What is Recession in Economy and Why is it Inevitable?

Recession is a downward slope in the growth curve of any economy. It is a period when unemployment increases that directly hits the economy of any country.

Author: Bharath R V

Table of Contents

- What is Recession in Economy?

- History of Economic Growth

- Global Events and Cause of Worry

- Indian Economy

- Indian Recession

- Decoupled Behaviour

- Is India in recession?

What is Recession in economy?

Economists define Recession as a period of decline in the growth of the economy. According to RBI, “A recession is a period of prolonged decline in output experienced across much of the economy”. A recession is said to be in progress when total output, in this case, real quarterly GDP, has declined for at least two consecutive quarters.

Are we in a recession? Let me answer this question for you. As of August 2022 world economy is in a recession. There is no reason to run away from this technical fact. Before that, we need to understand a few other factors in the current market economy of the world and India. This will help us understand our economy and plan for the future efficiently.

Also, we need to answer a few questions before we deep dive into the topic. Is this recession good or bad? Should we look at recession on a global point of view or Indian economy point of view? Is India not affected by the global economic shocks? What are the effects of the recession? and more factors.

History of Economic Growth

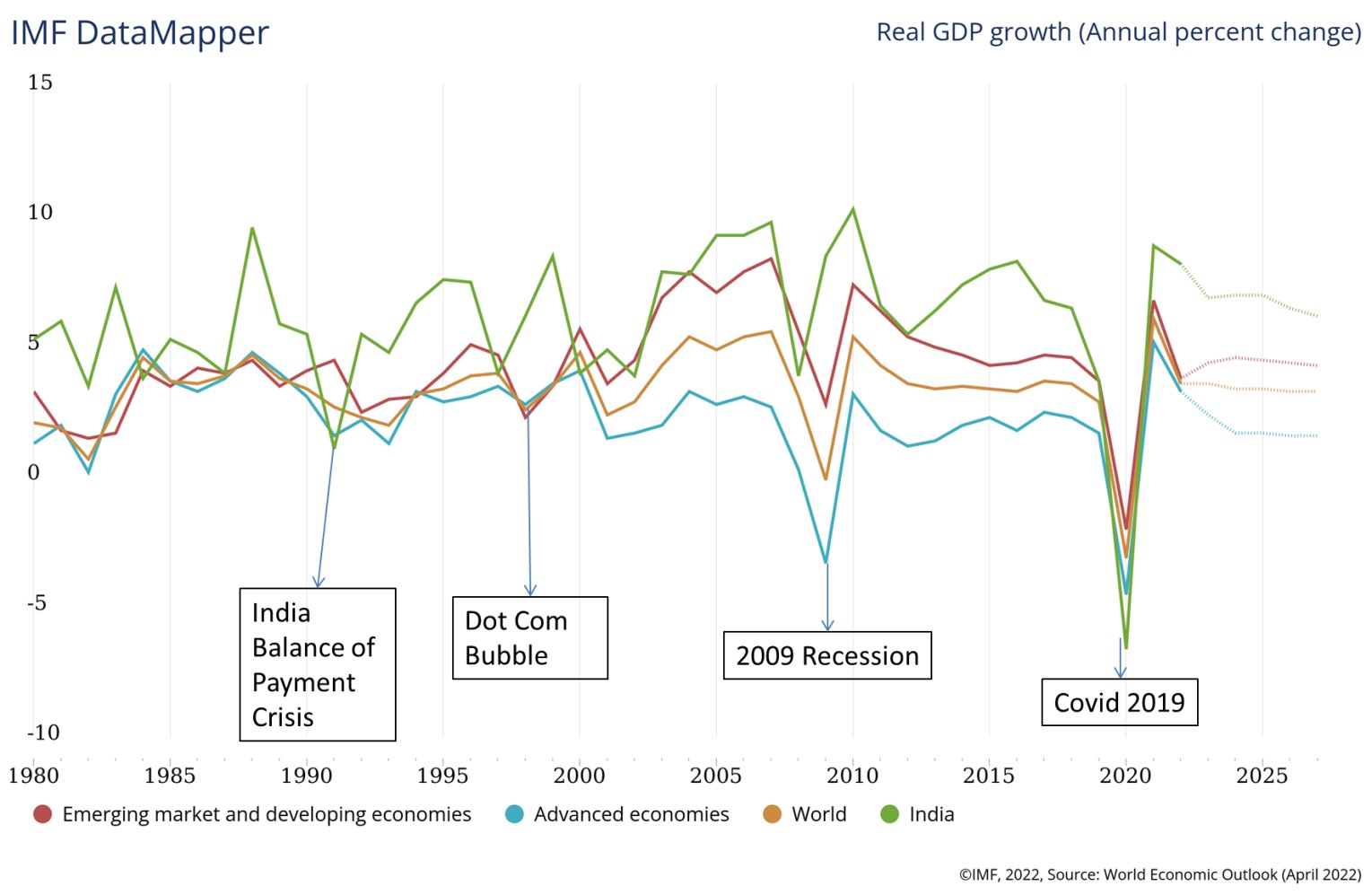

Let us take a look at the GDP growth from 1980 – 2022 in the Figure 1. As of 2022, the world economy is experiencing a contraction. The economy has recently faced an onslaught of COVID-induced economic contraction and now it is feeling the heat of the sudden recovery.

Historically, the global economic shocks are felt in India, but sometimes the Indian economy has behaved as an anomaly to global behaviour during the time of the global economic downturn as seen dot com bubble, and the 2009 recession. However this recession, we are seeing the Indian economy following the global trend, but there are certain factors we need to consider.

