CAclubindia Reviews on Courses, Pricing, Features & Career Impact

- About CAclubindia

- Why Choose CAclubindia?

- Types of Courses Offered By CAclubindia

- Popular Courses Offered By CAclubindia

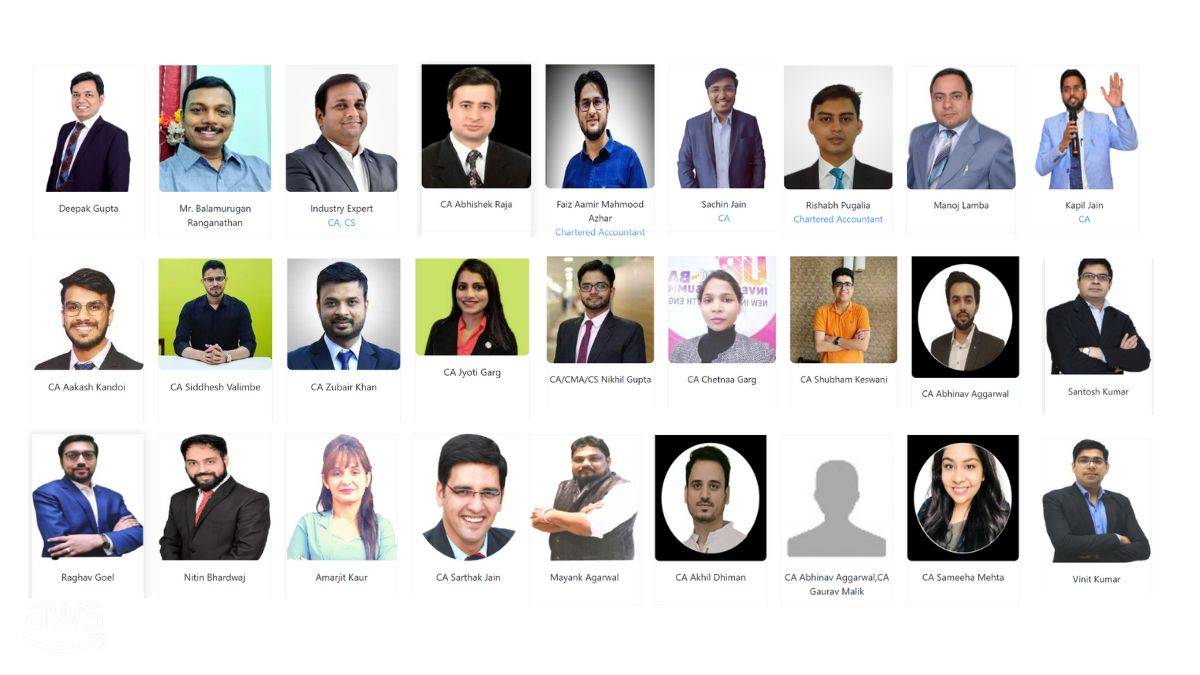

- Instructors At CAclubindia

- CAclubindia Student Reviews

- FAQs Related to CAClubindia

Why Choose CAclubindia?

Students who are interested to progress in the field of Finance, Taxation, Auditing and Accounting should choose CAclubindia for the following reasons:

- Over 14000 students have been placed through CAclubindia's platform.

- The institute has a dedicated forum for students to help them resolve queries related to the CA curriculum and related courses.

- CAclubindia offers pre-recorded video coaching classes by renowned faculties. This ensures that students can view these sessions from anywhere and at any time.

- Courses covering all major topics from CA-Foundation to CA-Final are available on CAclubindia.

- CAclubindia has an app that allows students to access the course content they have enrolled in.

Commonly asked questions

Q: What are the benefits of a CCI Pro subscription by CAclubindia?

Those who take a CCI Pro subscription will be able to browse the website without any ads. They will receive a daily e-newsletter. All the latest updates related to the course will be delivered to students through WhatsApp. They will get access to featured job postings on the Jobs homepage.

Q: Can a student get refund for a CCI Pro subscription offered by CAclubindia?

