Saumya JainAssistant Manager- Content

The Chartered Financial Analyst (CFA) 2025 exam pattern is prescribed by the CFA Institute. The CFA exam will be conducted in the computer-based test mode across various centres. Earlier, the exam was conducted in the paper-based test mode, but, from 2021 onwards the exam is only being conducted in the CBT mode. The CFA 2025 exam Levels I, II and III will be conducted only in the CBT mode with different time durations and on different dates. Each level of the CFA exam has a different exam structure and the difficult level rises as the level does. Read on to know the detailed CFA exam pattern 2025.

Also Read:

Q: What is the syllabus and exam pattern of CFA exam?

Chartered financial analyst designation is a professional credential that is offered by the CFA institute to the financial and investment professionals. The designation of the Chartered Financial Analyst or CFA Charter is the most recognized and respected credential in the field of investment banking. It is a globally recognized credential. There are three levels in CFA Program that students will have to go through. Based on the historical data, pass rate for the CFA examination is about 40 percent.

There is a wide range of topics related to investment management, stocks, derivatives, financial analysis which give you great understanding of everything you need in order to become a better Financial Analyst/Investment banker.

CFA Level I Exam: This is the first examination that students will have to go through. In level one, students will have to focus on the concepts and tools that are applied to investment management and valuation. The CFA Level 1 exam is conducted in two sessions, each 3 hours long. It consists of 240 multiple-choice questions in two sessions of 120 questions each. The questions are designed based on the topic weightages given in the CFA Level 1 Exam Syllabus, with very slight deviation.

CFA Level II Exam: This is the second examination that students will have to go through after passing the CFA level I Exam. In Level II, students will have to deal with the assets valuation. Students must have the ability to apply the concepts and tools that they have learned in level I. There are total 20 item set questions, split in two sessions. The morning and evening sessions have 10 item set questions each. The total number of questions in the CFA Level II exam is 120. The duration of the exam is 360 minutes. Some of the CFA level II topics are covered only in the morning session and other topics are covered only in the evening session.

CFA Level III Exam: This is the last CFA exam that students will have to pass to become a CFA charterholder. In the level 3 examination, students will have to go through portfolio management in depth. CFA Level I and CFA Level II revolved around basic financial knowledge, investment valuation comprehension and the application of both. CFA Level III exam focuses on portfolio management and wealth planning. All the best.

Q: What is the exam structure of CFA exam Level I?

The CFA Level I exam comprises a total of 180 multiple-choice questions to be answered in two sessions of 135 minutes each. There are 90 MCQ questions for each session. The first session includes topics such as professional standards, financial reporting, and quantitative methods, while the second session includes questions about corporate finance, fixed income, derivatives, alternative investments, and portfolio management. This exam is given twice a year, once in June and once in December.

Q: What is the mode of CFA exam?

The CFA (Chartered Financial Analyst) exams are conducted in a computer-based testing (CBT) format. The transition from paper-based exams to computer-based exams was implemented by CFA Institute to provide a more efficient and secure testing experience for candidates.

Under the CBT format, candidates take the exams on a computer at designated testing centers. The exams are administered over multiple sessions, with each session focusing on specific topics. The CFA Level I exam consists of multiple-choice questions, while the Level II and Level III exams include item-set questions (also known as vignettes) and constructed response (essay) questions.

The CBT format offers several advantages, such as immediate exam results, standardized navigation tools, the ability to mark and review questions, and an enhanced exam security system. Additionally, candidates have the flexibility to choose their preferred exam date within the available testing window.

It's important to note that while the CFA exams are computer-based, they still maintain the same level of rigor and depth in assessing candidates' knowledge and skills in finance and investment management.

