CFA syllabus consists of the concepts of the academic disciplines of Finance and Investment. The CFA syllabus for all three levels, i.e. Level I, II and III is the same (more or less), however, the weightage of the questions differs at each level. It assesses the candidates on a varied range of concepts, such as Financial, Accounting-related or Mathematical. Shiksha brings you a is a comprehensive blog that details the CFA syllabus and weightage of the questions, important topics and subtopics, etc. Read below to know the detailed CFA syllabus 2025.

Also Read: When is the CFA exam?

Q: How tough is the CFA exam? What are important preparation tips for the CFA exam?

Q: How will I get the study material for CFA course?

To obtain the study material for the CFA course, there are the following options:

- The CFA institute proivdes an official curriculum for each exam level. This curriculum covers all the required topics and is considered the rimary source of the study material for the CFA exam. Students are given the option to purchase the curriculum directly from the institute's website.

- Many third-party vendors also offer study materials for the CFA exam which is specifically designed to help the aspirants prepare for the exam. These materials often include study guides, practice questions, mock tests, online course and/or video lectures.

- There are various online sources available for obtaining the CFA study material. Websites, forums and online communities dedicated to CFA exam preparation provide free or low-cost study materials, practice papers, and other helpful preparation tips.

- Joining or forming a study group can be beneficial for sharing study materials and insights with fellow aspirants. It will help you discuss challenging topics, solve practice questions, and gain different prespectives on the exam content.

It is important to find authentic study material which aligns with our learning style and preferences. Consider your buget, time constraints, and the level of support and guidance you need to prepare for the CFA exam. Additionally, always refer to the CFA curriculum provided by the CFA institute for accurate and up to date information.

Q: What is the mode of CFA exam?

The CFA (Chartered Financial Analyst) exams are conducted in a computer-based testing (CBT) format. The transition from paper-based exams to computer-based exams was implemented by CFA Institute to provide a more efficient and secure testing experience for candidates.

Under the CBT format, candidates take the exams on a computer at designated testing centers. The exams are administered over multiple sessions, with each session focusing on specific topics. The CFA Level I exam consists of multiple-choice questions, while the Level II and Level III exams include item-set questions (also known as vignettes) and constructed response (essay) questions.

The CBT format offers several advantages, such as immediate exam results, standardized navigation tools, the ability to mark and review questions, and an enhanced exam security system. Additionally, candidates have the flexibility to choose their preferred exam date within the available testing window.

It's important to note that while the CFA exams are computer-based, they still maintain the same level of rigor and depth in assessing candidates' knowledge and skills in finance and investment management.

CFA Syllabus 2025: Level I

Refer to the table below to know the CFA syllabus for the Level I exam:

| Topic | Weightage (in Percentage) | Sub-Topics |

|---|---|---|

| Ethical and Professional Standards |

15-20 | Global investment performance standards, Standard of Professional Conduct |

| Quantitative Methods |

6-9 | Discounted Cash Flow Applications, Time, Value and Money, Statistical Concepts and Market Returns |

| Economics |

6-9 | Firm and Market Scheme, Demand and Supply Analysis, Aggregate Output, Prices, Economic Growth |

| Financial Reporting and Analysis |

11-14 | Income statement, Drafting Balance Sheet, Financial Reporting Mechanics and Standards |

| Corporate Issuers |

6-9 | Cost of Capital, Capital Budgeting, Corporate Ownership Structures, Business Models |

| Portfolio Management |

8-12 | Basics of Portfolio Planning and Construction |

| Equity Investments |

11-14 | Market Efficiency, Security Market Indices, Market Organization and Structure |

| Fixed Income |

11-14 | Fixed Income Markets, Fixed Income Securities, Introduction to Fixed Income Valuation |

| Derivatives |

5-8 | Derivative Markets and Instruments |

| Alternative Investments |

7-10 | Mutual Funds and Real Estate |

Changes in Level I Syllabus

- According to the research, many Level I candidates have mastered various introductory financial concepts during their graduation or early career roles. Hence, to avoid duplication and streamline the Level I CFA curriculum, exam conducting authorities have moved some of the content and are now providing it separately as reference material for registered candidates.

- The content has been moved to pre-read topics such as time and value of money, basic statistics, microeconomics, and introduction to company accounts, etc. which are building blocks for later learning. By not directly assessing these topic areas, there is more room for advanced practice concepts and more time for the new practical skills modules.

- Students who do not have exposure to such concepts, or who simply wish to review materials during their preparation for the Level I CFA exam, can access the content as pre-read materials at no additional charges. Registered candidates can also use these materials to get a sense of gaps in their knowledge and assess their readiness for the exam.

Also Read: What to Expect of CFA Level 1 Exam

CFA Syllabus 2025: Level II

Refer to the table below to know the CFA syllabus for the Level II exam:

| Topic | Weightage |

|---|---|

| Ethical and Professional Standards |

15 |

| Quantitative Methods |

15 |

| Economics |

10 |

| Financial Reporting and Analysis |

15 |

| Corporate Finance |

10 |

| Portfolio Management |

10 |

| Equity Investments |

15 |

| Fixed Income |

15 |

| Derivatives |

5 |

| Alternative Investments |

5 |

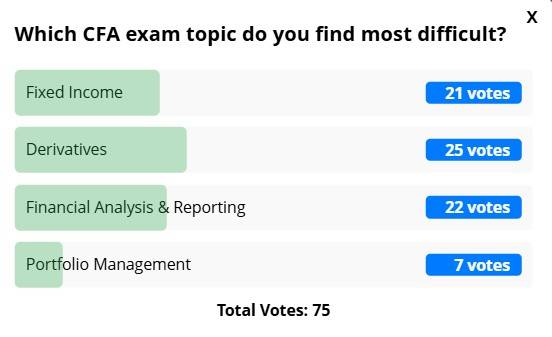

Shiksha conducted a poll on which CFA topic students find the most difficult. Here are the poll results:

