Md ShahzadSenior Executive - Content

The Jharkhand Academic Council has released the JAC 12th Syllabus 2024 for Commerce stream on the official JAC website. It has also been provided below for the reference of students. Students must note that the Jharkhand Board refers NCERT books for preparing its students for the board exams.

JAC 12th Economics Syllabus 2024

Students can check below the JAC Class 12 Economics Syllabus 2024

| Part A: Introductory Macroeconomics | |

| Unit 1: National Income and Related Aggregates | What is Macroeconomics? Basic concepts in macroeconomics: consumption goods, capital goods, final goods, intermediate goods; stocks and flows; gross investment and depreciation. Circular flow of income (two-sector model); Methods of calculating National Income - Value Added or Product method, Expenditure method, Income method. Aggregates related to National Income: Gross National Product (GNP), Net National Product (NNP), Gross Domestic Product (GDP) and Net Domestic Product (NDP) - at market price, at factor cost; Real and Nominal GDP GDP Deflator, GDP and Welfare |

| Unit 2: Money and Banking | Money – meaning and functions, supply of money - Currency held by the public and net demand deposits held by commercial banks. Money creation by the commercial banking system. Central bank and its functions (example of the Reserve Bank of India): Bank of issue, Govt. Bank, Banker's Bank, Control of Credit through Bank Rate, Cash Reserve Ratio (CRR), Statutory Liquidity Ratio (SLR), Repo Rate and Reverse Repo Rate, Open Market Operations, Margin requirement. |

| Unit 3: Determination of Income and Employment | Aggregate demand and its components. Propensity to consume and propensity to save (average and marginal). Short-run equilibrium output; investment multiplier and its mechanism. Meaning of full employment and involuntary unemployment. Problems of excess demand and deficient demand; measures to correct them - changes in government spending, taxes and money supply. |

| Unit 4: Government Budget and the Economy | Government budget - meaning, objectives and components. Classification of receipts - revenue receipts and capital receipts; Classification of expenditure – revenue expenditure and capital expenditure. Balanced, Surplus and Deficit Budget – measures of government deficit. |

| Unit 5: Balance of Payments | Balance of payments account - meaning and components; Balance of payments – Surplus and Deficit Foreign exchange rate - meaning of fixed and flexible rates and managed floating. Determination of exchange rate in a free market, Merits and demerits of flexible and fixed exchange rate. Managed Floating exchange rate system |

| Part B: Indian Economic Development | |

| Unit 6: Development Experience (1947-90) and Economic Reforms since 1991 | A brief introduction of the state of Indian economy on the eve of independence. Indian economic system and common goals of Five Year Plans. Main features, problems and policies of agriculture (institutional aspects and new agricultural strategy), industry (IPR 1956; SSI – role & importance) and foreign trade. Economic Reforms since 1991: Features and appraisals of liberalisation, globalisation and privatisation (LPG policy); Concepts of demonetization and GST |

| Unit 7: Current challenges facing Indian Economy | Human Capital Formation: How people become resource; Role of human capital in economic development; Growth of Education Sector in India Rural development: Key issues - credit and marketing - role of cooperatives; agricultural diversification; alternative farming - organic farming Employment: Growth and changes in work force participation rate in formal and informal sectors; problems and policies Sustainable Economic Development: Meaning, Effects of Economic Development on Resources and Environment, including global warming |

| Unit 8: Development Experience of India | A comparison with neighbours India and Pakistan India and China Issues: economic growth, population, sectoral development and other Human Development Indicators |

Provided below is the complete JAC Class 12 Syllabus for Economics:

