some situations in which an employer may not issue Form 16 to an employee:

- The employee is not salaried but a freelancer or contractor.

- The employee’s income falls below the taxable slab, and there is no deduction of TDS.

- The employee has not submitted their PAN number to the employer.

- The employee has left the job before the end of the financial year, and the employer cannot contact them.

Benefits of Form 16

Now that you know the Form 16 Meaning, you must wonder why Form 16 is important.

In India, Form 16 is an essential document for salaried employees for the following reasons:

- ITR Filing: Form 16 is the mandatory document for filing ITR. It provides all the necessary information about the employee’s income and tax deductions to calculate the tax liability and enable the taxpayer to file the returns accurately.

- Claiming Tax Refunds: If a taxpayer has paid more tax than what is due, s/he can claim a refund of the excess tax paid. You would need Form 16 while claiming tax refunds.

- Loan Applications: Banks and other financial institutions require Form 16 as proof of income when processing loan applications. Form 16 helps the lender assess the borrower’s creditworthiness and determine the loan amount and terms.

- Visa Processing: If you are applying for a visa to travel abroad, then Form 16 would serve as proof of income when processing visa applications. It helps embassies or consulates to assess the applicant’s financial stability and determine whether you should be granted a visa.

- Opening Bank Accounts: Some banks ask applicants to submit Form 16 to assess their financial stability and determine the account type and benefits.

How to Get Form 16?

An employee cannot download it directly from the Income Tax Department website. Only your employer can download and issue the Form 16.

There might be some misconception about downloading Form 16, but you must know you cannot!

Employers generate and issue Form 16. If you have not received your Form 16, you can follow the below steps to obtain Form 16:

- Contact Your Employer: Your employer will generate and issue your Form 16, usually by the end of May or early June of the given Financial year. Contact your employer/HR/finance division to request a copy of Form 16.

- Verify the Details: Once you receive Form 16 from your employer, carefully review all the details provided in Part A and Part B. Ensure that your personal information, PAN, and other financial details are accurate.

- Save the Form 16: Many employers now issue digitally signed Form 16s, which are valid as per the Income Tax Department. You may receive the form as a PDF file via email or through an online portal provided by your employer. Make sure to download and save the digital Form 16 securely.

If you notice any discrepancies or errors in Form 16, such as incorrect salary figures or missing deductions, contact your employer immediately to rectify the issues.

FAQs on Form 16

When should I receive Form 16 from my employer?

Employers must issue Form 16 to their employees by June 15 of the following financial year.

What should I do if I don’t receive Form 16 from my employer?

If you have not received Form 16 from your employer by June 15, you can contact them and request a copy. If you cannot get Form 16 from your employer, contact the Income Tax Department for assistance.

Can I file my income tax return without Form 16?

Yes, you can file your income tax return without Form 16. However, you must manually provide all the necessary information about your income and tax deductions. This can be a time-consuming and error-prone process. It is advisable to file your income tax return with Form 16.

Under which section is TDS deducted from income?

TDS is deducted from different types of income under various sections of the Income Tax Act, 1961.

TDS on salary income: TDS on salary income is deducted under Section 192 of the Income Tax Act, 1961. The employer is responsible for deducting TDS from the employee’s salary and depositing it with the government.

TDS on income from rent/commission: TDS on income from rent/commission is deducted under Section 194 of the Income Tax Act, 1961. The person paying the rent or commission is responsible for deducting TDS and depositing it with the government.

Is it necessary to take Form-16 from a previous employer when job switching?

Yes, it is necessary to take Form-16 from a previous employer when job switching. This is because you must include the income details from each job in your income tax return.

Rashmi is a postgraduate in Biotechnology with a flair for research-oriented work and has an experience of over 13 years in content creation and social media handling. She has a diversified writing portfolio and aim... Read Full Bio