Figure 1: Real GDP growth rate [Source – World Economic Outlook 2022- April]

Best-suited Law courses for you

Learn Law with these high-rated online courses

Global Events and Causes of Worry

We have just now come out of the COVID 2019 pandemic and all the economies are recovering in the world has seen some majority events showing a distress signal

- Russia Ukraine War.

- Sri Lankan Default of payments.

- Pakistan and Bangladesh – Verge of Default.

- China – Taiwan relations.

- Oil Price Increase due to OPEC decision.

These are some of the events which have directly affected India and the world.

Coming to India’s context, as India’s neighboring countries are facing a lot of distress due to China’s BRI schemes, it will fall upon India’s Political strategy to help them.

India may not have an unemployment ratio increase for a while but these effects will have a spillover effect on the Sub-continent and eventually, India will feel the heat.

1. Unemployment

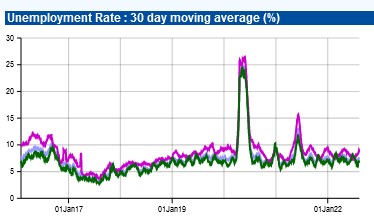

As a direct consequence of COVID 2019, we are seeing a sudden increase in unemployment in 2020, but this has reduced to a nominal level of below 10% after that, but we are seeing signs of an increasing trend, which is the cause of worry.

Figure 2: CMIE data for Unemployment in India, Rural [Green], Urban [Blue] and Overall [Pink]

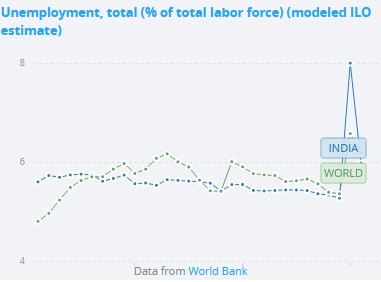

Figure 3: Unemployment data of the world and India from World Bank Database till 2021

There is a widespread case of unemployment in the global economy, but the same is not seen in India. The news of many CEOs in the US and Europe firing employees is all over the internet. Some sectors of India are also seeing major restructuring happening, but these may be due to market corrections happening after the demand surge after COVID 2019.

But we are yet to see the demand contraction in India which may trigger a bigger round of unemployment. Hopefully, India doesn’t see this one, as we already experienced the demand stabilization in 2021-2022, which is encouraging.