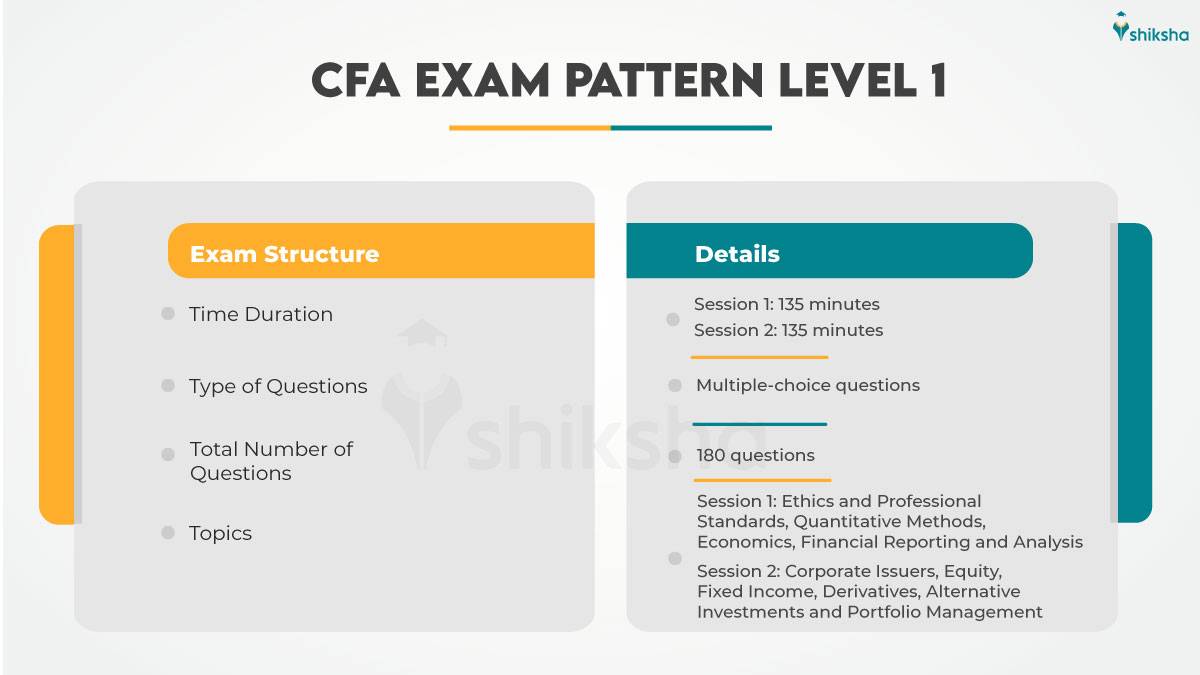

CFA 2025 Exam Pattern: Level I

The Level I exam as per the CFA exam pattern consists of 180 multiple-choice questions. The test is split into two sessions, each session is held for 135 minutes. It is mandatory for the candidates to appear in both sessions.

- The morning session is of two hours and 15 minutes in which the candidate will have to solve 90 multiple-choice questions.

- The afternoon session is of two hours and 15 minutes in which the candidate will have to solve the remaining 90 multiple-choice questions. Each question carries the same weightage and there’s no negative marking for a wrong answer.

- The first session of the exam will be based on topics such as Ethics and Professional Standards, Quantitative Methods, Economics, Financial Reporting and Analysis

- The second session of the exam will be based on topics such as Corporate Issuers, Equity, Fixed Income, Derivatives, Alternative Investments and Portfolio Management

CFA Level I Marking Scheme

Check out the table below to know the marking scheme for the CFA 2025 Level I exam:

| Topics | Weightage |

|---|---|

| Ethics and Professional Standards | 15%- 20% |

| Quantitative Methods | 6%- 9% |

| Economics | 6%- 9% |

| Financial Reporting and Analysis | 11%- 14% |

| Corporate Finance | 6%- 9% |

| Portfolio Management | 8%- 12% |

| Equity Investment | 11%- 14% |

| Fixed Income | 11%- 14% |

| Derivatives | 5%- 8% |

| Alternative Investments | 7%- 10% |

Also Read:

Q: How many times can one give CFA Exam level 1 in one enrollment?

Q: How long is each CFA exam level?

CFA exam is conducted in the computer-based test mode. Candidates who wish to appear for the exam need to visit the CFA exam centre and take the exam. There will be sets-based and multiple choice type questions in the CFA exam. Given below is the duration of the each CFA exam level:

- Level I: 6 hours

- Level II: 4 hours and 24 minutes (divided into two sessions of 2 hours and 12 minutes each)

- Level III: 4 hours and 24 minutes (divided into two sessions of 2 hours and 12 minutes each)

Q: What is the weightage of the CFA Level I exam?

The Level I exam covers a broad range of topics, and the weightings can vary slightly from one exam to another. The approximate weightings were as follows:

- Ethics and Professional Standards: 15%

- Quantitative Methods: 10%

- Economics: 10%

- Financial Reporting and Analysis: 15%

- Corporate Finance: 10%

- Equity Investments: 11%

- Fixed Income: 10%

- Derivatives: 6%

- Alternative Investments: 6%

- Portfolio Management and Wealth Planning: 6%

- Quantitative Review: 1%

CFA 2025 Exam Pattern: Level II

Level II of the CFA exam will have item set questions which will be comprised of vignettes. The test will be conducted in two sessions - morning and afternoon. The total duration of the exam will be 4 hours and 24 minutes which will be divided into two sessions.