CFA Syllabus 2025: Level III

Refer to the table below to know the CFA syllabus for the Level III exam:

| CFA Syllabus 2025 Level III | |

|---|---|

| Behavioral Finance |

Capital Market Expectations |

| Asset Allocation & Related Decisions in Portfolio Management |

Derivatives & Currency Management |

| Fixed-Income Portfolio Management |

Equity Portfolio Management |

| Alternative Investments for PM |

Private Wealth Management |

| PM- Institutional Trading, Performance Evaluation, and Manager Selection |

Cases in Portfolio Management and Risk Management |

| Ethics and Related Topics |

|

CFA Level 3 Specialised Pathways

CFA 2025 exam onwards for Level 3, CFA institute has introduced two new versions of Level 3 in Private Wealth and Private Markets while also keeping the traditional pathway, Portfolio Management. Candidates can choose the path according to their interests and aspirations. The three pathways of Level 3 will have one common core of the curriculum and additional specialised content for each pathway.

Candidates can choose one of the three pathway options during the CFA registration. Candidates must carefully choose the pathway as they cannot be changed after registration. The common core of the curriculum will have 65% to 75% weightage and 25% to 25% weightage will be given to the specialised pathway.

Common Core Curriculum

The common core will include the following:

- Asset Allocation- Capital market expectations, macro forecasting, handling constraints

- Portfolio Construction- Equity, Fixed Income and Alternatives Portfolio Construction, Institutional versus Private Wealth Portfolio Construction, Trading Costs

- Performance Measurement- Performance Attribution, Manager Selection, Global Investment Performance Standards

- Derivatives and Risk Management- Options strategies, swaps/ forwards/ futures strategies, Currency Hedging Strategies

- Ethics- Code of Ethics, Standards of Professional Conduct, Asset Manager Code

Private Wealth Pathway

The private wealth pathway offers a global perspective and universal guidelines for working with High Net Worth clients who have a net worth of 5 million dollars. It follows a journey from a young adult starting to build wealth, through working with a private wealth manager, to eventually transferring wealth to the next generation. This pathway expands on previous CFA Program content, going beyond just investment management and financial planning. It now includes new topics such as family management, philanthropy, and serving star athletes. This specialised pathway is further divided into seven chapters:

- Private Wealth Management Industry: Different kinds of business models in the wealth management industry which have different fee and compensations structures, coordinating with various advisors and understanding regulatory and compliance issues for wealth managers

- Working With Wealthy: Includes family dynamics and human psychology. Understanding social and psychological aspects of wealth whilst dealing with complex family structures and developing the skills to serve and educate high net-worth clients.

- Wealth Planning: Creating goal-based financial plans, managing financial risks, protecting assets, understanding tax impacts and developing liquidity strategies.

- Investment Planning: Recommending investment portfolios to private clients, maximizing tax efficiency, helping clients plan retirement through retirement and saving plans, evaluating investment performance through reporting, etc.

- Preserving Wealth: Identifying the various types of risks to human capital using insurance and other products, and strategies to protect against inflation and currency volatility.

- Advising the Wealthy: Navigating citizenship, nationality and residency issues whilst handling complex family financial situations. Maximizing the net worth of wealthy professionals along with managing their business assets.

- Transferring Wealth: Using gifts and bequests to transfer wealth and strategies for charitable giving and philanthropy.

Private Markets Pathway

This pathway addresses the investments made by the private markets from the perspective of the General Partner (GP). It expands on important valuation skills and other key concepts from all four asset classes of the CFA program. The curriculum includes recent engaging examples from the private markets such as Elon Musk’s acquisition of Twitter, Facebook’s acquisition of WhatsApp, Blackstone REIT, events at Silicon Valley Bank, Gabon’s debt-for-nature swap and several high-profile LBOs such as Thyssen elevators in 2020. It is further divided into seven chapters:

- Private Investments and Structures: As the name suggests, it focuses on understanding the private investments and structures. It includes the methods and structures of debt, equity, infrastructure, etc. It also explores the difference between the various types of performance metrics and compares the risk and return profiles of private versus public markets within strategic asset allocation.

- GP and LP Perspectives: This explores the roles and responsibilities of GPs or General Partners and Limited Partners (LPs) in managing the private investment fund. Learning about fee structures, fund performance and alignment of interests between investors and investment firms. One will also get to explore favourable characteristics of investment targets, due diligence, business planning, and alternative exit routes and their impact on value.

- Private Equity: Delves into the private equity strategies which include venture capital, growth equity, and buyout investments. It also includes private equity investments and the risk and return as compared to other investments.

- Private Debt: Examines the use of debt financing in private market strategies including leveraged loans, high-yield bonds, mezzanine debt, and uni-tranche debt. Candidates can learn about the private debt profile and ratio analysis while comparing the risk and return on other debt investments.

- Private Social Situations: Explores event-driven opportunities which involve financial dislocation or distress, financing alternatives for issuers in distress and investment strategies such as capital structure arbitrage.

- Private Real Estate: Focuses on the features and economic drivers of private real estate investments including farmland and timberland. Understanding the due diligence and valuation process for real estate and comparing their risk and return profiles within strategic asset allocation.

- Infrastructure: Talks about private infrastructure investment features, vehicles and methods. It studies the overall investment process including the roles of equity financing and debt and compares their risk and return profiles within strategic asset allocation.

Read More:

FAQs Related to CFA Syllabus

Check some of the Frequently Asked Questions (FAQs) on CFA syllabus:

Registration - 6 Feb '25

Registration - 6 Feb '25