Explore finance courses

2. Inflation

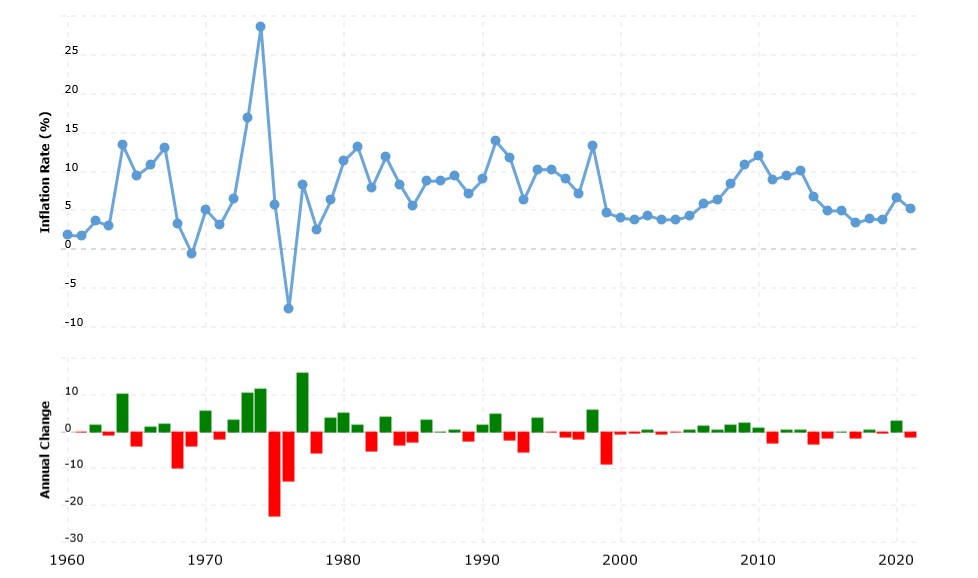

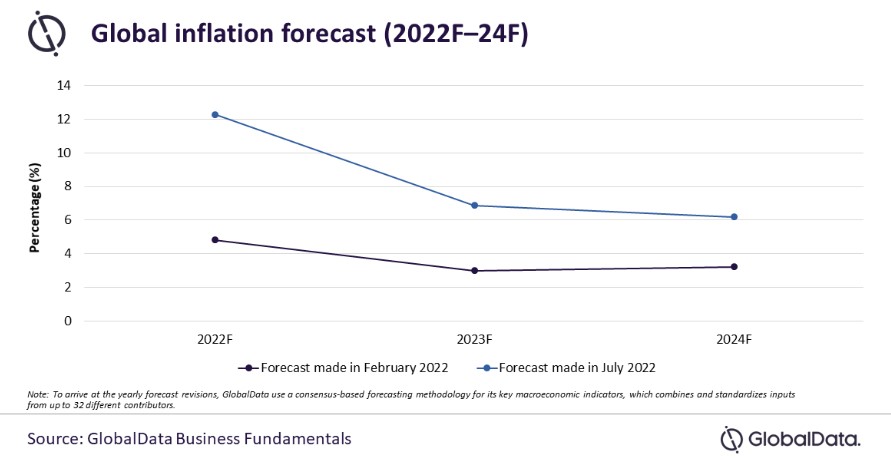

Inflation is another macroeconomic factor that will indicate the state of the economy. We are seeing higher inflation across the world as a direct consequence of the financial stimuli provided by various nations due to COVID 2019.

This high inflation will haunt the nations for all the year 2022, but central banks all the countries are increasing the interest rates to pull out the money from the market and control the inflation.

The elastic relation between inflation and unemployment will come into the picture after this and unemployment may continue to grow. This may intern worsen into recession as GDP contraction may persist.

This is a worrying factor. If the central banks want to contain inflation, they will have to face the brunt of unemployment and the consequence of the recession.

Figure 4: Inflation rate in India

Figure 5: Global Inflation forecast [source – Global data website]

So these two factors combine and tend to keep the central banks busy throughout the year and they will have to find a way to fight his calamity in a new way.