- Each question is of three points with no penalty for wrong answers

- Each session will be conducted for 2 hours and 12 minutes

- Each set will be followed by four or six MCQs

- Each session will have 44 multiple-choice questions

Level 2 CFA exam is standardized with 11 item sets for each session, hence the total number of sets is 22 on the exam. 20 questions of these 22 will be scored and two questions will not be scored as they are on the trial by the CFA institute. The CFA Level II exam consists of 22 item sets comprised of vignettes with 88 accompanying multiple-choice questions.

The CFA topics areas will be placed randomly and all the topics of the CFA exam will be covered. Each item vignette will begin with a statement of the topic and total point value. For instance:

Topic: QUANTITATIVE METHODS

Total Points Value of this Question set is 12 points

Also Read: How hard is the CFA exam?

Q: What is the format of the Level II CFA exam?

The Level II CFA (Chartered Financial Analyst) exam has a unique format compared to the other CFA exam levels.

- The CFA Level II consists of item sets, known as vignettes which are designed to assess the candidate's ability to apply knowledge rather than just recall facts and definitions.

- The exam will be conducted in two sessions - morning and afternoon.

- Each session will be 2 hours and 12 minutes long, with an optional break in between.

- Each set will be followed by four or six MCQs.

- The total duration of the exam will be 4 hours and 24 minutes, divided equally into two sessions.

- The Level II CFA exam typically includes 21 item sets in total.

- The Level II exam builds upon the foundational knowledge tested in Level I.

- It focuses on the application of that knowledge to specific real-world scenarios and cases and includes topics such as ethics and professional standards, quantitative methods, economics, financial reporting and analysis, corporate finance, equity investments, fixed income, derivatives, alternative investments, portfolio management, and wealth planning.

Each question will be of three points, and there will be no penalty for wrong answers. The exam will be conducted in a computer-based test mode, and the number of questions has been reduced to 180. The duration of the exam has also been reduced, and there will be no more June exams at any level.

Q: Are there any changes in the Level II curriculum of the CFA exam?

The Level II curriculum for the CFA exam has not changed significantly. While it has gone through the same review to improve the instructional design, all current topics have been maintained. The Level III candidates will have the opportunity to choose to be tested on a specialization. The core of the curriculum will remain the same, but candidates will have the opportunity to focus a percentage of their Level III effort on one of three specialised paths: portfolio management, private markets, or private wealth management.