No, students cannot get a refund for a CCI Pro subscription. This is a one-time payment plan and it needs to be repurchased once the CCI Pro subscription expires.

Types of Courses Offered By CAclubindia

The following types of courses are offered by CAclubindia:

|

Types of Courses |

Description |

|

Live Classes |

These classes occur on a fixed time slot where students can directly communicate with the instructor to clarify their doubts. These live classes come with recorded sessions with a validity of a particular time period with unlimited number of views. |

|

Certification Course |

The institute offers several certification courses related to business analytics tools, Cryptocurrency, financial modelling, ITR and accounting. These have a time duration between 3-12 months. |

|

CA Foundation |

There are several CA foundation courses dedicated to different topics taught in the course. These include courses on accounting, business law, Mathematics and Logical Reasoning, Business economics, Quantitative Aptitude |

|

CA Inter |

These include courses on the topics of CA-Inter including Corporate Law, Cost and Management Accounting, DT & IDT, Advanced Accounting, Accounting and Audit. |

|

CA Final New |

This category covers courses on topics belonging to CA final. This includes courses on Corporate and Economic Laws, Risk Management, Audit, Strategic Financial Management, Financial Reporting and Indirect Tax. |

Commonly asked questions

Q: Does CAclubindia offer other courses besides Accounting, Taxation, Finance and Corporate Law?

Yes, CAclubindia does offer other types of courses besides Accounting, Finance, Taxation and Corporate Law. These include courses on communication skills, MS Excel and MS Word.

Popular Courses Offered By CAclubindia

The following courses are popular amongst students as mentioned on the CAclubindia website:

|

Popular Courses |

USP |

|

Calculation of Income from Salary and Filing their Income Tax Return |

|

|

Learn Excel Dashboard |

|

|

Learn Microsoft Word |

|

|

GSTR -9/9c |

|

|

GST Return Practical and Theory Recording |

|

Commonly asked questions On Others

Q: What will you learn in the GSTR -9/9c course offered by CAclubindia?

This 4 hour long course helps students learn about annual reconciliations and GSTR-9/9C. Basics of reconciliations under GST from Tax audit and GST Returns point of view will be discussed. In this course, students will also learn about tax audit with live practical examples.

Q: What will students learn in the GST Return Practical and Theory course offered by CAclubindia?

This course will start from teaching ITC claims in GST. Further, it will train students in filing GSTR-1 and GSTR-2. Students will also learn to view forms GSTR-2A, GSTR-2B and GSTR-3B. By the end of this course, students will be able to prepare and file quarterly statements form GST CMP-08, Quarterly Form GSTR-4 and Annual Form GSTR-4.

Instructors At CAclubindia

The following instructors have been training students at CAclubindia since 2007

Commonly asked questions On Faculty

Q: How does CAclubindia support students with placement?

CAclubindia has a dedicated job portal for students as well as recruiters on its website. Students can find out the most suitable job profile listed on CAclubindia's website and apply for it. Recruiters also have the facility to post jobs on the website.

Q: What is the placement record of CAclubindia?

CAclubindia has successfully helped over 20,000 students in getting placed. 4301 students have been placed in articleship jobs, 14,209 students have gotten professional jobs and 1869 students have been placed in Income Tax related job roles.

FAQs Related to CAClubindia

These are some of the frequently asked questions related to CAClubindia that students can find useful:

Q: Can a student get refund for a CCI Pro subscription offered by CAclubindia?

No, students cannot get a refund for a CCI Pro subscription. This is a one-time payment plan and it needs to be repurchased once the CCI Pro subscription expires.

Q: What is the minimum requirement to view videos on CAclubindia?

Those who want to view the videos on CAclubindia first need to make an account on CAclubindia. Along with an account, they should have their own laptop or PC with stable internet connection. Either IE9, FF or Chrome browser must be available to students.

Q: Does CAclubindia offer any free courses?

CAclubindia does not offer any free courses. Instead, it offers free notes and free video for the convenience of students. To access these resources, students need to register on CAclubindia.

CAclubindia

Student Forum

Content authored by:

Updated on Dec 30, 2024