Explore subject-wise topics asked in JAC 12th

Select your preferred subject

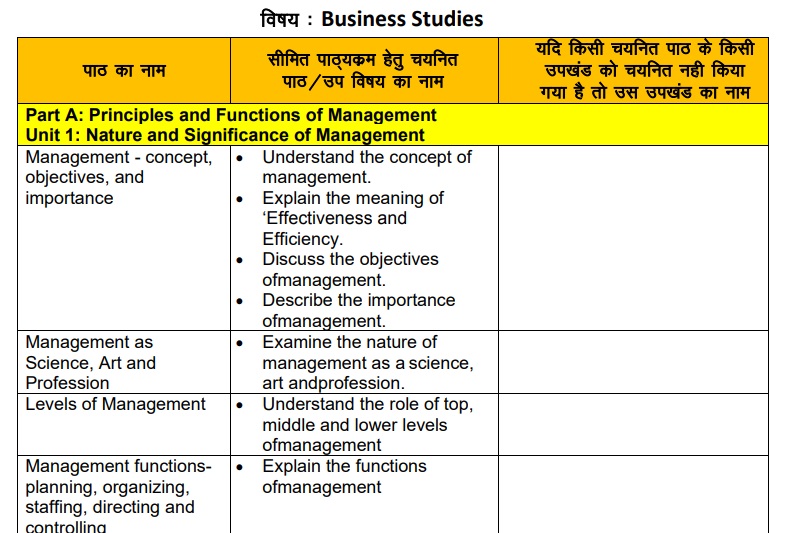

JAC 12th Syllabus 2024 for Business Studies

JAC 12th Syllabus 2024 for Accountancy

JAC 12th Syllabus for Arts: Frequently Asked Questions

Q. Do I need to prepare from the revised syllabus only?

A. Yes, students have to prepare from the syllabus only for the examinations.

Q. How can I prepare for the JAC 12th Arts exams?

A. Students must refer to the books prescribed by NCERT and be thorough with them for the preparation.

Explore popular UG exams which are accepted by top colleges

News & Updates

Get prep tips, practice papers, exam details and important updates

Explore top Commerce exams

22 Jan '25 - 24 Jan '25 | JEE Main 2025 Exam Date Sessio... |

30 Dec '24 - 15 Feb '25 | MHT CET 2025 Application Form |

27 Dec '24 - 27 Jan '25 | MH CET Law 2025 Application (f... |

7 Jan '25 - 9 Jan '25 | NIFT 2025 application form OPE... |

JAC 12th Exam

Student Forum

Answered 2 months ago

Yes, 75% attendance criteria is compulsory for appearing in the JAC 12th exam. Students are required to secure a minimum of 33% marks in theory and practical exams separately. Also, they will have to get at least 33% marks in aggregate to pass the examination.

Answered 2 months ago

Yes, the JAC offers a re-evaluation process for students who are dissatisfied with their results. After the JAC 12th results are declared, students can apply for re-evaluation within a specified time frame. The board will announce the date to apply for JAC 12th answer sheet e-evaluation. Students ca

M

Contributor-Level 10

Answered 2 months ago

To pass the JAC 12th Exams, students must score at least 33% in each subject. In addition to passing individual subjects, students also need to achieve an overall aggregate score of 33% across all subjects. If a student fails in one or two subjects, they may appear for the supplementary exams. Faili

M

Contributor-Level 10

Answered 2 months ago

Once the JAC 12th timetable is released, students should create a detailed study plan that aligns with the exam dates. Prioritize subjects that are scheduled earlier in the exam timetable and allocate sufficient time for revision of each subject. Keep in mind that balancing between weaker and strong

M

Contributor-Level 10

Answered 2 months ago

Jharkhand Board releases the JAC Class 12 time table 2025 PDF online on its website at jacexamportal.in. Students can download the JAC 12th timetable from the official JAC website by navigating to the "Examinations" or "Timetable" section. Once the timetable is uploaded, we will also provide a direc

M

Contributor-Level 10

Answered 2 months ago

To use JAC 12th model papers effectively, students should first complete their syllabus. Thereafter, students should incorporate model papers into their revision schedule. Solving one or two model papers each week helps in applying learned concepts and improving retention. After completing a model p

M

Contributor-Level 10

Answered 2 months ago

JAC 12th model papers are crucial for the studuents who are preparing for the Jharkhand Board 12th exam. It give students a clear understanding of the exam pattern, question types, and marking scheme. By solving these papers, students can familiarize themselves with time management and improve their

M

Contributor-Level 10

Answered 2 months ago

Students can apply for the JAC 12th Exam through their respective schools. The school authorities provide the necessary forms and instructions. The application process includes submitting personal and academic details along with a photograph and signature. After the forms are completed, schools send

M

Contributor-Level 10

Answered 2 months ago

Jharkhand Board prescribes the JAC 12th syllabus for the students from which questions are asked in the final board exams. The JAC 12th syllabus is divided into three streams: Science, Commerce, and Arts. The subjects vary depending on the stream, but core subjects such as Mathematics, Physics, Chem

M

Contributor-Level 10

Answered 2 months ago

The JAC 12th Exam is conducted by the Jharkhand Academic Council for students in the 12th grade. It is an annual state-level exam that covers subjects in the Science, Arts, and Commerce streams. The exam typically takes place in February. Jharkhand Board 12th exam plays a critical role in determinin

M

Contributor-Level 10

Popular Courses After 12th

Exams: BHU UET | KUK Entrance Exam | JMI Entrance Exam

Bachelor of Design in Animation (BDes)

Exams: UCEED | NIFT Entrance Exam | NID Entrance Exam

BA LLB (Bachelor of Arts + Bachelor of Laws)

Exams: CLAT | AILET | LSAT India

Bachelor of Journalism & Mass Communication (BJMC)

Exams: LUACMAT | SRMHCAT | GD Goenka Test

Is the 75% attendance criteria compulsory for appearing in JAC 12th exam?