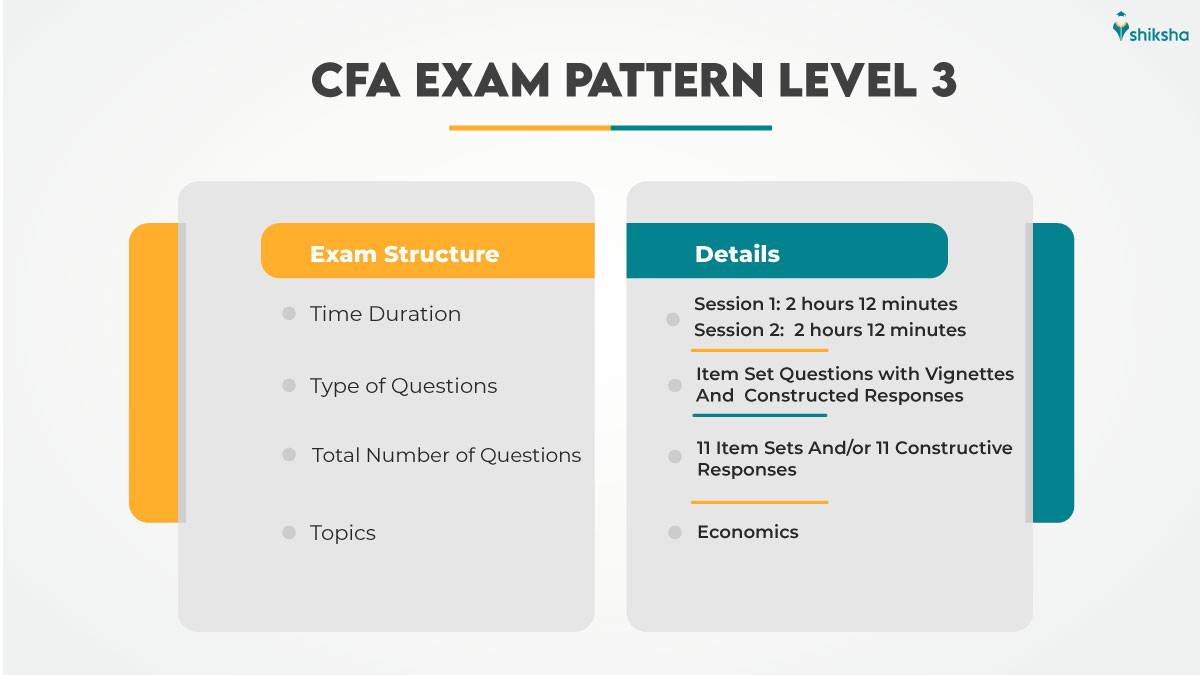

CFA 2025 Exam Pattern: Level III

Like the Level II exam, Level III exam will also have item set questions which will be comprised of vignettes. The CFA level 3 exam will also have constructed responses (essays) sets. The exam will be conducted in two sessions. The total duration of the Level III exam will also be 4 hours and 24 minutes. This will be divided equally into two sessions.

- Level III consists of item sets and essay-type questions

- Morning session: Constructed response (essay) questions

- Each session will be conducted for 2 hours and 12 minutes with an optional break in between

- All the questions are mandatory

Candidates need to refer the vignette before answering each item. Each session will have either six item sets and five constructed responses. Overall the Level 3 exam consists of 11 item sets and 11 essay sets for 12 points each. Like the Level 2 CFA exam, each vignette in the Level 3 exam will also begin with a statement of the topic and total point value which will always be 12 points. For instance:

Topic: ECONOMICS

Total Point Value of this question set is 12 Points

Read More:

Q: What is the weightage of Level III of the CFA exam?

The CFA exam has three levels, and each level has a different weightage of topics. Here is the weightage of topics for Level III of the CFA exam:

Level III:

- Ethical and Professional Standards: 5%

- Quantitative Methods: 5%

- Economics: 10%

- Financial Reporting and Analysis: 5%

- Corporate Finance: 5%

- Portfolio Management: 15%

- Equity Investments: 10%

- Fixed Income: 10%

- Derivatives: 10%

- Alternative Investments: 10%

Q: What is the Level III CFA exam format?

The Level III CFA exam format is as follows:

- The exam will be conducted in two sessions, each lasting 2 hours and 12 minutes.

- There will be an optional break in between the two sessions.

- The exam will consist of constructed response (essay) questions and item set questions, which will be comprised of vignettes.

- Each item set will consist of a vignette followed by four multiple-choice questions.

- There will be a total of 11 essay sets and 11 item sets, each worth 12 points.

FAQs on CFA Exam Pattern

Check some of the Frequently Asked Questions (FAQs) on CFA pattern:

Q: What happens if I fail an exam level in CFA exam?

If you fail a level of the CFA exam, you have the opportunity to retake that specific level in future exam windows. You need to register again to take the same exam in the subsequent exam window. The CFA Level I exam is offered twice a year (in February and August). You will ne required to pay the registration fee again for the level you are retaking.

It's advisable to use the time between your failed attempt and your retake to further prepare and strengthen your understanding of the exam material. Many candidates who initially fail use this period to study more intensively, seek additional resources, and address their weaknesses.

There is no limit to the number of times you can retake a specific level of the CFA exam. You can keep attempting the same level until you pass. Remember that the CFA exams are known for their difficulty, and it's not uncommon for candidates to fail at least one level before ultimately passing. Many successful CFA charterholders faced initial setbacks but persevered through the process. With dedication, effective study strategies, and a commitment to improving your knowledge in areas of weakness, you can increase your chances of success in retaking and passing the exam level you previously failed.

Q: How tough is the CFA exam? What are important preparation tips for the CFA exam?

News & Updates

Get all exam details, important updates and more.

CFA Exam Exam

Student Forum

Answered 2 months ago

Here are some practical tips to help you perform your best on the CFA exam.

- Financial Statement Analysis: Questions on this topic are based on International Financial Reporting Standards (IFRS) unless otherwise noted. If a question references U.S. GAAP, this will be explicitly stated.

- No penalty for g

A

Contributor-Level 10

Answered 2 months ago

Follow the steps mentioned below to learn how to fill out the CFA application form

- Visit the official website of the CFA institute

- Click on the application link or copy https://login.cfainstitute.org/LoginApplication.

- Create a login account with the candidate’s email ID.

- The candidate will be asked to e

A

Contributor-Level 10

Answered 2 months ago

CFA Charter Holders have the distinct advantage of applying their skills in several professional roles. They can work in areas like wealth management, hedge funds, fixed income, insurance and equity research.

A

Contributor-Level 10

Can you share some tips to prepare for CFA exam?