Indian Economy

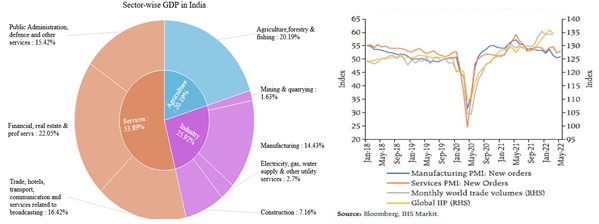

The Indian economy has various constituents contributing to it. The service sector is dominating the Indian economic growth.

Figure 6: Constituents of Indian Economy and Growth Rate [Source –RBI report – Nowcasting Global Growth [Jun, 2022], Ministry of Statistics and Programme Implementation, July 2021]

As major economies of the world are facing the contraction, but the demand as not bottomed so the majority of the work will be outsourced, which India can gain. As seen from the Index growth of the manufacturing and services in India are decreased compared the monthly world trade volume. This indicates India is not filling the trade gap the world is facing now as seen from the index growth.

India Recession –Job loss – Covid Cycle

The recession does not necessarily seem jobless as far as India is concerned. But the characteristic of the Indian job market are;

- Low cost

- Skilled- Semi Skilled Labour

- Export supportive environment

- Large Market

These characteristics will place India in a unique position to safeguard its economic prowess and also expand when other countries seen reduced growth.

Recent actions taken by RBI to increase the repo rate and control the NPA’s may bring some cheer as these measures were definitely needed and this will help contain the inflation and we pass over the global recession without much burn, but we will be ready to face the heat when effects of the recession appear in the Indian market.

Decoupled Behaviours

As pointed in the earlier section, India may not be part of the effects of the global recession as India as suffered its due in COVID 2019 [2020-2021]. The Indian market is seeing a certain downtrend to global factors but this may be considered as market corrections after the COVID 2019 effect. The demand for fuel and electricity is still higher and the cost of the procurement of crude oil is decreased due Russia-Ukraine war. This will enable India to build the momentum required to face the after-effects of the recession.

The strong monsoon of 2022, good manufacturing output, and growth in service exports will be factors to look for in the current scenario. This will help to sustain the growth, control inflation, maintain unemployment and have a war chest to face recession.

Is India in Recession?

As of the 1st Quarter of 2022-2023, India is in recession in technical terms. Are we seeing the effects of the recession? No. inflation is the effect of the global oil prices and demand and restructuring of the companies is due to some corrections in the market. Will India face the after-effects of the world recession? Yes, but the effect of the recession may be down as the world recovery of the global economy will boost the economic output of the nation

India will definitely head towards a recession for prolonged in the later part of the year, but the effects of the recession such as job loss, inflation, demand contraction should have a minimal effect because of the unique characteristics of Indian economy, such agrarian economy in rural parts, service sector still in the growing mode in urban and huge potential for the Manufacturing sector in the global arena.

The agrarian economy in the rural sector may shield the effect of the recession in the rural as 40-50% of the Indian population is dependent on agriculture. A lot of government support and rules will safeguard the economy. The urban economy which contributes almost 50% to economic output in the form of the service sector will be the most hit.

We may see job loss and inflation but the huge Indian market and large demand for the service sector will give an additional cushion. But this all depends again on the financial stimuli of the government, in terms of the RBI rate cuts, and budget provision on the salary income, as these reforms, may be a deal breaker for the economy this year. The manufacturing sector is the area that can make a huge difference for the Indian economy in the coming years.

Conclusion

As this area does not see sudden growth changes, but the right environment for investment opportunities may have a short-term cushion required to balance the recession effects. Also, India has a great opportunity to become a champion in the manufacturing sector replacing China as it right kind of talent pool and favourable economic conditions. The global semiconductor crisis presents an opportunity for India to look at the problem with great attention to establish its 21st century manufacturing supply chain, as this is a digital era and we need to be part of it.

Recently completed any professional course/certification from the market? Tell us what liked or disliked in the course for more curated content.

Click here to submit its review with Shiksha Online.

This is a collection of insightful articles from domain experts in the fields of Cloud Computing, DevOps, AWS, Data Science, Machine Learning, AI, and Natural Language Processing. The range of topics caters to upski... Read Full Bio